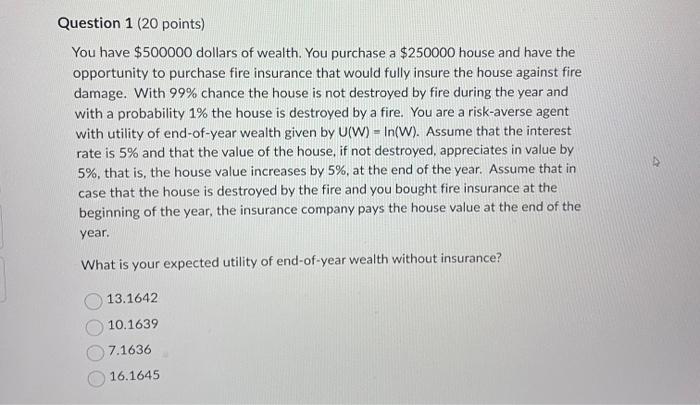

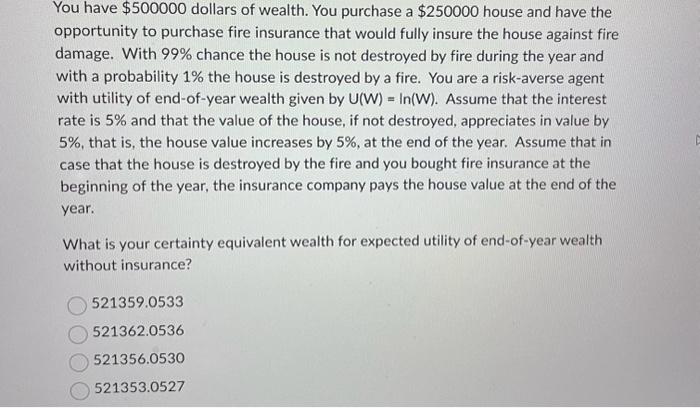

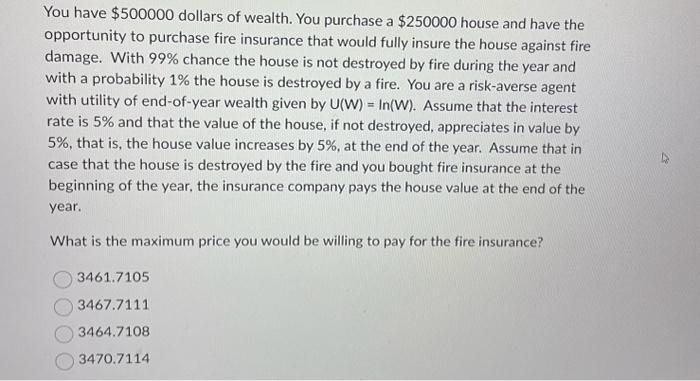

You have $500000 dollars of wealth. You purchase a $250000 house and have the opportunity to purchase fire insurance that would fully insure the house against fire damage. With 99% chance the house is not destroyed by fire during the year and with a probability 1% the house is destroyed by a fire. You are a risk-averse agent with utility of end-of-year wealth given by U(W)=ln(W). Assume that the interest rate is 5% and that the value of the house, if not destroyed, appreciates in value by 5%, that is, the house value increases by 5%, at the end of the year. Assume that in case that the house is destroyed by the fire and you bought fire insurance at the beginning of the year, the insurance company pays the house value at the end of the year. What is your expected utility of end-of-year wealth without insurance? 13.1642 10.1639 7.1636 16.1645 You have $500000 dollars of wealth. You purchase a $250000 house and have the opportunity to purchase fire insurance that would fully insure the house against fire damage. With 99% chance the house is not destroyed by fire during the year and with a probability 1% the house is destroyed by a fire. You are a risk-averse agent with utility of end-of-year wealth given by U(W)=ln(W). Assume that the interest rate is 5% and that the value of the house, if not destroyed, appreciates in value by 5%, that is, the house value increases by 5%, at the end of the year. Assume that in case that the house is destroyed by the fire and you bought fire insurance at the beginning of the year, the insurance company pays the house value at the end of the year. What is your certainty equivalent wealth for expected utility of end-of-year wealth without insurance? 521359.0533521362.0536521356.0530521353.0527 You have $500000 dollars of wealth. You purchase a $250000 house and have the opportunity to purchase fire insurance that would fully insure the house against fire damage. With 99% chance the house is not destroyed by fire during the year and with a probability 1% the house is destroyed by a fire. You are a risk-averse agent with utility of end-of-year wealth given by U(W)=ln(W). Assume that the interest rate is 5% and that the value of the house, if not destroyed, appreciates in value by 5%, that is, the house value increases by 5%, at the end of the year. Assume that in case that the house is destroyed by the fire and you bought fire insurance at the beginning of the year, the insurance company pays the house value at the end of the year. What is the maximum price you would be willing to pay for the fire insurance? 3461.71053467.71113464.71083470.7114