Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You deposit $2,000 at the end of the year (k = 0) into an account that pays interest at a rate of 7% compounded

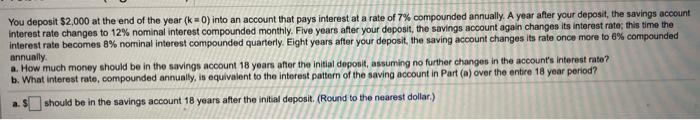

You deposit $2,000 at the end of the year (k = 0) into an account that pays interest at a rate of 7% compounded annually. A year after your deposit, the savings account interest rate changes to 12% nominal interest compounded monthly. Five years after your deposit, the savings account again changes its interest rate; this time the interest rate becomes 8% nominal interest compounded quarterly. Eight years after your deposit, the saving account changes its rate once more to 6% compounded annually. a. How much money should be in the savings account 18 years after the initial deposit, assuming no further changes in the account's interest rate? b. What interest rate, compounded annually, is equivalent to the interest pattern of the saving account in Part (a) over the entire 18 year period? should be in the savings account 18 years after the initial deposit. (Round to the nearest dollar)

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started