Question

You have a portfolio with a standard deviation of 30% and an expected return of 17%. You are considering adding one of the two stocks

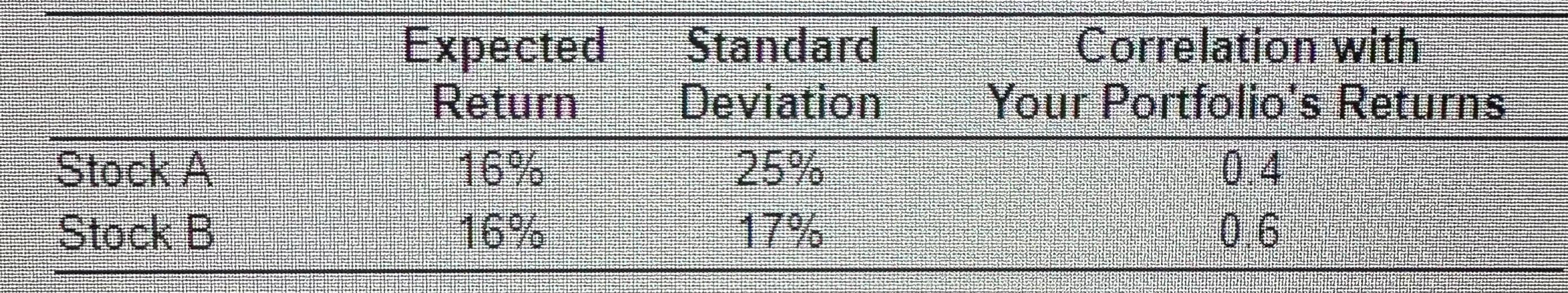

You have a portfolio with a standard deviation of 30% and an expected return of 17%. You are considering adding one of the two stocks in the following table. If after adding the stock you will have 30% of your money in the new stock and 70% of your money in your existing portfolio, which one should you add?

a) Standard deviation of the portfolio with stock A is _____ % (round 3 decimal)

b) Find the standard deviation of the portfolio with stock B calculating the variance of the portfolio using the formula below (round to 5 decimal)

(****Please ensure rounding is done correctly as well as being the correct answer, third time posting this question please only answer if you are sure its correct, thankyou)

please note the following answers listed below are incorrect,

Final Answer: (a) Standard deviation of the portfolio with stock A is =6.2325 = 2.496% (incorrect)

(b) Standard deviation of the portfolio with stock B is= 5.9553 = 2.440% (incorrect)

\begin{tabular}{lccc} \hline & ExpectedReturn & StandardDeviation & CorrelationwithYourPortfoliosReturns \\ \hline Stock & 16% & 25% & 0.4 \\ Stock B & 16% & 17% & 0.6 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started