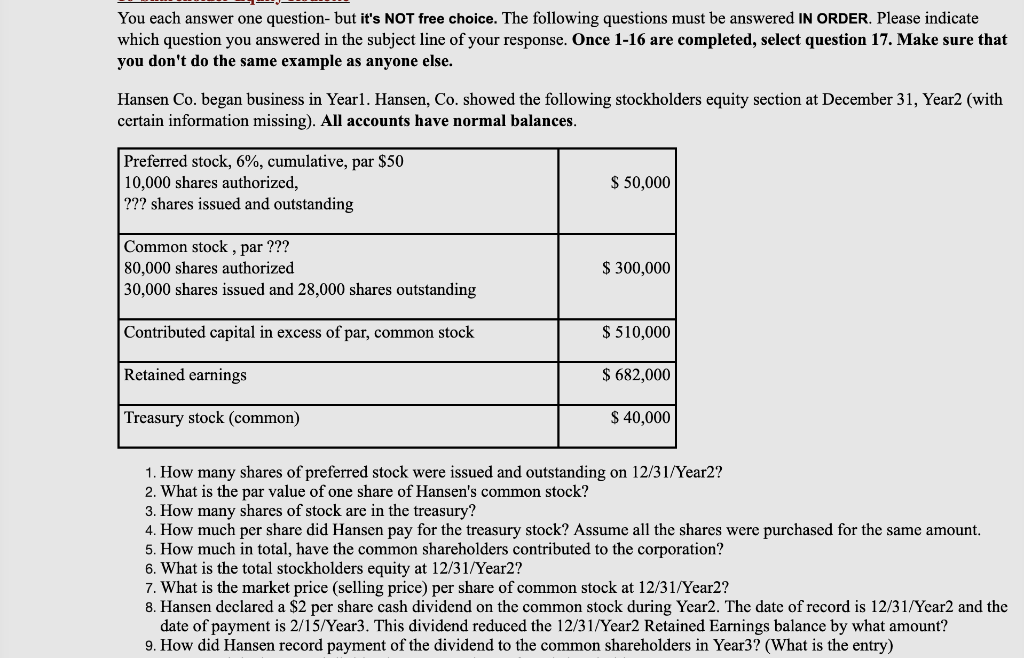

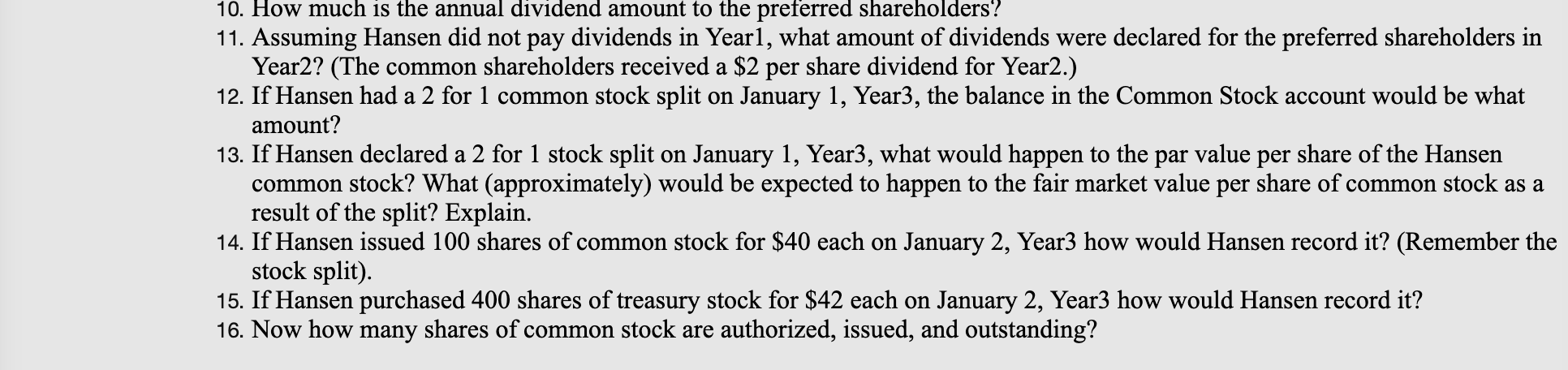

- You each answer one question- but it's NOT free choice. The following questions must be answered IN ORDER. Please indicate which question you answered in the subject line of your response. Once 1-16 are completed, select question 17. Make sure that you don't do the same example as anyone else. Hansen Co. began business in Yearl. Hansen, Co. showed the following stockholders equity section at December 31, Year2 (with certain information missing). All accounts have normal balances. Preferred stock, 6%, cumulative, par $50 10,000 shares authorized, ??? shares issued and outstanding $ 50,000 Common stock , par ??? 80,000 shares authorized 30,000 shares issued and 28,000 shares outstanding $ 300,000 Contributed capital in excess of par, common stock $ 510,000 Retained earnings $ 682,000 Treasury stock (common) $ 40,000 1. How many shares of preferred stock were issued and outstanding on 12/31/Year2? 2. What is the par value of one share of Hansen's common stock? 3. How many shares of stock are in the treasury? 4. How much per share did Hansen pay for the treasury stock? Assume all the shares were purchased for the same amount. 5. How much in total, have the common shareholders contributed to the corporation? 6. What is the total stockholders equity at 12/31/Year2? 7. What is the market price (selling price) per share of common stock at 12/31/Year2? 8. Hansen declared a $2 per share cash dividend on the common stock during Year2. The date of record is 12/31/Year2 and the date of payment is 2/15/Year3. This dividend reduced the 12/31/Year2 Retained Earnings balance by what amount? 9. How did Hansen record payment of the dividend to the common shareholders in Year3? (What is the entry) 10. How much is the annual dividend amount to the preferred shareholders? 11. Assuming Hansen did not pay dividends in Year1, what amount of dividends were declared for the preferred shareholders in Year2? (The common shareholders received a $2 per share dividend for Year2.) 12. If Hansen had a 2 for 1 common stock split on January 1, Year3, the balance in the Common Stock account would be what amount? 13. If Hansen declared a 2 for 1 stock split on January 1, Year3, what would happen to the par value per share of the Hansen common stock? What (approximately) would be expected to happen to the fair market value per share of common stock as a result of the split? Explain. 14. If Hansen issued 100 shares of common stock for $40 each on January 2, Year3 how would Hansen record it? (Remember the stock split). 15. If Hansen purchased 400 shares of treasury stock for $42 each on January 2, Year3 how would Hansen record it? 16. Now how many shares of common stock are authorized, issued, and outstanding