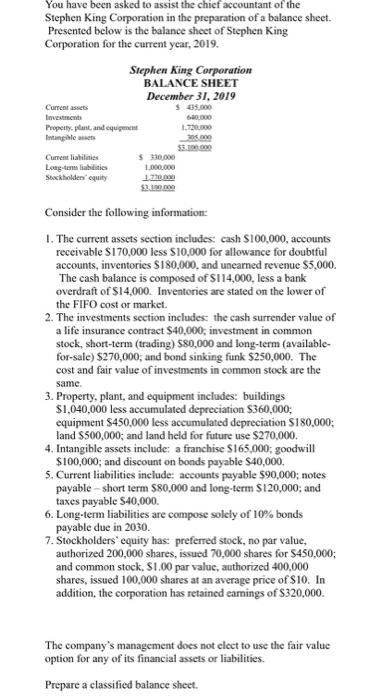

You have been asked to assist the chief accountant of the Stephen King Corporation in the preparation of a balance sheet. Presented below is the balance sheet of Stephen King Corporation for the current year, 2019. Stephen King Corporation BALANCE SHEET December 31, 2019 Current assets $ 435.000 Investments Property, plant, and equipment 1.720,000 Intangibles Current liabilities $ 330,000 Long-term liabilities 1.000.000 Stockholders' equity 1.320.00 51.100.000 Consider the following information: 1. The current assets section includes: cash $100,000, accounts receivable S170.000 less $10,000 for allowance for doubtful accounts, inventories $180,000, and unearned revenue $5,000. The cash balance is composed of $114,000, less a bank overdraft of $14,000. Inventories are stated on the lower of the FIFO cost or market. 2. The investments section includes the cash surrender value of a life insurance contract $40,000; investment in common stock, short-term (trading) $80,000 and long-term (available- for-sale) $270,000; and bond sinking funk $250,000. The cost and fair value of investments in common stock are the same 3. Property, plant, and equipment includes: buildings $1,040,000 less accumulated depreciation $360,000; equipment $450,000 less accumulated depreciation $180,000; land S500,000; and land held for future use $270,000. 4. Intangible assets include: a franchise S165,000; goodwill $100,000; and discount on bonds payable $40,000. 5. Current liabilities include: accounts payable $90,000; notes payable - short term $80,000 and long-term $120,000; and taxes payable $40,000 6. Long-term liabilities are compose solely of 10% bonds payable due in 2030 7. Stockholders' equity has preferred stock, no par value, authorized 200,000 shares, issued 70,000 shares for $450,000; and common stock, S1.00 par value, authorized 400,000 shares, issued 100,000 shares at an average price of $10. In addition, the corporation has retained camings of S320,000. The company's management does not clect to use the fair value option for any of its financial assets or liabilities. Prepare a classified balance sheet