You deposit $2000 into a savings account at the end of every year.

a) Use the annuity tables in chapter 12 of your book to find how much it is worth after 12 years at 7% interest compounded annually.

b) Use the appropriate formula in chapter 12 of your book (do not use the annuity tables) to find how much it is worth after 10 years at 6% interest compounded annually .

c) How much interest did you receive in part (b) after 10 years?

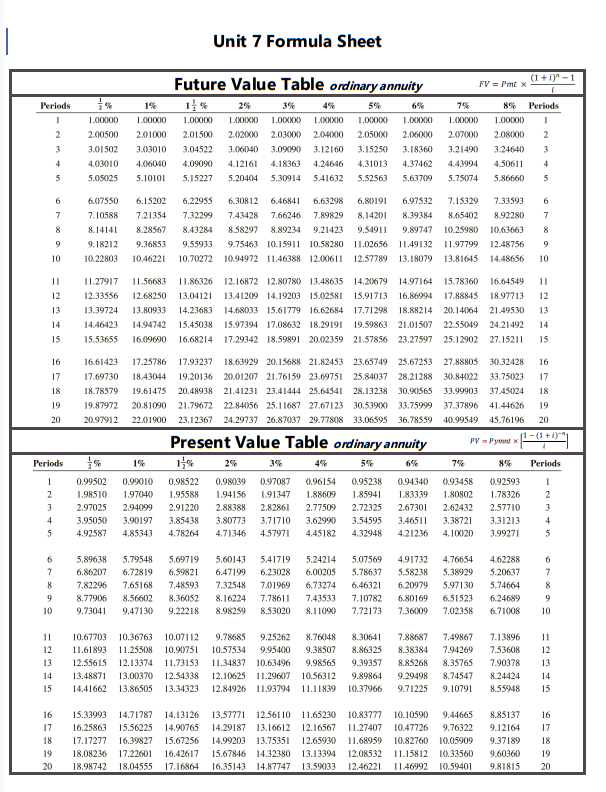

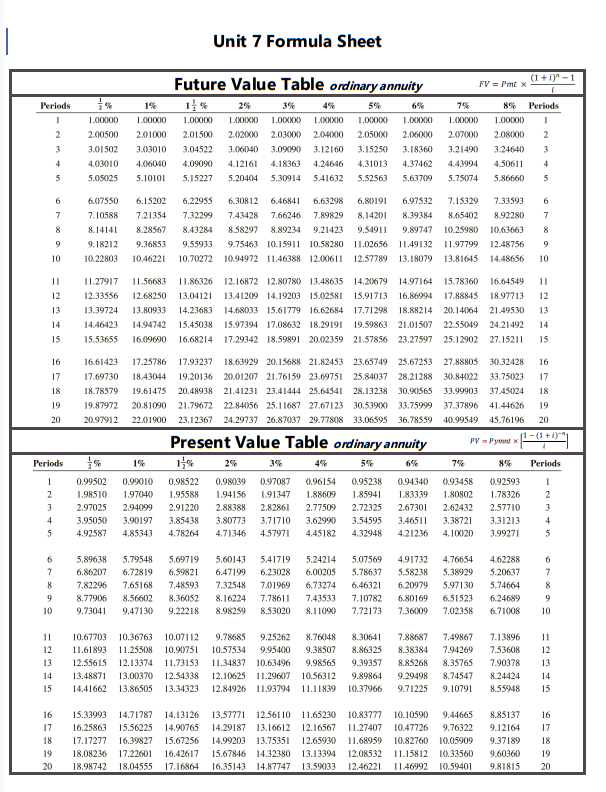

Unit 7 Formula Sheet (1+1)-1 Future Value Table ordinary annuity FV = Pmt x Periods 1 2 3 4 5 1.00000 2.00500 3.01502 4.03010 5.05025 1% 1.00000 2.01000 3.03010 4.06040 5.10101 1.00000 2.01500 3.04522 4.09090 5.15227 2% 1.000,00 1.00000 2.02000 2.03000 3.06040 3.09090 4.12161 4.18363 5.20404 5.30914 1.OXXO 2.04000 3.12160 4.24646 5.41632 5% 1.00000 2.05000 3.15250 4.31013 5.52563 6% 1.00000 2.06000 3.18360 4.37462 5.63709 7% 1.00000 2.07000 3.21490 4.43994 5.75074 8% Periods 1.00000 1 2.08000 2 3.24640 3 4.50611 4 5.86660 S 6 6 7 7 8 6.07550 7.10588 8.14141 9.18212 10.22803 6.15202 7.21354 8.28567 9.36853 10.46221 6.22955 6.30812 6.46841 6.63298 6.80191 6.97532 7.32299 7.43428 7.66246 7.89829 8.14201 8.39384 8.43284 8.58297 8.89234 9.21423 9.54911 9.89747 9.55933 9.75463 10.15911 10.58280 11.02656 11.49132 10.70272 10.94972 11.46388 12.00611 12.57789 13.18079 7.15329 8.65402 10.25980 11.97799 13.81645 7.33593 8.92280 10.63663 12.48756 14.48656 8 9 9 10 10 11 12 11 12 11.27917 12.33556 13.39724 14.46423 15.53655 11.56683 12.68250 13.80933 14.94742 16.09090 11.86326 12.16872 12.80780 13.48635 14.20679 14.97164 15.78360 16.64549 13.04121 13.41209 14.19203 15.02581 15.91713 16.86994 17.88845 18.97713 14.23683 14.68033 15.61779 16.62684 17.71298 18.88214 20.14064 21.49530 15.45038 15.97394 17.08632 18.29191 19.59863 21.01507 22.55049 24.21492 16.68214 17.29342 18.59891 20.02359 21.57856 23.27597 25.12902 27.15211 14 14 15 15 16 17 18 19 20 16 17 18 19 20 16.61423 17.25786 17.93237 18.63929 20.15688 21.82453 23.65749 25.67253 27.88805 30.32428 17.69730 18.43044 19.20136 20.01207 21.76159 23.69751 25.84037 28.21288 30.84022 33.75023 18.78579 19.61475 20.48938 21.41231 23.41444 25.64541 28.13238 30.90565 33.99903 37.45024 19.87972 20.8 1090 21.79672 22.84056 25.11687 27.67123 30.53900 33.75999 37.37896 41.44626 20.97912 22.01900 23.12367 24.29737 26.87037 29.77808 33.06395 36.78559 40.99549 45.76196 Present Value Table ordinary annuity PV-Pynt 19 2% 5% 6% 7% 8% 0.99502 0.99010 0.98522 0.98039 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 1.98510 1.97040 1.95588 1.94156 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 2.97025 2.94099 2.91220 2.88388 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710 3.95050 3.90197 3.85438 3.80773 3.71710 3.62990 3.54595 3.46511 3.38721 3.31213 4.92587 4.85343 4.78264 4.71346 4.57971 4.45182 4.32948 4.21236 4.10020 3.99271 Periods LT Periods 1 2 3 4 5 1 2 3 4 5 6 7 8 9 10 5.89638 6.86207 7.82296 8.77906 9.73041 5.79548 6.72819 7.65168 8.56602 9.47130 5.69719 6.59821 7.48593 8.36052 9.22218 5.60143 6.47199 7.32548 8.16224 8.98259 5.41719 6.23028 7.01969 7.78611 8.53020 5.24214 6.00205 6.73274 7.43533 8.11090 5.07569 5.78637 6.46321 7.10782 7.72173 491732 5.58238 6.20979 6.80169 7.36009 4.76654 5.38929 5.97130 6.51523 7.02358 4.62288 5.20637 5.74664 6.24689 6.71008 6 7 8 9 10 11 12 13 14 15 10.67703 11.61893 12.55615 13.48871 14.41662 10.36763 10.07112 11.25508 10.90751 12.13374 11.73153 13.00370 12.54338 13.8650S 13.34323 9.78685 9.25262 8.76048 10.57534 9.95400 9.38507 11.34837 10.63496 9.98565 12.10625 11.29607 10.56312 12.84926 11.93794 11.11839 8.30641 8.86325 9.39357 9.89864 10.37966 7.88687 8.38384 8.85268 9.29498 9.71225 7.49867 7.94269 8.35765 8.74547 9.10791 7.13896 7.53608 7.90378 8.24424 8.55948 11 12 13 14 15 16 17 18 19 20 15.33993 16.25863 17.17277 18.08236 18.98742 14.71787 14.13126 15.56225 14.90765 16.39827 15.67256 17.22601 16.42617 18.04555 17.16864 13.57771 12.56110 11.65230 14.29187 13.1661212.16567 14.99203 13.75351 12.65930 15.67846 14.32380 13.13394 16.35143 14.87747 13.59033 10.83777 10.10590 9.44665 11.27407 10.47726 9.76322 11.68959 10.82760 10.05909 12.08532 11.15812 10.33560 12.46221 11.46992 10.59401 8.85137 9.12164 9.37189 9.60360 9.81815 16 17 18 19 20