Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have $20,000 in your retirement fund that is earning 5.5 percent per year, compounded quarterly. How many dollars in withdrawals per month would reduce

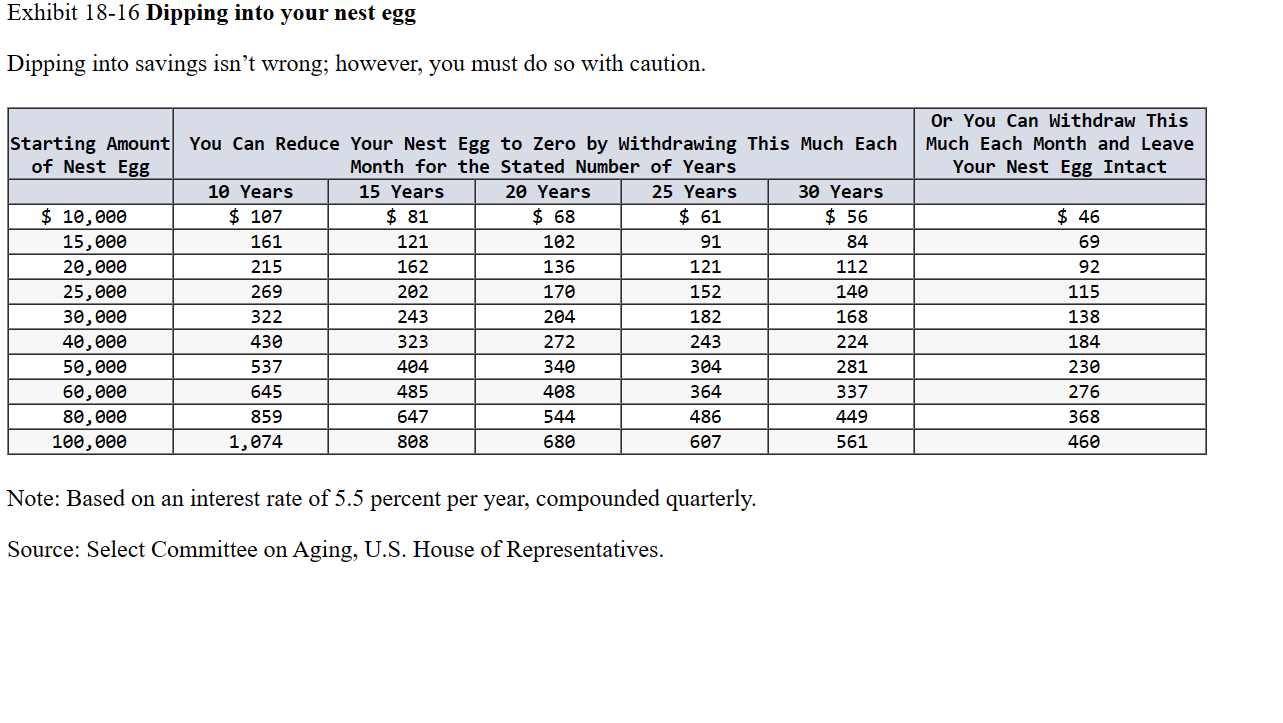

You have $20,000 in your retirement fund that is earning 5.5 percent per year, compounded quarterly. How many dollars in withdrawals per month would reduce this nest egg to zero in 20 years? (Use Exhibit 18-16.) Withdrawal rate Exhibit 18-16 Dipping into your nest egg Dipping into savings isn't wrong; however, you must do so with caution. Note: Based on an interest rate of 5.5 percent per year, compounded quarterly. Source: Select Committee on Aging, U.S. House of Representatives

You have $20,000 in your retirement fund that is earning 5.5 percent per year, compounded quarterly. How many dollars in withdrawals per month would reduce this nest egg to zero in 20 years? (Use Exhibit 18-16.) Withdrawal rate Exhibit 18-16 Dipping into your nest egg Dipping into savings isn't wrong; however, you must do so with caution. Note: Based on an interest rate of 5.5 percent per year, compounded quarterly. Source: Select Committee on Aging, U.S. House of Representatives Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started