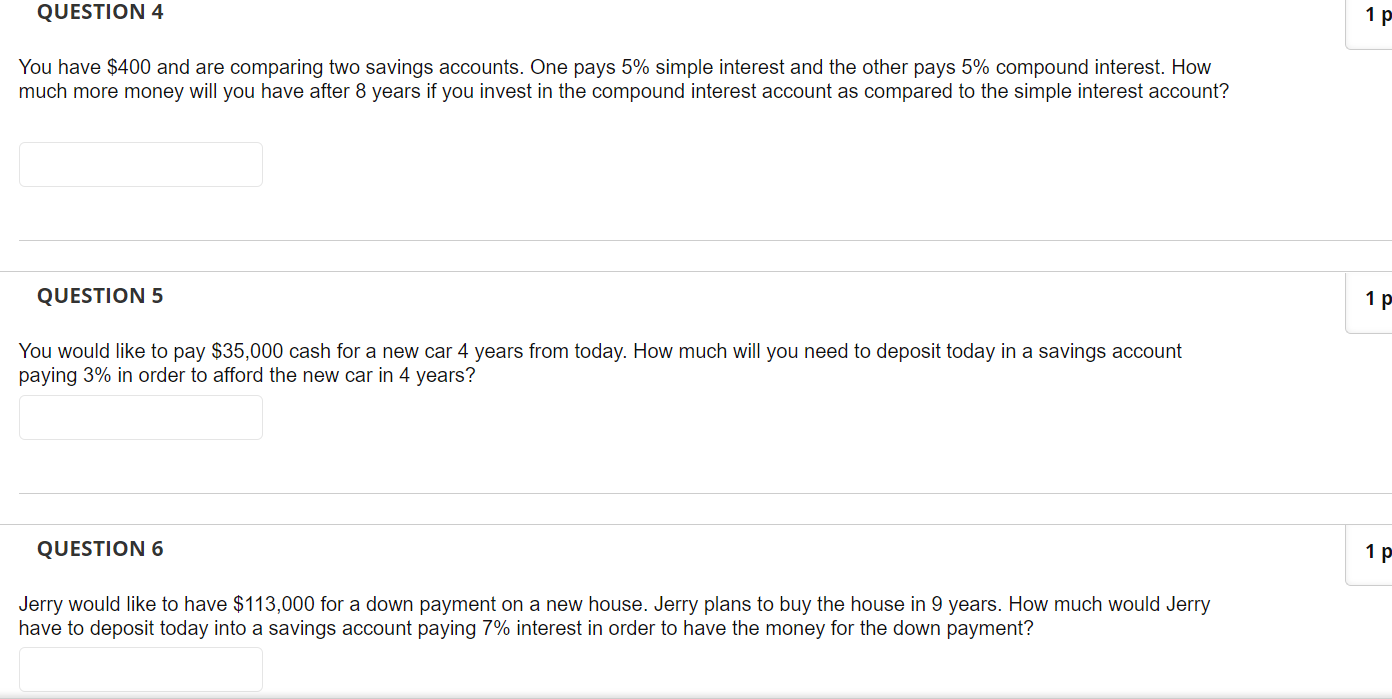

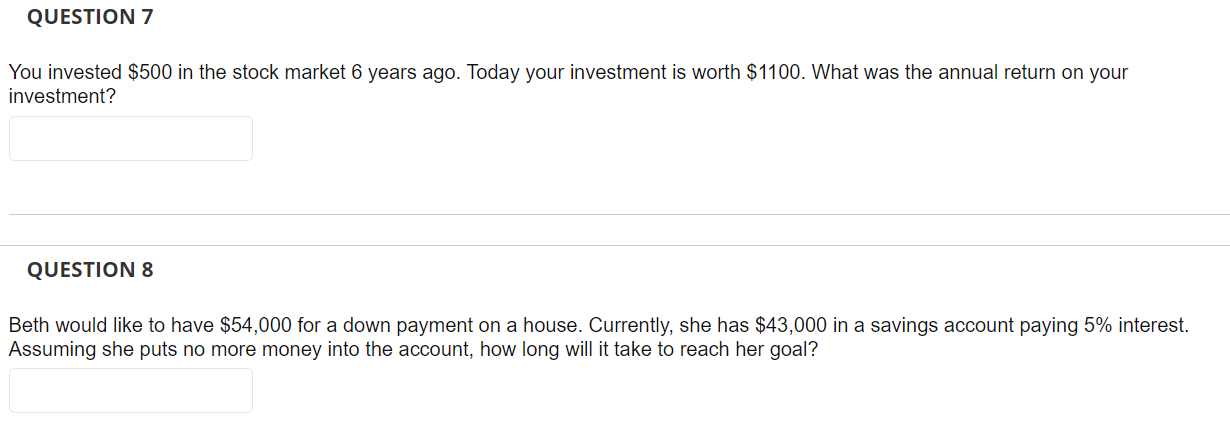

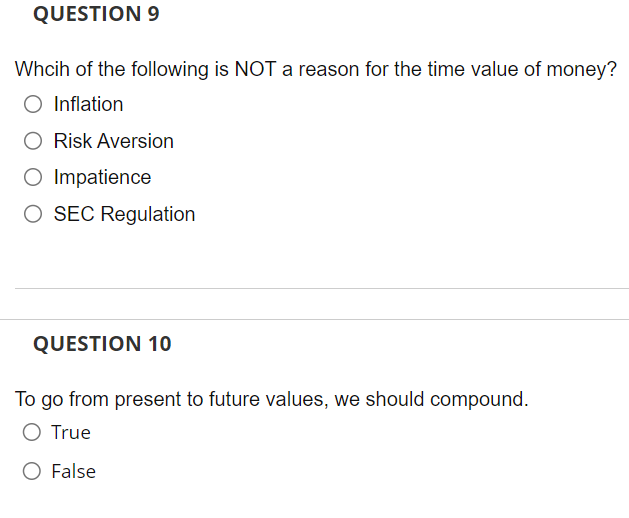

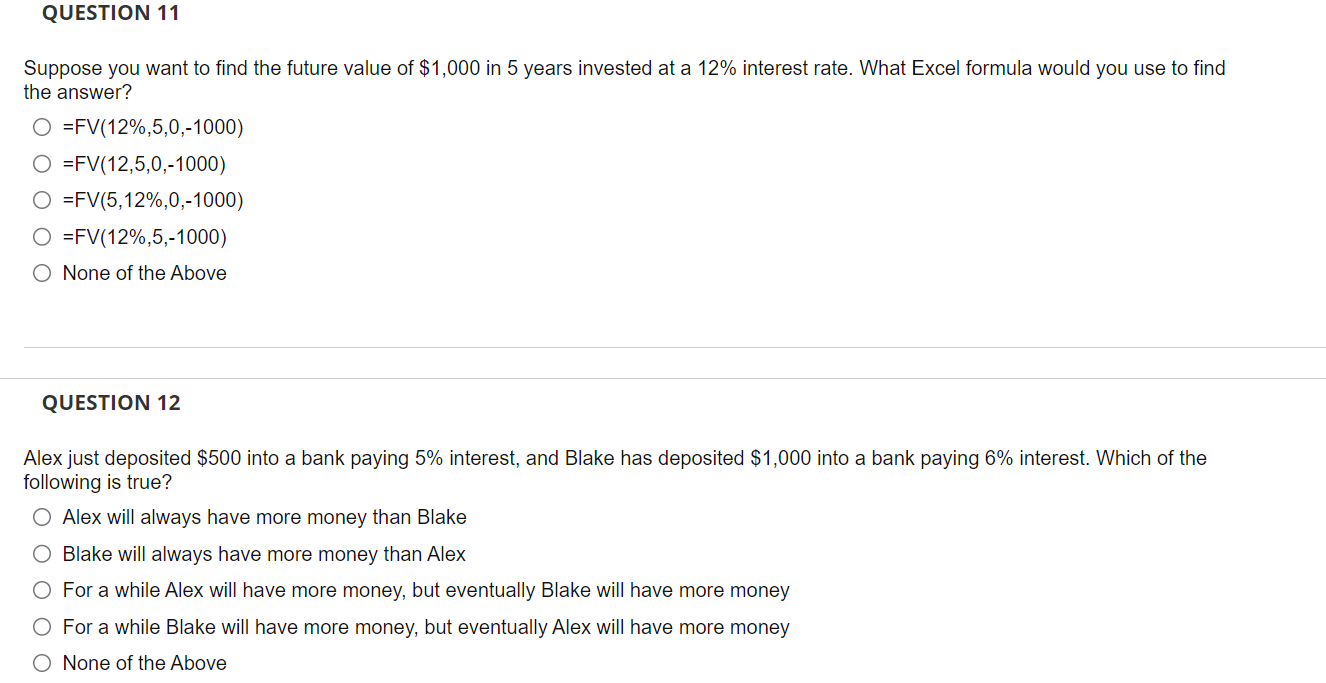

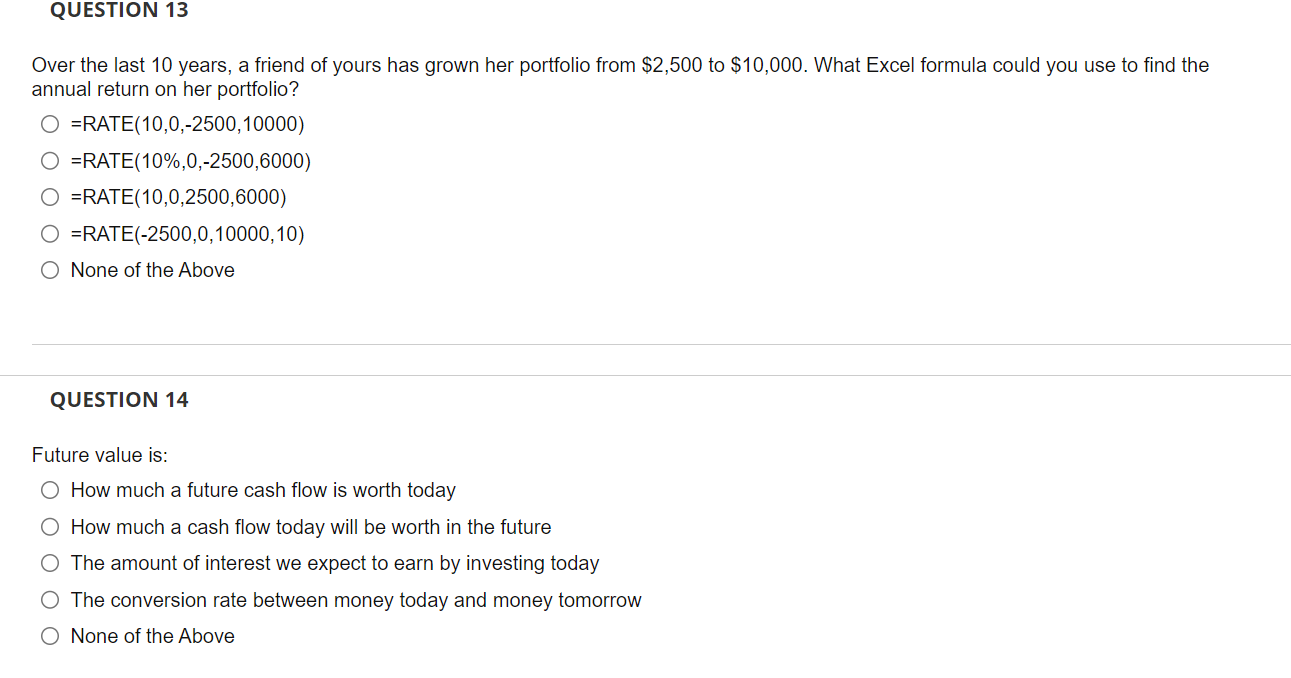

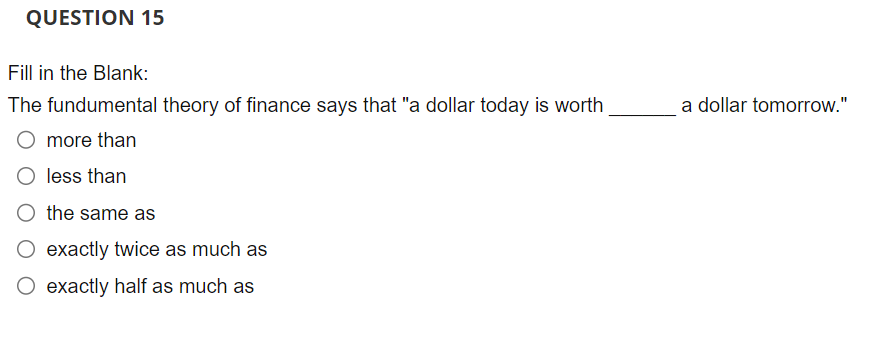

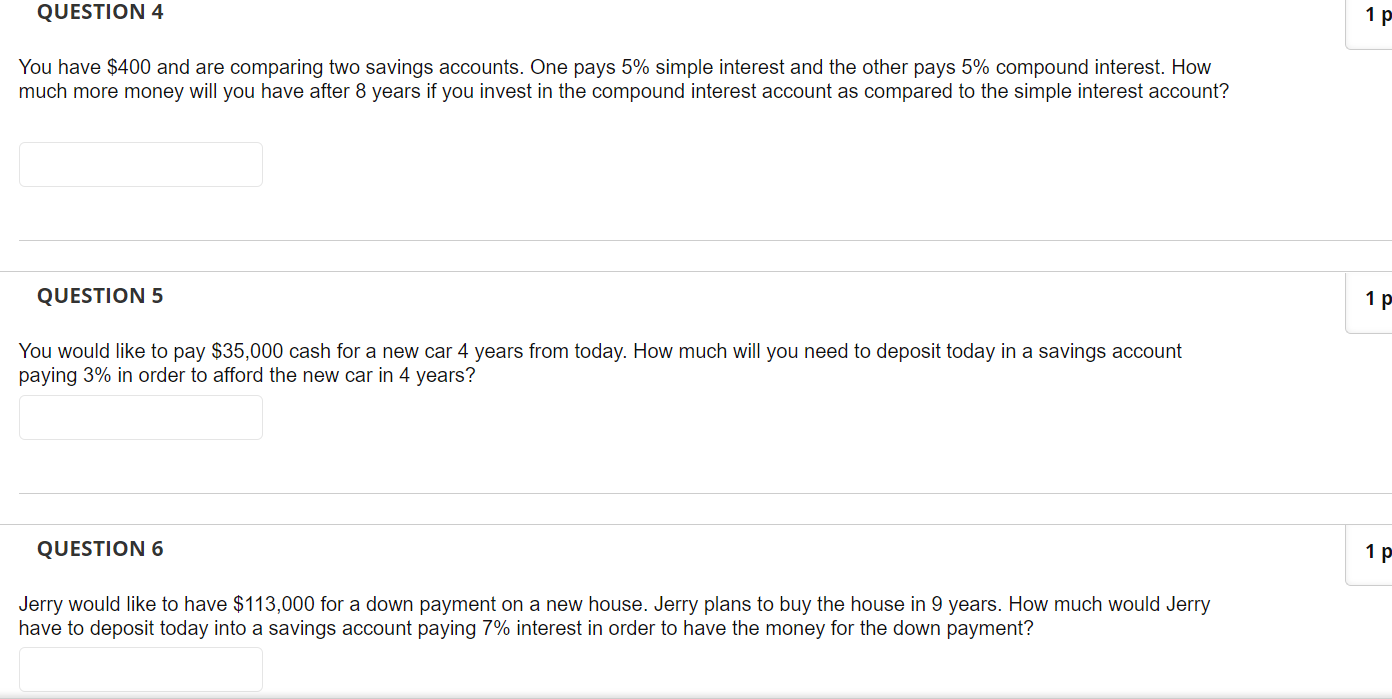

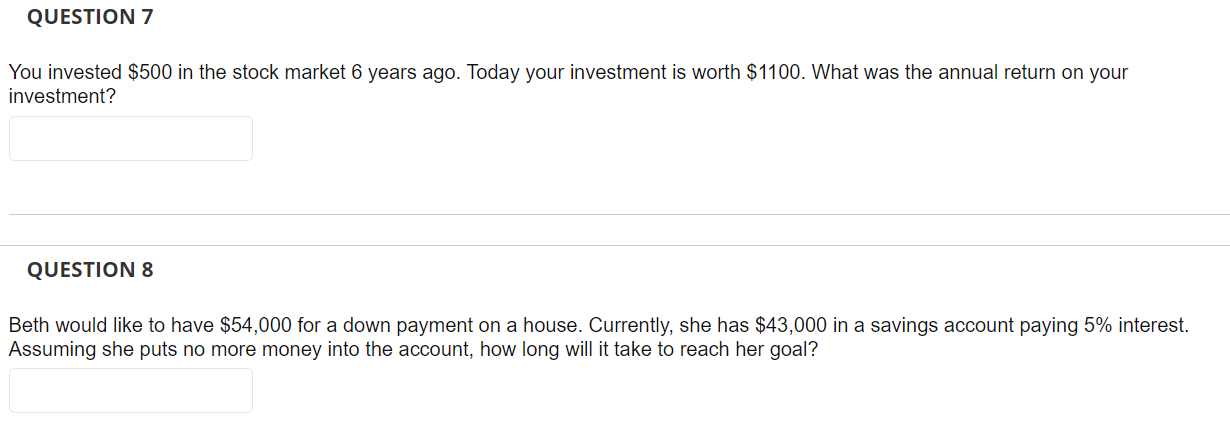

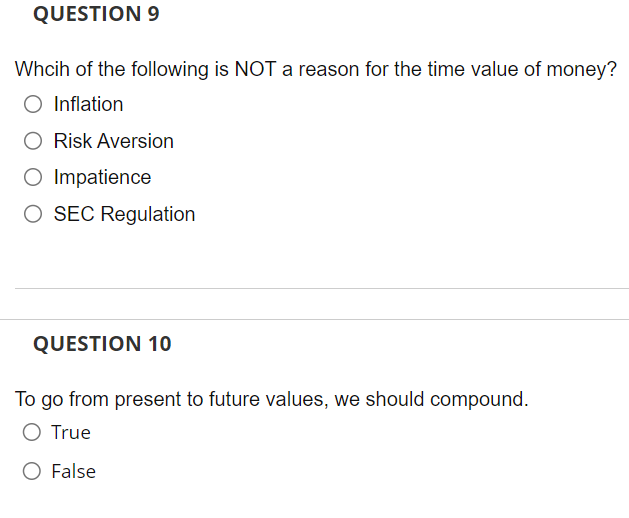

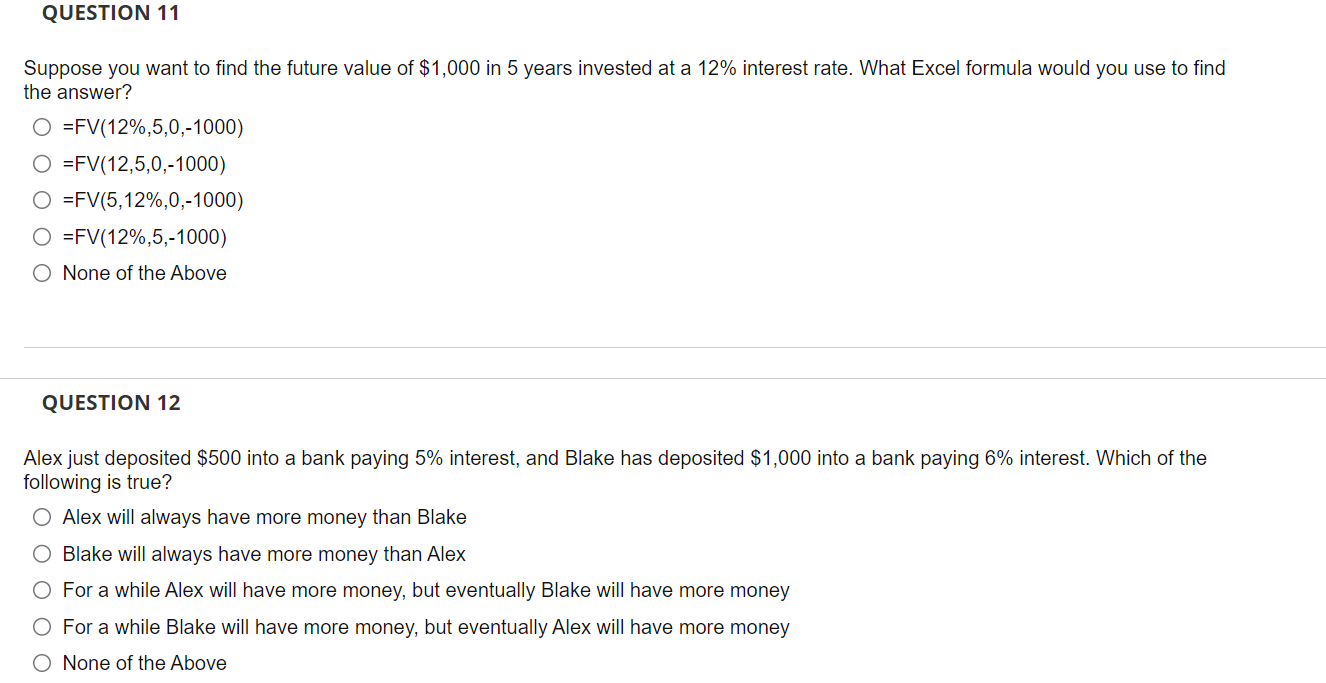

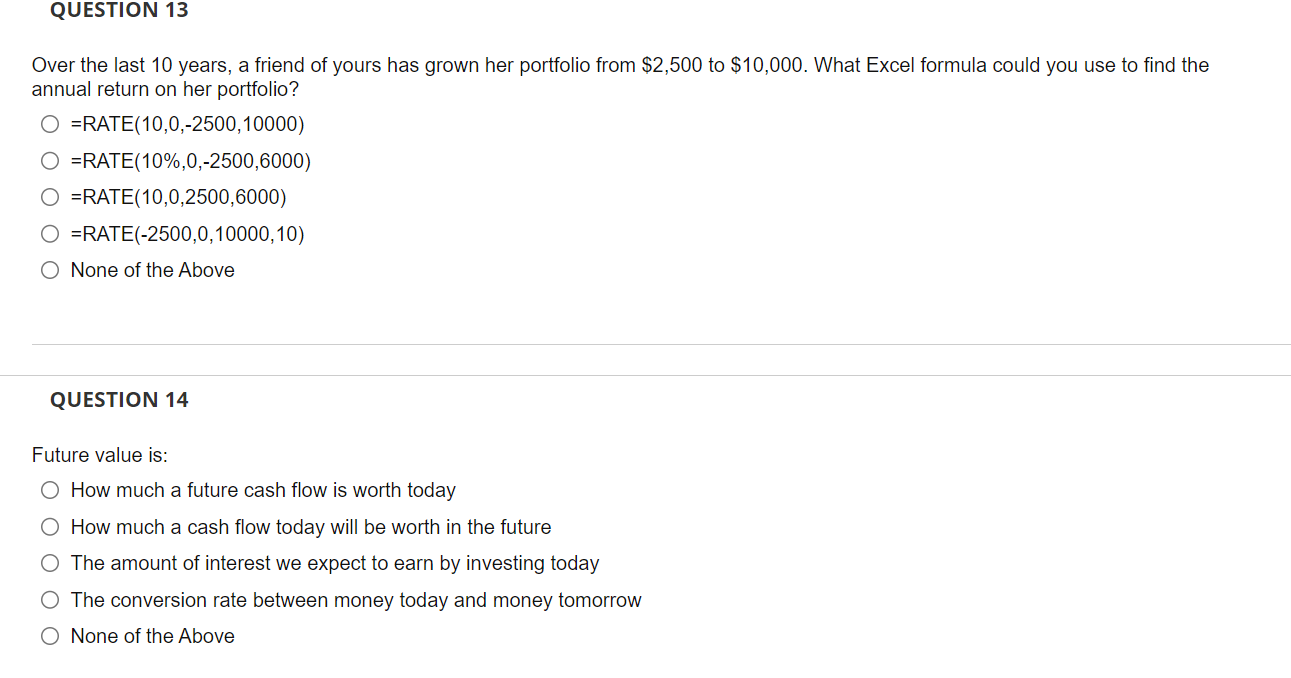

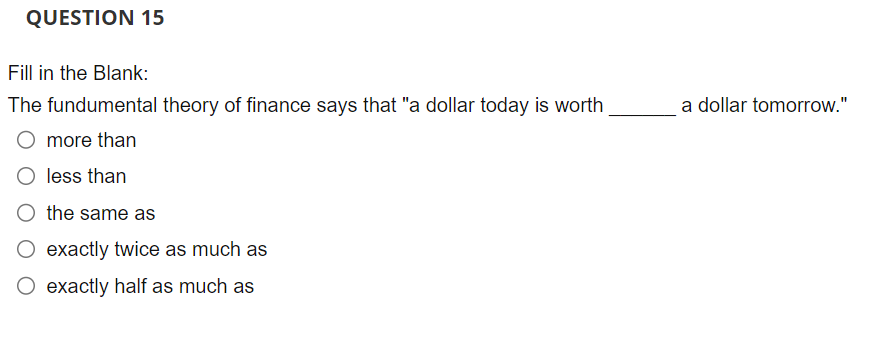

You have $400 and are comparing two savings accounts. One pays 5% simple interest and the other pays 5% compound interest. How much more money will you have after 8 years if you invest in the compound interest account as compared to the simple interest account? QUESTION 5 You would like to pay $35,000 cash for a new car 4 years from today. How much will you need to deposit today in a savings account paying 3% in order to afford the new car in 4 years? QUESTION 6 Jerry would like to have $113,000 for a down payment on a new house. Jerry plans to buy the house in 9 years. How much would Jerry have to deposit today into a savings account paying 7% interest in order to have the money for the down payment? You invested $500 in the stock market 6 years ago. Today your investment is worth $1100. What was the annual return on your investment? QUESTION 8 Beth would like to have $54,000 for a down payment on a house. Currently, she has $43,000 in a savings account paying 5% interest. Assuming she puts no more money into the account, how long will it take to reach her goal? Whcih of the following is NOT a reason for the time value of money? Inflation Risk Aversion Impatience SEC Regulation QUESTION 10 To go from present to future values, we should compound. True False Suppose you want to find the future value of $1,000 in 5 years invested at a 12% interest rate. What Excel formula would you use to find the answer? =FV(12%,5,0,1000)=FV(12,5,0,1000)=FV(5,12%,0,1000)=FV(12%,5,1000) None of the Above QUESTION 12 Alex just deposited $500 into a bank paying 5% interest, and Blake has deposited $1,000 into a bank paying 6% interest. Which of the following is true? Alex will always have more money than Blake Blake will always have more money than Alex For a while Alex will have more money, but eventually Blake will have more money For a while Blake will have more money, but eventually Alex will have more money None of the Above Over the last 10 years, a friend of yours has grown her portfolio from $2,500 to $10,000. What Excel formula could you use to find the annual return on her portfolio? =RATE(10,0,2500,10000)=RATE(10%,0,2500,6000)=RATE(10,0,2500,6000)=RATE(2500,0,10000,10) None of the Above QUESTION 14 Future value is: How much a future cash flow is worth today How much a cash flow today will be worth in the future The amount of interest we expect to earn by investing today The conversion rate between money today and money tomorrow None of the Above Fill in the Blank: The fundumental theory of finance says that "a dollar today is worth a dollar tomorrow." more than less than the same as exactly twice as much as exactly half as much as