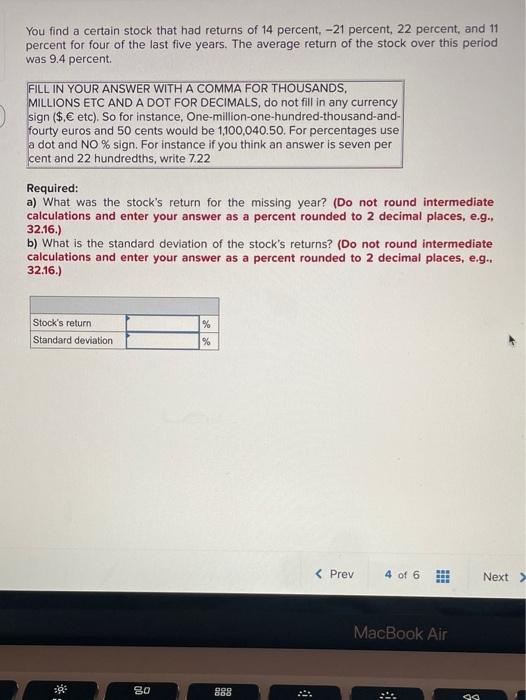

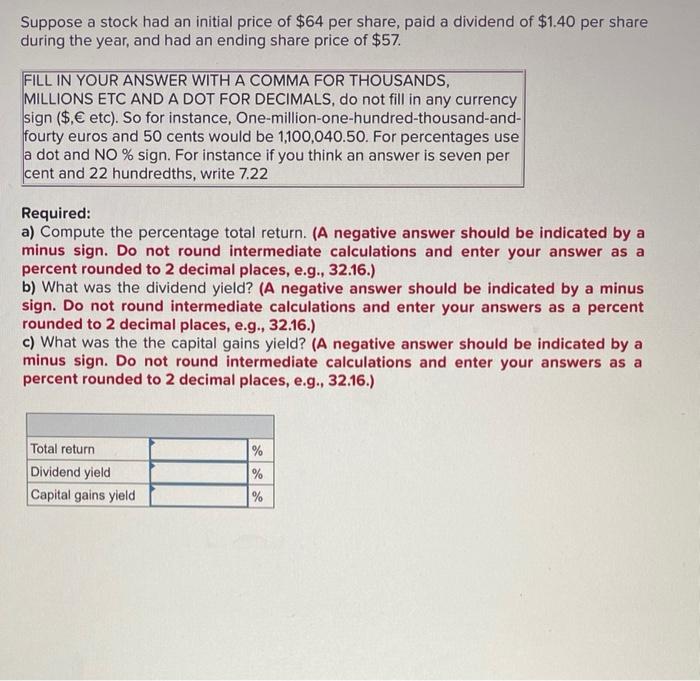

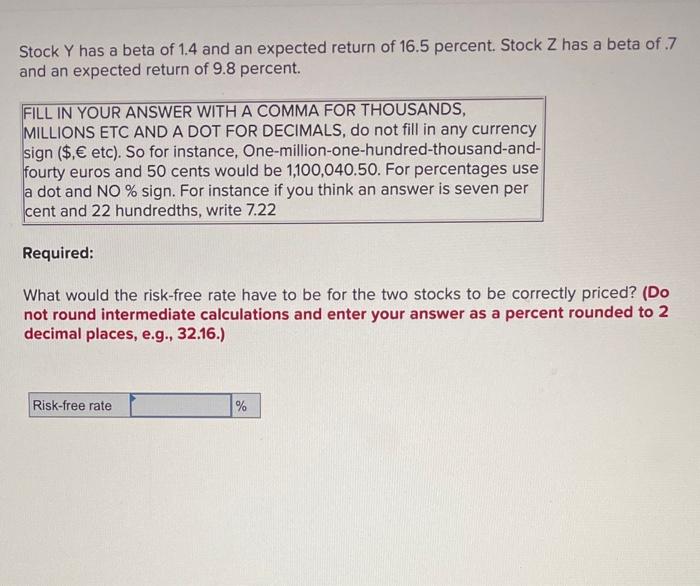

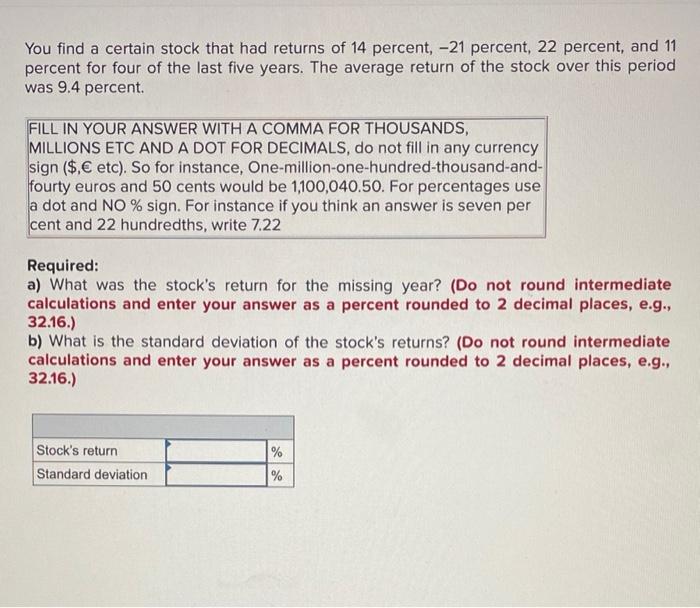

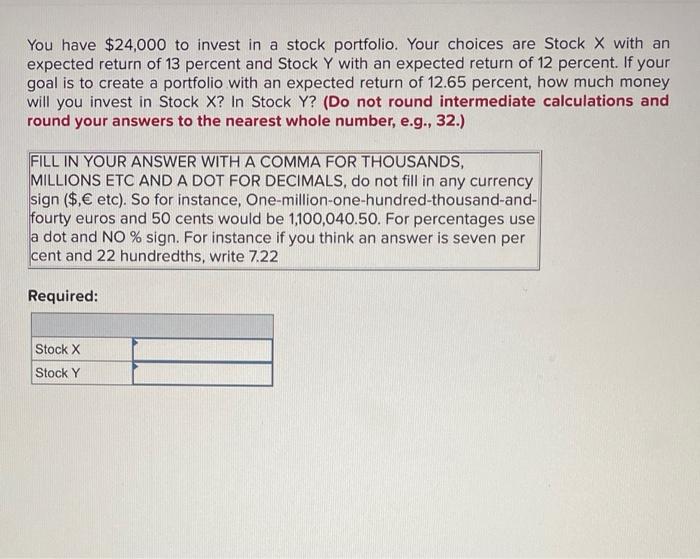

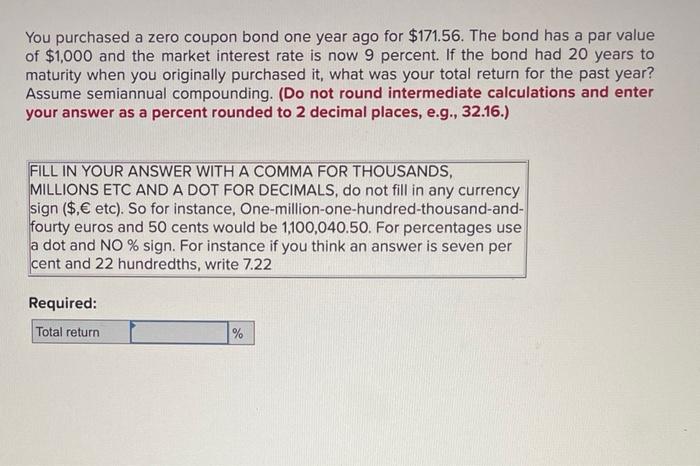

You find a certain stock that had returns of 14 percent. -21 percent, 22 percent, and 11 percent for four of the last five years. The average return of the stock over this period was 9.4 percent FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($. etc). So for instance, One-million-one-hundred-thousand-and- fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: a) What was the stock's return for the missing year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) b) What is the standard deviation of the stock's returns? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.. 32.16.) % Stock's return Standard deviation % MacBook Air 80 . ao Suppose a stock had an initial price of $64 per share, paid a dividend of $1.40 per share during the year, and had an ending share price of $57. FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($. etc). So for instance, One-million-one-hundred-thousand-and- fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: a) Compute the percentage total return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b) What was the dividend yield? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c) What was the the capital gains yield? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Total return Dividend yield Capital gains yield % % % Stock Y has a beta of 1.4 and an expected return of 16.5 percent. Stock Z has a beta of 7 and an expected return of 9.8 percent. FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($. etc). So for instance, One-million-one-hundred-thousand-and- fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: What would the risk-free rate have to be for the two stocks to be correctly priced? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Risk-free rate % You find a certain stock that had returns of 14 percent, -21 percent, 22 percent, and 11 percent for four of the last five years. The average return of the stock over this period was 9.4 percent FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($. etc). So for instance, One-million-one-hundred-thousand-and- fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: a) What was the stock's return for the missing year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b) What is the standard deviation of the stock's returns? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Stock's return % % Standard deviation You have $24,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 13 percent and Stock Y with an expected return of 12 percent. If your goal is to create a portfolio with an expected return of 12.65 percent, how much money will you invest in Stock X? In Stock Y? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($, etc). So for instance, One-million-one-hundred-thousand-and- fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: Stock X Stock Y You purchased a zero coupon bond one year ago for $171.56. The bond has a par value of $1,000 and the market interest rate is now 9 percent. If the bond had 20 years to maturity when you originally purchased it, what was your total return for the past year? Assume semiannual compounding. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($. etc). So for instance, One-million-one-hundred-thousand-and- fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: Total return %