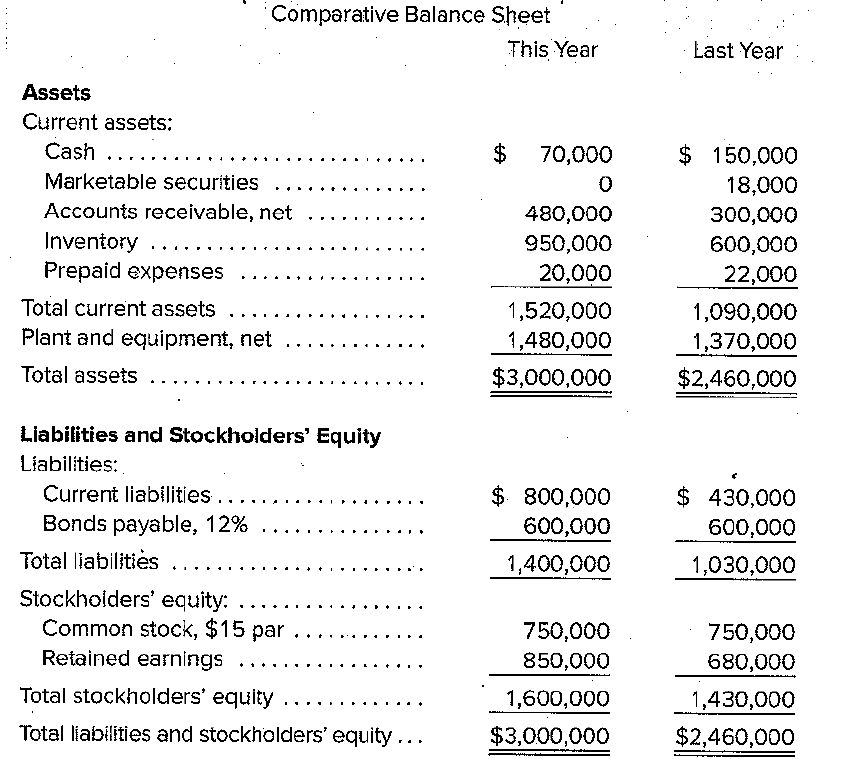

You have been asked to apply some analytical procedures to the financial statements for an audit client in connection with a loan it is seeking to deal with a cash shortage. Specifically, it is requesting a $500,000 long term loan from First State Bank. $100,000 will be used to increase the cash account and $400,000 to modernize equipment. Financial Statements available are:

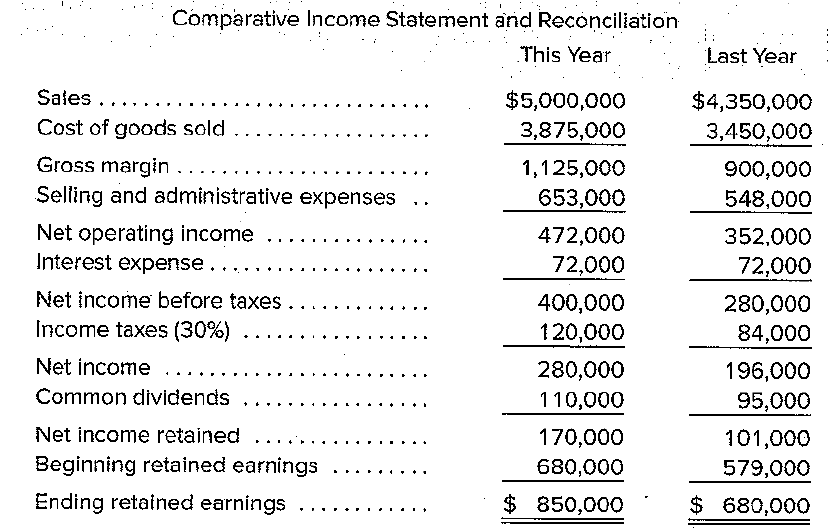

During the past year the company introduced several new product lines and increased the selling price on several older product lines to improve it profit margin. The company also hired a new sales manager, who has expanded sales into several new territories. Sales terms are 2/10, n/30 and all sales are on account.

Required:

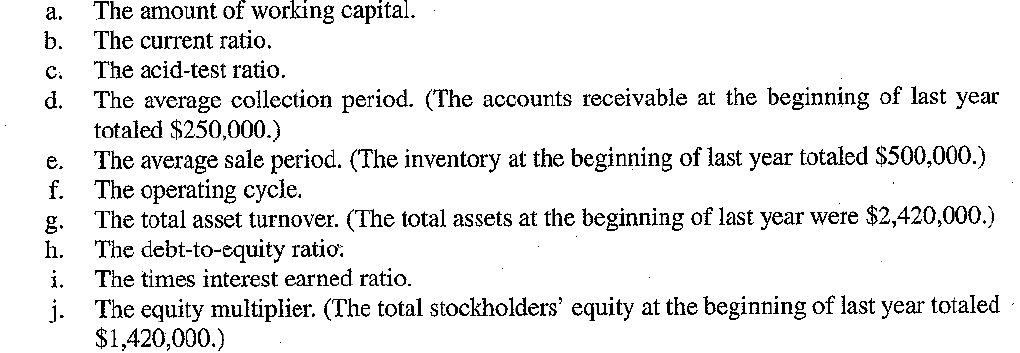

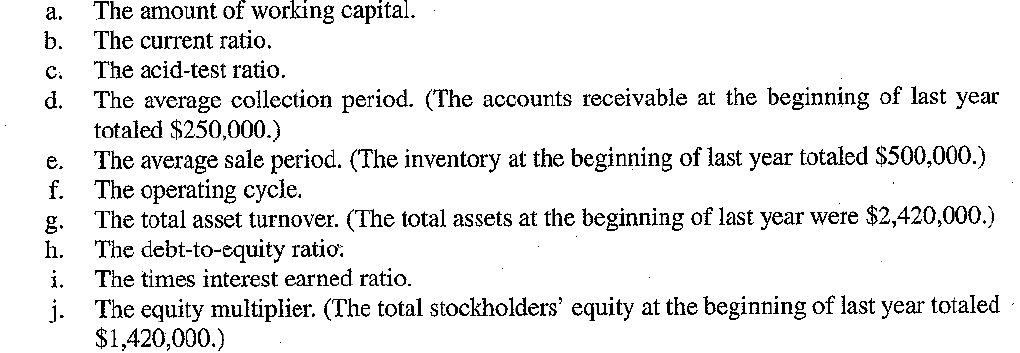

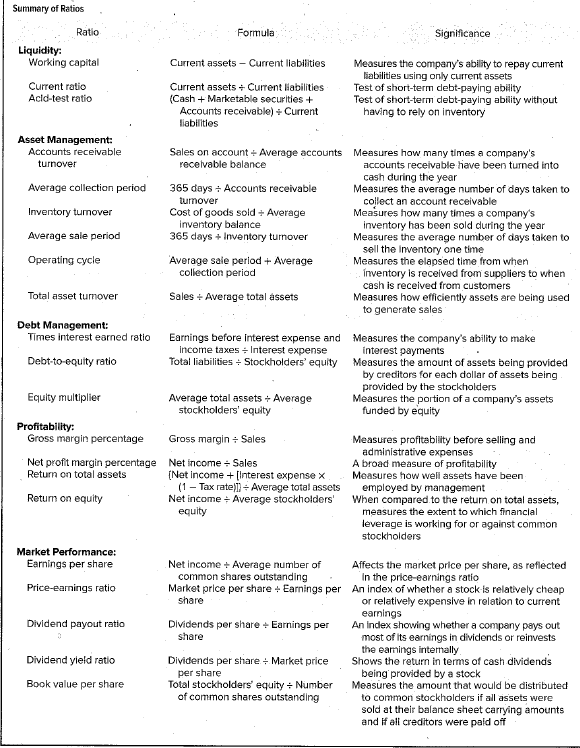

- To assist the company in its preparation for seeking the loan, compute the following rations for both this year and last year. Use the summary of ratios provided on the next page.

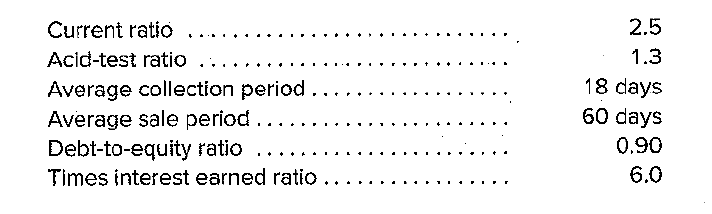

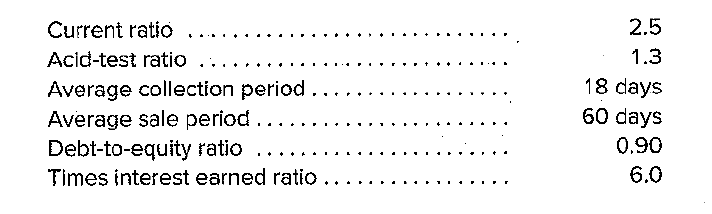

- The following financial data and ratios are typical of companies in your clients industry:

Compare your clients financial results to the benchmarks provided in part 2.

- Provide your conclusion and supporting rationale as to whether the company is likely to get its loan application approved.

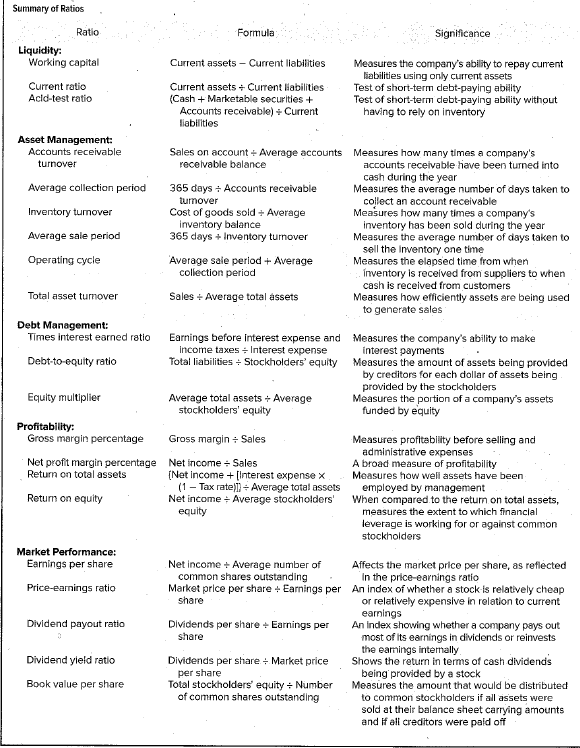

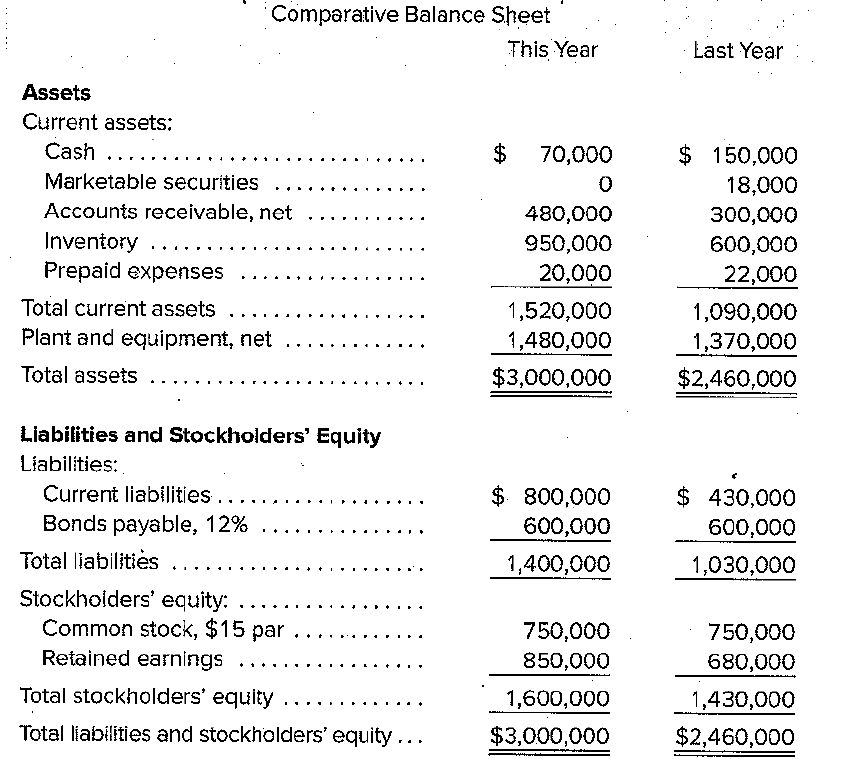

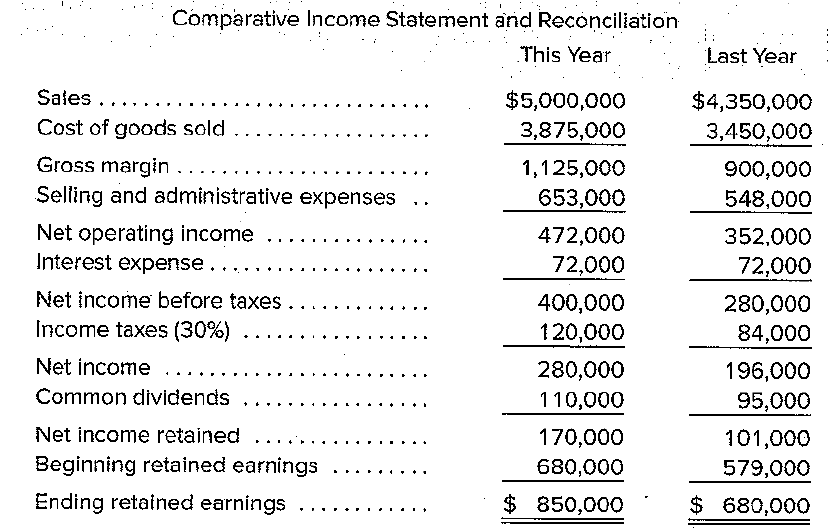

Comparative Balance Sheet This Year Last Year Comparative Income Statement and Reconcilation a. The amount of working capital. b. The current ratio. c. The acid-test ratio. d. The average collection period. (The accounts receivable at the beginning of last year totaled $250,000.) e. The average sale period. (The inventory at the beginning of last year totaled $500,000.) f. The operating cycle. g. The total asset turnover. (The total assets at the beginning of last year were $2,420,000.) h. The debt-to-equity ratio: i. The times interest earned ratio. j. The equity multiplier. (The total stockholders' equity at the beginning of last year totaled $1,420,000. Current ratio Acid-test ratio Average collection period Average sale period Debt-to-equity ratio Times interest earned ratio 2.5 1.3 18 days 60 days 0.90 6.0 Summary of Ratios Ratio Liquidity: Working capital Current rotio Acid-test ratio Asset Management: Accounts receivable turnover Average collection period Inventory tumover Average sale period Operating cycle Total asset tumover Debt Management: Times interest earned ratio Debt-to-equity ratio Equity multiplier Profitability: Gross margin percentage Net profit margin percentage Return on total assets Return on equity Market Performance: Earnings per share Price-earnings ratio Dividend payout ratio Dividend yield ratio Book value per share Formula Current assets - Current liabilities Current assets Current liabilities (Cash + Marketable securities + Accounts receivable) Current liabilities Sales on account Average accounts recelvable balance 365 days Accounts receivable tumover Cost of goods sold Average inverstory balance 365 days + Inventory tumover Average sale period + Average collection period Sales Average total assets Earnings before interest expense and income taxes Interest expense Total liabilities Stockholders' equity Average total assets Average stockholders' equity Gross margin Sales Net income Sales Net income + [interest expense x (1 Tax rate )1] Average total assets Net income Average stockholders' equity Net income Average number of common shares outstanding Market price per share Earnings per share Dividends per share Earnings per share Dividends per share Market price per share Total stockholders' equity Number of common shares outstanding Measures the company's ability to repay current liabilities using only current assets Test of short-term debt-paying ability Test of short-term debt-paying ability without having to rely on inventory Measures how many times a company's accounts recelvable tiave been turned into cash during the year Measures the average number of days taken to collect an account receivable Measures how many times a company's inventory has been sold during the year Measures the average number of days taken to sell the inventory one time Measures the elapsed time from when irnentory is received from suppliers to when cash is received from customers Measures how efficiently assets are being used to generate sales Measures the company's ability to make interest payments Measures the amount of assets being provided by creditors for each dollar of assets being provided by the stockholders Measures the portion of a company's assets funded by equity Measures profitablilty before selling and administrative expenses A broad measure of profitability Measures how well assets have been employed by management When compared to the retum on total assets, measures the extent to which financial leverage is working for or against common stockholders Affects the market price per share, as reflected In the price-earnings ratio An index of whether a stock is relatively cheap or relatively expensive in relation to current earnings An index showing whether a company pays out most of its earnings in dividends or reinvests. the eamings intemally Shows the return in terms of cash dividends being provided by a stock Measures the amount that would be distributed to common stockholders if all assets were sold at their balance sheet carrying amounts and if all creditors were paid off