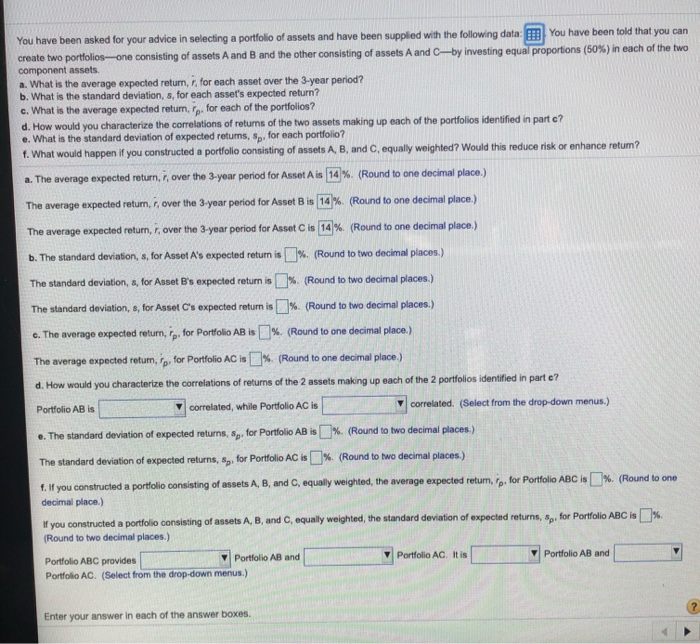

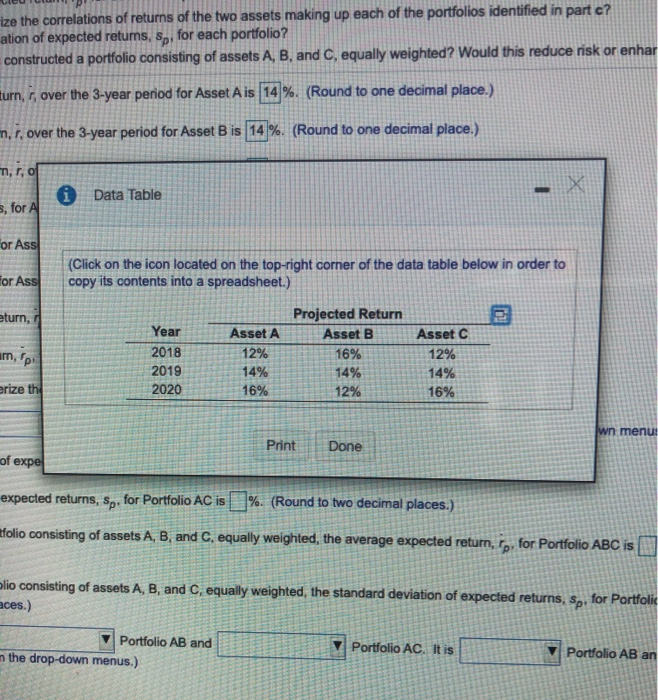

You have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data: You have been told that you can create two portfolios-one consisting of assets A and B and the other consisting of assets A and C-by investing equal proportions (50%) in each of the two component assets. a. What is the average expected return, r, for each asset over the 3-year period? b. What is the standard deviation, s, for each asset's expected return? c. What is the average expected return, for each of the portfolios? d. How would you characterize the correlations of returns of the two assets making up each of the portfolios identified in parte? e. What is the standard deviation of expected retums, Sp, for each portfolio? f. What would happen if you constructed a portfolio consisting of assets A, B, and C, equally weighted? Would this reduce risk or enhance retur? a. The average expected return, r, over the 3-year period for Asset Ais 14%. (Round to one decimal place.) The average expected return, r, over the 3-year period for Asset Bis 14%. (Round to one decimal place.) The average expected return, r, over the 3-year period for Asset C is 14% (Round to one decimal place.) b. The standard deviation, &, for Asset A's expected return is % (Round to two decimal places) The standard deviation, for Asset B's expected return is (Round to two decimal places.) The standard deviation, &, for Asset C's expected return is %. (Round to two decimal places.) e. The average expected return, p. for Portfolio AB is % (Round to one decimal place.) The average expected retum, fp, for Portfolio AC is % (Round to one decimal place.) d. How would you characterize the correlations of returns of the 2 assets making up each of the 2 portfolios identified in parte? correlated, while Portfolio AC is correlated. (Select from the drop-down menus.) .. The standard deviation of expected returns, Sp. for Portfolio AB is % (Round to two decimal places.) The standard deviation of expected returns, S, for Portfolio AC is % (Round to two decimal places.) 1. If you constructed a portfolio consisting of assets A, B, and C, equally weighted, the average expected retum, fp, for Portfolio ABC %. (Round to one decimal place) If you constructed a portfolio consisting of assets A, B, and C, equally weighted, the standard deviation of expected returns, Sp, for Portfolio ABC is % (Round to two decimal places.) Portfolio ABC provides Portfolio AB and Portfolio AC. It is Portfolio AB and Portfolio AC. (Select from the drop-down menus.) Enter your answer in each of the answer boxes answer boy UCUD ize the correlations of returns of the two assets making up each of the portfolios identified in part c? ation of expected retums, so, for each portfolio? constructed a portfolio consisting of assets A, B, and C, equally weighted? Would this reduce risk or enhar turn, over the 3-year period for Asset Ais 14 %. (Round to one decimal place.) miner, over the 3-year period for Asset Bis 14%. (Round to one decimal place.) ,r, o i Data Table s, for for Ass for Ass eturn, (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Projected Return Year Asset A Asset B Asset C 2018 12% 2019 14% 2020 12% am, ipi erize the 16% Print Done of expe expected returns, Sp, for Portfolio AC is %. (Round to two decimal places.) mfolio consisting of assets A, B, and C, equally weighted, the average expected return, ro, for Portfolio ABC is plio consisting of assets A, B, and C, equally weighted, the standard deviation of expected returns, Sp, for Portfolic aces.) Portfolio AB and Portfolio AC. It is n the drop-down menus.) 1 Portfolio AB an