Question

You estimated the single index (market) model for stocks A and B with the following results: Return on Stock A: RA = 0.06 +

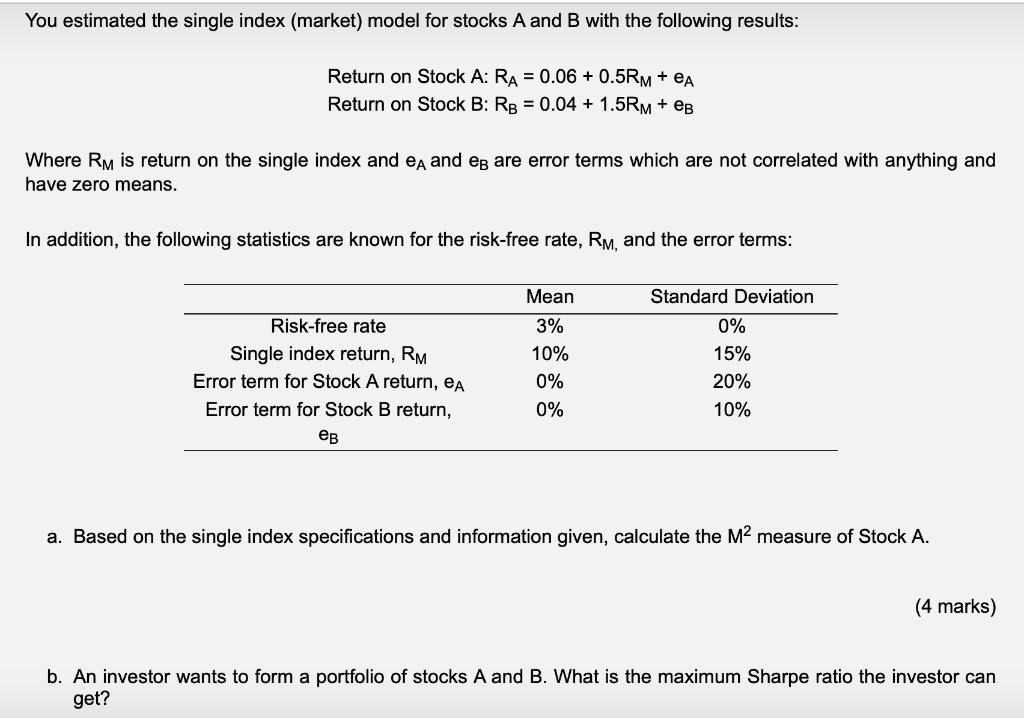

You estimated the single index (market) model for stocks A and B with the following results: Return on Stock A: RA = 0.06 + 0.5RM + A Return on Stock B: RB = 0.04 + 1.5RM + B Where RM is return on the single index and e and B are error terms which are not correlated with anything and have zero means. In addition, the following statistics are known for the risk-free rate, RM, and the error terms: Risk-free rate Mean 3% Standard Deviation 0% Single index return, RM Error term for Stock A return, eA 10% 15% 0% 20% Error term for Stock B return, 0% 10% a. Based on the single index specifications and information given, calculate the M measure of Stock A. (4 marks) b. An investor wants to form a portfolio of stocks A and B. What is the maximum Sharpe ratio the investor can get?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

ISE Investments

Authors: Zvi Bodie, Alex Kane, Alan Marcus

12th International Edition

1260571157, 978-1260571158

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App