Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have a $9,000,000 portfolio that has a beta of 1.5 to the S&P500. You have decided you want to hedge this portfolio over the

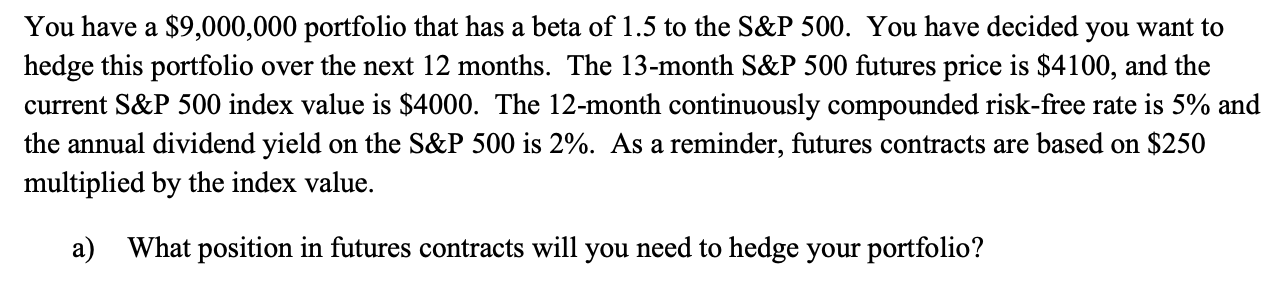

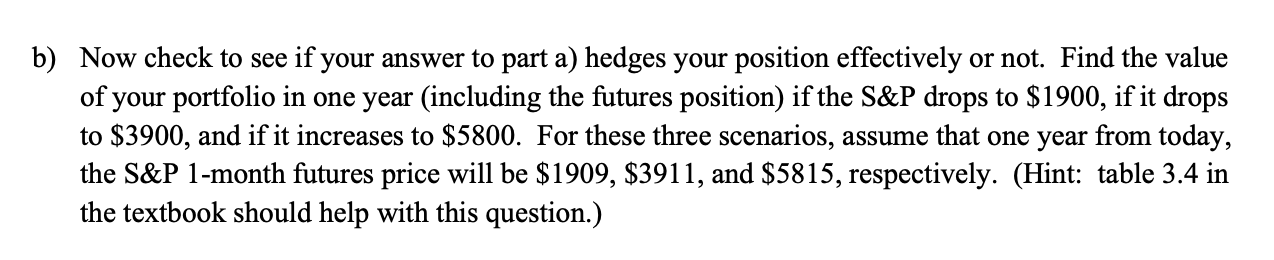

You have a $9,000,000 portfolio that has a beta of 1.5 to the S&P500. You have decided you want to hedge this portfolio over the next 12 months. The 13-month S\&P 500 futures price is $4100, and the current S\&P 500 index value is $4000. The 12 -month continuously compounded risk-free rate is 5% and the annual dividend yield on the S\&P 500 is 2%. As a reminder, futures contracts are based on $250 multiplied by the index value. a) What position in futures contracts will you need to hedge your portfolio? Now check to see if your answer to part a) hedges your position effectively or not. Find the value of your portfolio in one year (including the futures position) if the S\&P drops to $1900, if it drops to $3900, and if it increases to $5800. For these three scenarios, assume that one year from today, the S\&P 1-month futures price will be $1909,$3911, and $5815, respectively. (Hint: table 3.4 in the textbook should help with this question.)

You have a $9,000,000 portfolio that has a beta of 1.5 to the S&P500. You have decided you want to hedge this portfolio over the next 12 months. The 13-month S\&P 500 futures price is $4100, and the current S\&P 500 index value is $4000. The 12 -month continuously compounded risk-free rate is 5% and the annual dividend yield on the S\&P 500 is 2%. As a reminder, futures contracts are based on $250 multiplied by the index value. a) What position in futures contracts will you need to hedge your portfolio? Now check to see if your answer to part a) hedges your position effectively or not. Find the value of your portfolio in one year (including the futures position) if the S\&P drops to $1900, if it drops to $3900, and if it increases to $5800. For these three scenarios, assume that one year from today, the S\&P 1-month futures price will be $1909,$3911, and $5815, respectively. (Hint: table 3.4 in the textbook should help with this question.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started