Answered step by step

Verified Expert Solution

Question

1 Approved Answer

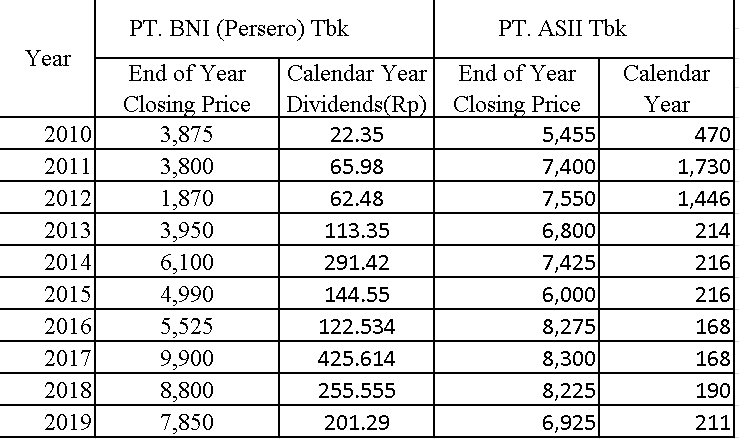

You form a diversified portfolio consisting of BNI and ASII stocks. a. Using different proportions that BNI could constitute the portfolio ranging from 0% to

You form a diversified portfolio consisting of BNI and ASII stocks.

a. Using different proportions that BNI could constitute the portfolio ranging from 0% to 100% in 10% increments. Calculate the Portfolio Variance, Standard Deviation and Expected Return.

b. What are the investment proportions/allocation in the optimal portfolio of the 2 stocks? What is the Expected Return and the Standard Deviation of its rate of return? (risk-free interest rate = 5%.

PT. BNI (Persero) Tbk PT. ASII Tbk Year Calendar Year 470 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 End of Year Closing Price 3,875 3,800 1,870 3,950 6,100 4,990 5,525 9,900 8,800 7,850 Calendar Year End of Year Dividends(Rp) Closing Price 22.35 5,455 65.98 7,400 62.48 7,550 113.35 6,800 291.42 7,425 144.55 6,000 122.534 8,275 425.614 8,300 255.555 8,225 201.29 6,925 1,730 1,446 214 216 216 168 168 190 211 PT. BNI (Persero) Tbk PT. ASII Tbk Year Calendar Year 470 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 End of Year Closing Price 3,875 3,800 1,870 3,950 6,100 4,990 5,525 9,900 8,800 7,850 Calendar Year End of Year Dividends(Rp) Closing Price 22.35 5,455 65.98 7,400 62.48 7,550 113.35 6,800 291.42 7,425 144.55 6,000 122.534 8,275 425.614 8,300 255.555 8,225 201.29 6,925 1,730 1,446 214 216 216 168 168 190 211Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started