Answered step by step

Verified Expert Solution

Question

1 Approved Answer

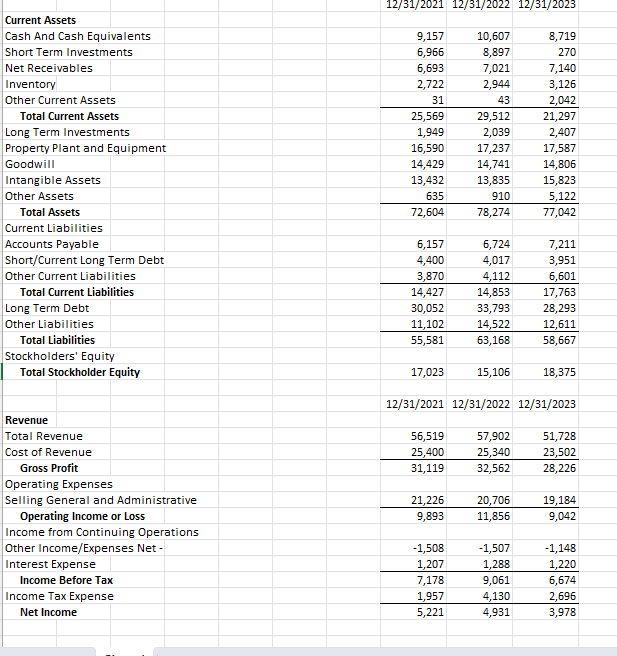

You have been asked by the CFO to analyze a prospective customer who has requested sales on credit. Use the financial statements for TechnoTCL, Inc

You have been asked by the CFO to analyze a prospective customer who has requested sales on credit. Use the financial statements for TechnoTCL, Inc Download financial statements for TechnoTCL, Inc to calculate the attached ratios and complete the assignment.

Prepare a brief presentation (maximum of 4 slides) to the CFO including the calculations and 2-3 sentences interpreting each ratio.

- Slide One: Calculate and interpret the following debt ratios: debt ratio, debt-equity ratio, and times interest earned for all three years.

- Slide Two: Analyze one of the debt ratios including why the ratio is used and what the actual results for TechnoTCL might indicate.

- Slide Three: Calculate and interpret the following profitability ratios: operating profit margin, net profit margin, return on assets, and return on equity for all three years.

- Slide Four: Analyze one of the profitability ratios including why the ratio is used and what the actual results for TechnoTCL might indicate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To create the slides for the CFO presentation follow the steps below for each of the requested financial ratios Slide One Debt Ratios 1 Debt Ratio Formula Debt Ratio Total Liabilities Total Assets Cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started