Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You graduated from the university and started working in a financial intermediary. You are looking at different stocks listed on Borsa Istanbul and trying to

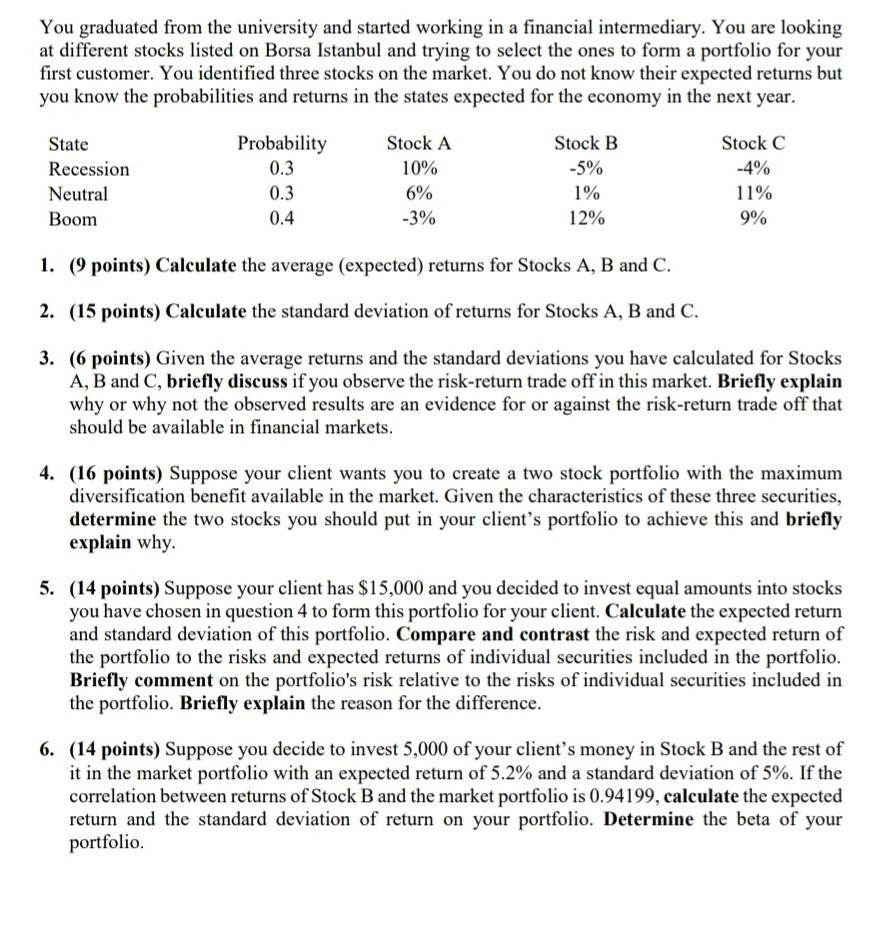

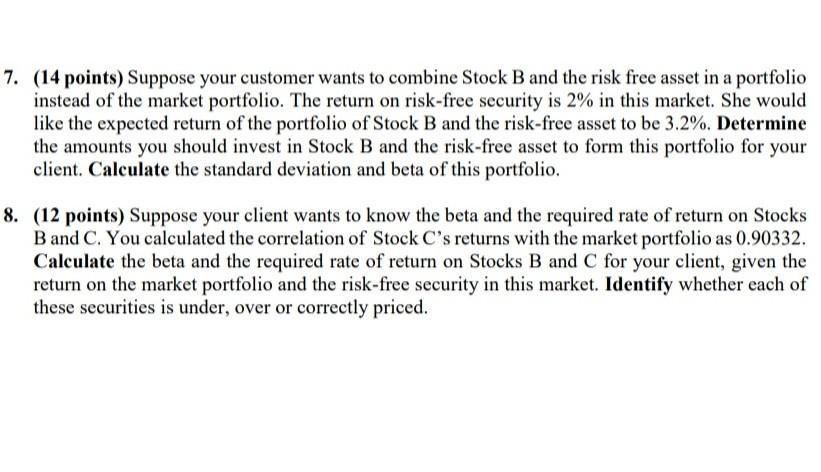

You graduated from the university and started working in a financial intermediary. You are looking at different stocks listed on Borsa Istanbul and trying to select the ones to form a portfolio for your first customer. You identified three stocks on the market. You do not know their expected returns but you know the probabilities and returns in the states expected for the economy in the next year. State Recession Neutral Boom Probability 0.3 0.3 0.4 Stock A 10% 6% -3% Stock B -5% 1% 12% Stock C -4% 11% 9% 1. (9 points) Calculate the average (expected) returns for Stocks A, B and C. 2. (15 points) Calculate the standard deviation of returns for Stocks A, B and C. 3. (6 points) Given the average returns and the standard deviations you have calculated for Stocks A, B and C, briefly discuss if you observe the risk-return trade off in this market. Briefly explain why or why not the observed results are an evidence for or against the risk-return trade off that should be available in financial markets. 4. (16 points) Suppose your client wants you to create a two stock portfolio with the maximum diversification benefit available in the market. Given the characteristics of these three securities, determine the two stocks you should put in your client's portfolio to achieve this and briefly explain why. 5. (14 points) Suppose your client has $15,000 and you decided to invest equal amounts into stocks you have chosen in question 4 to form this portfolio for your client. Calculate the expected return and standard deviation of this portfolio. Compare and contrast the risk and expected return of the portfolio to the risks and expected returns of individual securities included in the portfolio. Briefly comment on the portfolio's risk relative to the risks of individual securities included in the portfolio. Briefly explain the reason for the difference. 6. (14 points) Suppose you decide to invest 5,000 of your client's money in Stock B and the rest of it in the market portfolio with an expected return of 5.2% and a standard deviation of 5%. If the correlation between returns of Stock B and the market portfolio is 0.94199, calculate the expected return and the standard deviation of return on your portfolio. Determine the beta of your portfolio 7. (14 points) Suppose your customer wants to combine Stock B and the risk free asset in a portfolio instead of the market portfolio. The return on risk-free security is 2% in this market. She would like the expected return of the portfolio of Stock B and the risk-free asset to be 3.2%. Determine the amounts you should invest in Stock B and the risk-free asset to form this portfolio for your client. Calculate the standard deviation and beta of this portfolio. 8. (12 points) Suppose your client wants to know the beta and the required rate of return on Stocks B and C. You calculated the correlation of Stock C's returns with the market portfolio as 0.90332. Calculate the beta and the required rate of return on Stocks B and C for your client, given the return on the market portfolio and the risk-free security in this market. Identify whether each of these securities is under, over or correctly priced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started