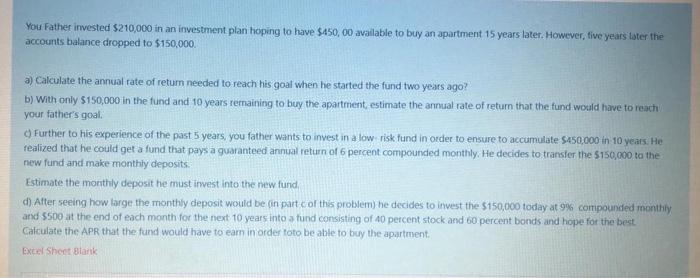

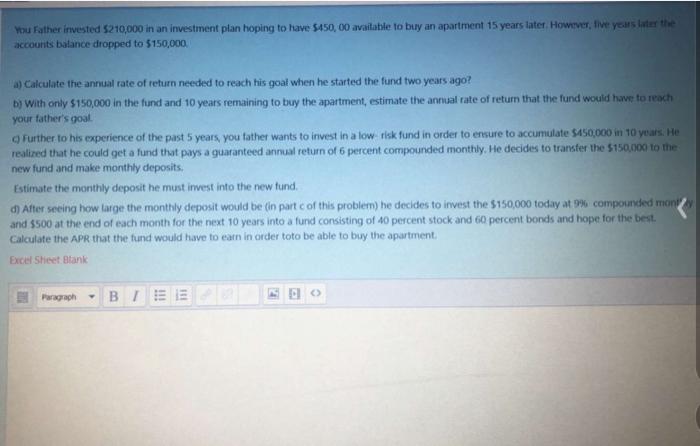

You Father invested $210,000 in an investment plan hoping to have $450,00 available to buy an apartment 15 years later. However, five years later the accounts balance dropped to $150,000 a) Calculate the annual rate of retum needed to reach his goal when he started the fund two years ago? b) with only $150,000 in the fund and 10 years remaining to buy the apartment, estimate the annual rate of return that the fund would have to reach your father's goal Further to his experience of the past 5 years, you father wants to invest in a low risk fund in order to ensure to accumulate $450,000 in 10 years. He tealized that he could get a fund that pays a guaranteed annual return of 6 percent compounded monthly. He decides to transfer the $150,000 to the new fund and make monthly deposits. Estimate the monthly deposit he must invest into the new fund d) After seeing how larger the monthly deposit would be (in part of this problem) he decides to invest the $150,000 today at 9% compounded monthly and 5500 at the end of each month for the next 10 years into a fund consisting of a percent stock and 60 percent bonds and hope for the best Calculate the APR that the fund would have to earn in order toto be able to buy the apartment Excel Sheet Blank You Father invested $210,000 in an investment plan hoping to have $450,00 available to buy an apartment 15 years later. However, tive years later the account balance dropped to $150,000 a) Calculate the annual rate of return needed to reach his goat when he started the fund two years ago? b) with only $150,000 in the fund and 10 years remaining to buy the apartment, estimate the annual rate of return that the fund would have to reach your father's goal Further to his experience of the past 5 years, you father wants to invest in a low-risk fund in order to ensure to accumulate $450,000 in 10 years. He realized that he could get a fund that pays a guaranteed annual return of 6 percent compounded monthly. He decides to transfer the $150,000 to the new fund and make monthly deposits Estimate the monthly deposit he must invest into the new fund. After seeing how large the monthly deposit would be (in part of this problem) he decides to invest the $150,000 today at 9% compounded mont and $500 at the end of each month for the next 10 years into a fund consisting of 40 percent stock and 60 percent bonds and hope for the best Calculate the APR that the fund would have to earn in order toto be able to buy the apartment Excel Sheet Bank Paragraph BI SE