Question

You gathered the following data from time cards and individual employee earnings records. Task 1. On December 5, 202X,prepare a payroll register for this biweekly

You gathered the following data from time cards and individual employee earnings records.

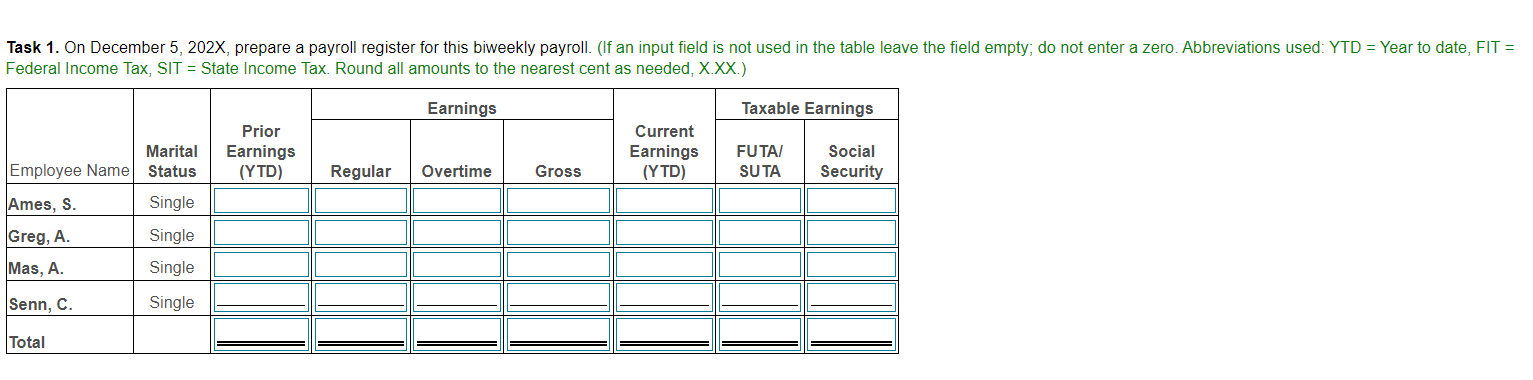

Task 1. On December 5, 202X,prepare a payroll register for this biweekly payroll. (If an input field is not used in the table leave the field empty; do not enter a zero. Abbreviations used: YTD = Year to date, FIT = Federal Income Tax, SIT = State Income Tax. Round all amounts to the nearest cent as needed, X.XX.)

| Employee | Marital Status | Cumulative Earnings Before This Payroll | Biweekly Salary | Check No. | Department |

|---|---|---|---|---|---|

| Ames, Sioban | Single | $6,500 | $1,530 | 30 | Production |

| Greg, Andi | Single | 48,400 | 1,980 | 31 | Office |

| Mas, Arlo | Single | 141,700 | 2,100 | 32 | Production |

| Senn, Chris | Single | 162,500 | 760 | 33 | Office |

(Assume no overtime earnings.)

| STANDARD Withholding Rate Schedules Single or Married Filing Separately | |||

|

| The tentative amount to withhold is: | Plus this percentage | of the amount that the Adjusted Wage exceeds |

|---|---|---|---|

| Adjusted wage amount is at least $0, but less than $483 | $0.00 | 0% | $0 |

| Adjusted wage amount is at least $483, but less than $865 | $0.00 | 10% | $483 |

| Adjusted wage amount is at least $865, but less than $2,041 | $38.20 | 12% | $865 |

| Adjusted wage amount is at least $2,041, but less than $3,805 | $179.32 | 22% | $2,041 |

| Adjusted wage amount is at least $3,805, but less than $6,826 | $567.40 | 24% | $3,805 |

| Adjusted wage amount is at least $6,826, but less than $8,538 | $1,292.44 | 32% | $6,826 |

| Adjusted wage amount is at least $8,538, but less than $20,621 | $1,840.28 | 35% | $8,538 |

| Adjusted wage amount is at least $20,621 | $6,069.33 | 37% | $20,621 |

| 1. | On December 5,202X,prepare a payroll register for this biweekly payroll. |

| 2. | Calculate the employer taxes of FICA Social Security, FICA Medicare, FUTA, and SUTA. |

| 3. | Journalize the Payroll Register and the employer's tax liability. |

Assume the following:

| 1. | FICA Social Security is 6.2% on $142,800; FICA Medicare is 1.45% on all earnings. |

| 2. | Federal income tax is calculated using the biweekly payroll withholding chart included. |

| 3. | State income tax is 10% of gross pay. |

| 4. | Charitable Contributions are $14 biweekly. |

| 5. | The SUTA rate is 5.0% and the FUTA rate is 0.6% on earnings up to $7,000. (Note that the $7,000 wage base applies to both SUTA and FUTA.) |

Please show explanations to your calculation.

Please show explanations to your calculation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started