Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have a choice between the following three investments: . A bank bill. The bill was issued as a 90-day bank bill 30 days

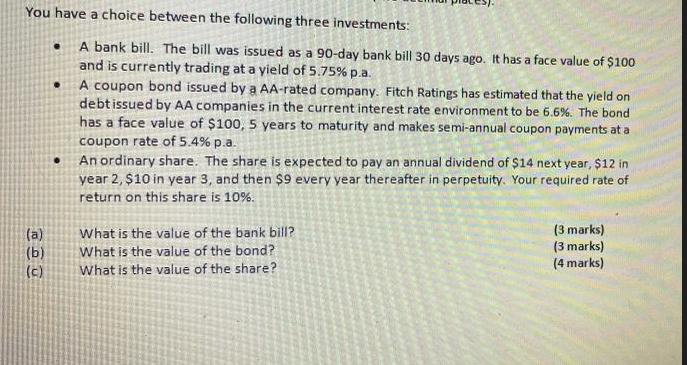

You have a choice between the following three investments: . A bank bill. The bill was issued as a 90-day bank bill 30 days ago. It has a face value of $100 and is currently trading at a yield of 5.75% p.a. A coupon bond issued by a AA-rated company. Fitch Ratings has estimated that the yield on debt issued by AA companies in the current interest rate environment to be 6.6%. The bond has a face value of $100, 5 years to maturity and makes semi-annual coupon payments at a coupon rate of 5.4% p.a. (a) (b) (c) . . An ordinary share. The share is expected to pay an annual dividend of $14 next year, $12 in year 2, $10 in year 3, and then $9 every year thereafter in perpetuity. Your required rate of return on this share is 10%. What is the value of the bank bill? What is the value of the bond? What is the value of the share? (3 marks) (3 marks) (4 marks)

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Value of Bank Bill Face Value x 1 Yield2 Number of Days365 Value of Bank Bill 100 x 1 005752 90...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started