Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been asked to analyze three technology companies and have been provided with the following information on the companies: table [ [ ,

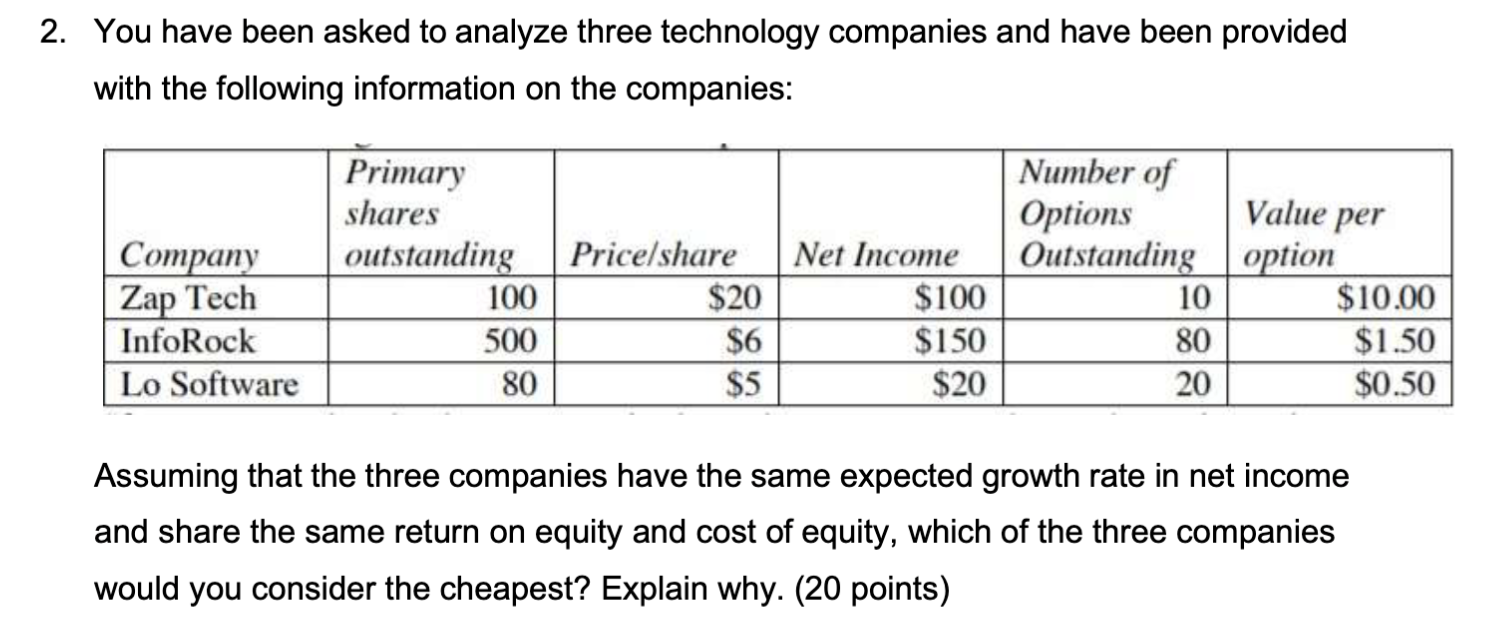

You have been asked to analyze three technology companies and have been provided with the following information on the companies:

tabletablePrimarysharesoutstandingPriceshareNet Income,tableNumber ofOptionsOutstandingtableValue peroptionZap Tech,$$$ I need to know how to use this adat to calculate the chaeapest seems like the answwer provided has a typo in step calculation of EPS for LoSoftware can you explain that step? TIt should be $ which means all of the stocks have the same PE ratio? What other ration can be used to determine the cheapest?

I thought enterprise value was calculated by adding back debt you used net income. Can you explain? Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started