Question

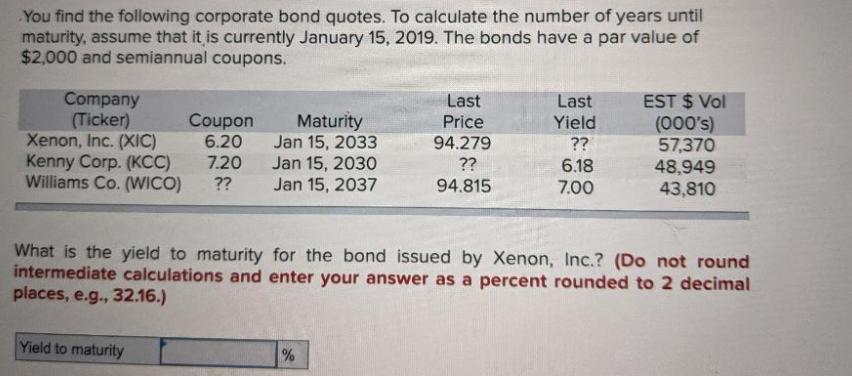

You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15, 2019. The

You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15, 2019. The bonds have a par value of $2,000 and semiannual coupons. Company (Ticker) Last Last EST $ Vol Coupon Maturity Price Yield (000's) Xenon, Inc. (XIC) 6.20 Jan 15, 2033 94.279 ?? 57,370 Kenny Corp. (KCC) Williams Co. (WICO) 7.20 Jan 15, 2030 ?? 6.18 48,949 ?? Jan 15, 2037 94.815 7.00 43,810 What is the yield to maturity for the bond issued by Xenon, Inc.? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Yield to maturity %

Step by Step Solution

3.39 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Solution To calculate the yield to maturity for the bond issued by Xenon Inc XIC we c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Corporate Finance

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan

6th Edition

978-0073405131, 9780073405131

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App