Answered step by step

Verified Expert Solution

Question

1 Approved Answer

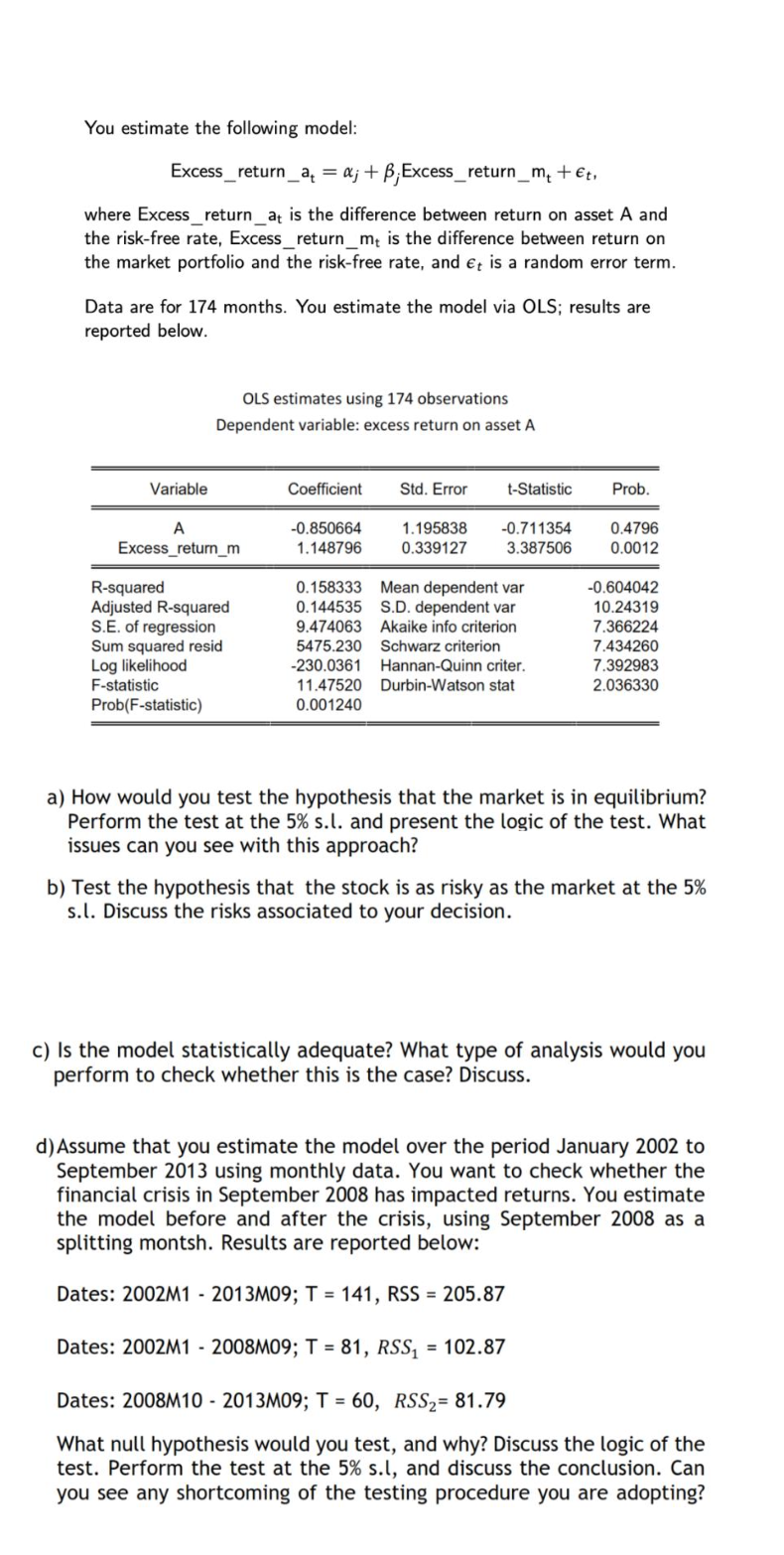

You estimate the following model: E x c e s s r e t u r n a ? t = j + j E

You estimate the following model:

where Excessreturn is the difference between return on asset A and

the riskfree rate, Excessreturn is the difference between return on

the market portfolio and the riskfree rate, and is a random error term.

Data are for months. You estimate the model via OLS; results are

reported below.

OLS estimates using observations

Dependent variable: excess return on asset

a How would you test the hypothesis that the market is in equilibrium?

Perform the test at the and present the logic of the test. What

issues can you see with this approach?

b Test the hypothesis that the stock is as risky as the market at the

sl Discuss the risks associated to your decision.

c Is the model statistically adequate? What type of analysis would you

perform to check whether this is the case? Discuss.

d Assume that you estimate the model over the period January to

September using monthly data. You want to check whether the

financial crisis in September has impacted returns. You estimate

the model before and after the crisis, using September as a

splitting montsh. Results are reported below:

Dates: ;

Dates: MM; RSS

Dates: MM; RSS

What null hypothesis would you test, and why? Discuss the logic of the

test. Perform the test at the and discuss the conclusion. Can

you see any shortcoming of the testing procedure you are adopting?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started