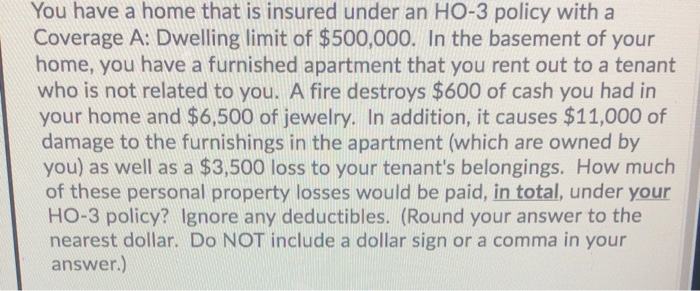

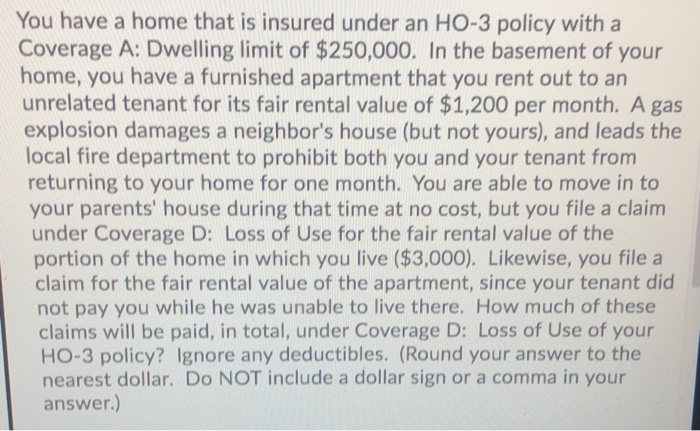

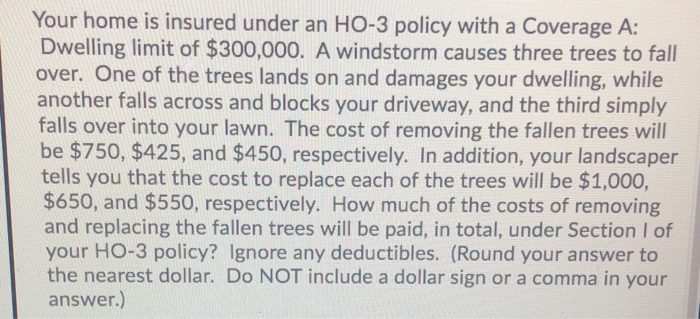

You have a home that is insured under an HO-3 policy with a Coverage A: Dwelling limit of $500,000. In the basement of your home, you have a furnished apartment that you rent out to a tenant who is not related to you. A fire destroys $600 of cash you had in your home and $6,500 of jewelry. In addition, it causes $11,000 of damage to the furnishings in the apartment (which are owned by you) as well as a $3,500 loss to your tenant's belongings. How much of these personal property losses would be paid, in total, under your HO-3 policy? Ignore any deductibles. (Round your answer to the nearest dollar. Do NOT include a dollar sign or a comma in your answer.) You have a home that is insured under an HO-3 policy with a Coverage A: Dwelling limit of $250,000. In the basement of your home, you have a furnished apartment that you rent out to an unrelated tenant for its fair rental value of $1,200 per month. A gas explosion damages a neighbor's house (but not yours), and leads the local fire department to prohibit both you and your tenant from returning to your home for one month. You are able to move in to your parents' house during that time at no cost, but you file a claim under Coverage D: Loss of Use for the fair rental value of the portion of the home in which you live ($3,000). Likewise, you file a claim for the fair rental value of the apartment, since your tenant did not pay you while he was unable to live there. How much of these claims will be paid, in total, under Coverage D: Loss of Use of your HO-3 policy? Ignore any deductibles. (Round your answer to the nearest dollar. Do NOT include a dollar sign or a comma in your answer.) Your home is insured under an HO-3 policy with a Coverage A: Dwelling limit of $300,000. A windstorm causes three trees to fall over. One of the trees lands on and damages your dwelling, while another falls across and blocks your driveway, and the third simply falls over into your lawn. The cost of removing the fallen trees will be $750, $425, and $450, respectively. In addition, your landscaper tells you that the cost to replace each of the trees will be $1,000, $650, and $550, respectively. How much of the costs of removing and replacing the fallen trees will be paid, in total, under Section I of your HO-3 policy? Ignore any deductibles. (Round your answer to the nearest dollar. Do NOT include a dollar sign or a comma in your answer.)