Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you have 40 min to solve this businessman is considering an investment project that requires an initial outlay of 200,000 and is expected to generate

you have 40 min to solve this

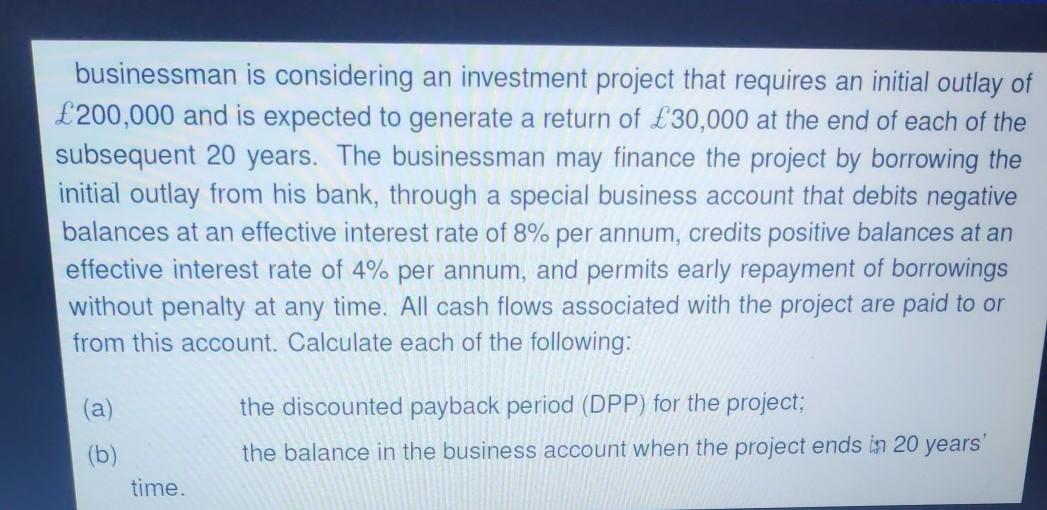

businessman is considering an investment project that requires an initial outlay of 200,000 and is expected to generate a return of 30,000 at the end of each of the subsequent 20 years. The businessman may finance the project by borrowing the initial outlay from his bank, through a special business account that debits negative balances at an effective interest rate of 8% per annum, credits positive balances at an effective interest rate of 4% per annum, and permits early repayment of borrowings without penalty at any time. All cash flows associated with the project are paid to or from this account. Calculate each of the following: (a the discounted payback period (DPP) for the project; the balance in the business account when the project ends in 20 years' (b) timeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started