Question

You have a financial planning client who has an assembled balance sheet represented in the graphic below. The clients home is the primary asset and

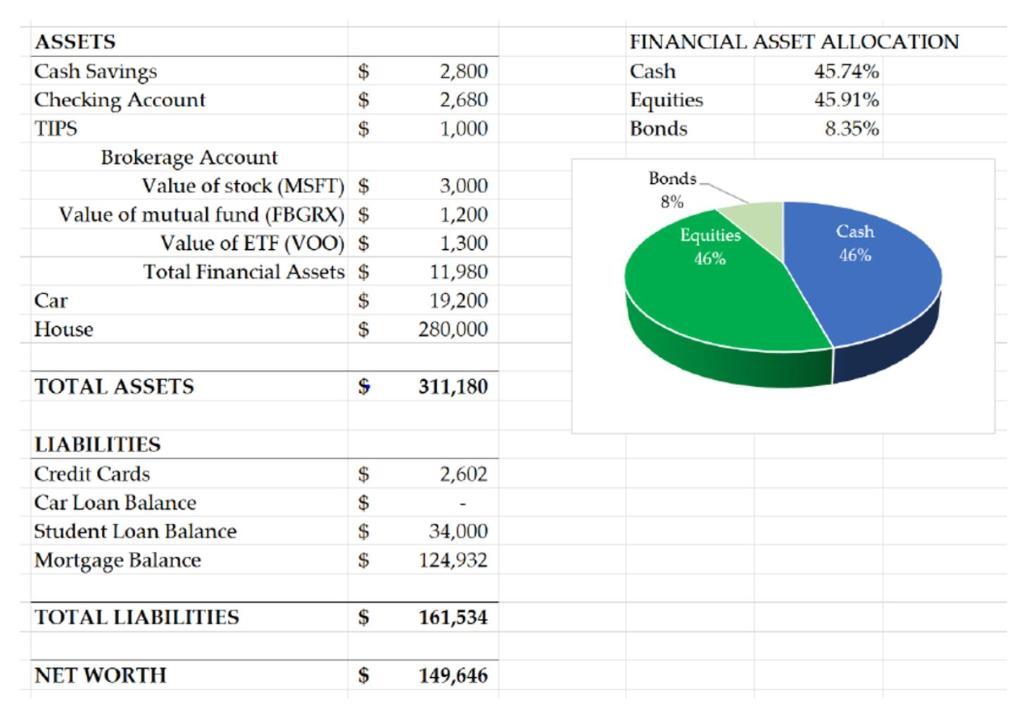

You have a financial planning client who has an assembled balance sheet represented in the graphic below. The client’s home is the primary asset and the corresponding mortgage the primary liability. The client has a positive net worth. Financial assets total $11,980. The stock mutual fund (FBGRX), shares of Microsoft and the stock ETF (VOO) have a value of $5,500. Your client has just gone through a risk profile exercise in which the financial asset recommendation is to be 70% in equities, 8% in bonds and 22% in cash. Whether it is a new stock-based investment or an additional investment in one of the three existing stock investments, what total amount of investment is required in equities to rebalance your client’s financial asset portfolio?

ASSETS FINANCIAL ASSET ALLOCATION Cash Savings $ 2,800 Cash 45.74% Checking Account $ 2,680 Equities 45.91% TIPS $ 1,000 Bonds 8.35% Brokerage Account Value of stock (MSFT) $ Bonds. 3,000 8% Value of mutual fund (FBGRX) $ 1,200 Value of ETF (VOO) $ 1,300 Equities Cash 46% 46% Total Financial Assets $ 11,980 Car House $ 19,200 $ 280,000 TOTAL ASSETS $ 311,180 LIABILITIES Credit Cards Car Loan Balance Student Loan Balance Mortgage Balance SSSS $ 2,602 $ $ 34,000 $ 124,932 TOTAL LIABILITIES $ 161,534 NET WORTH $ 149,646

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To rebalance the clients financial asset portfolio we need to d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started