Answered step by step

Verified Expert Solution

Question

1 Approved Answer

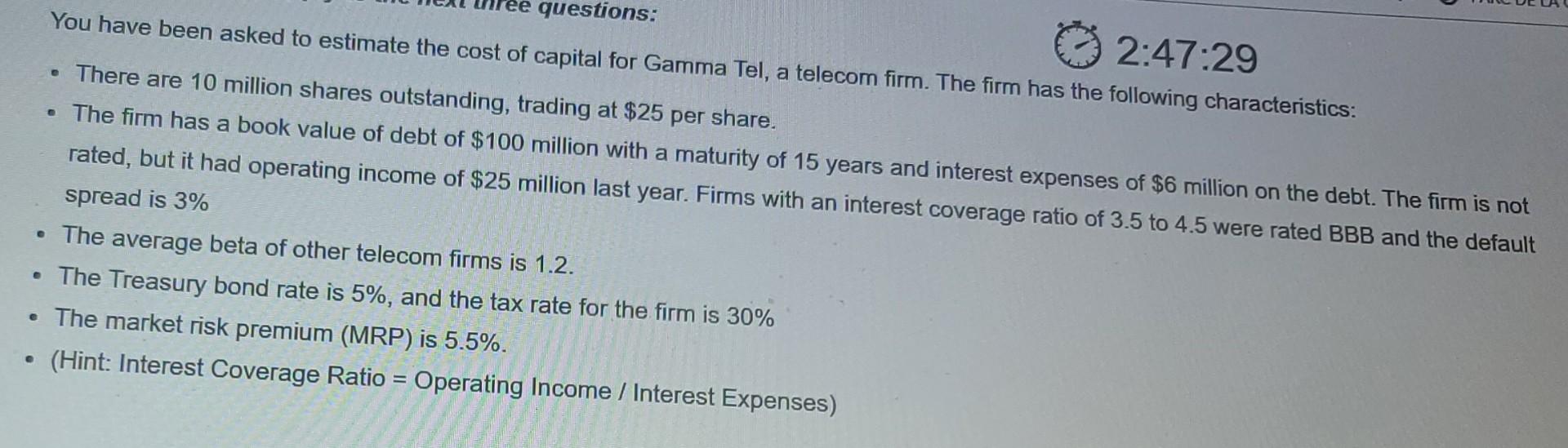

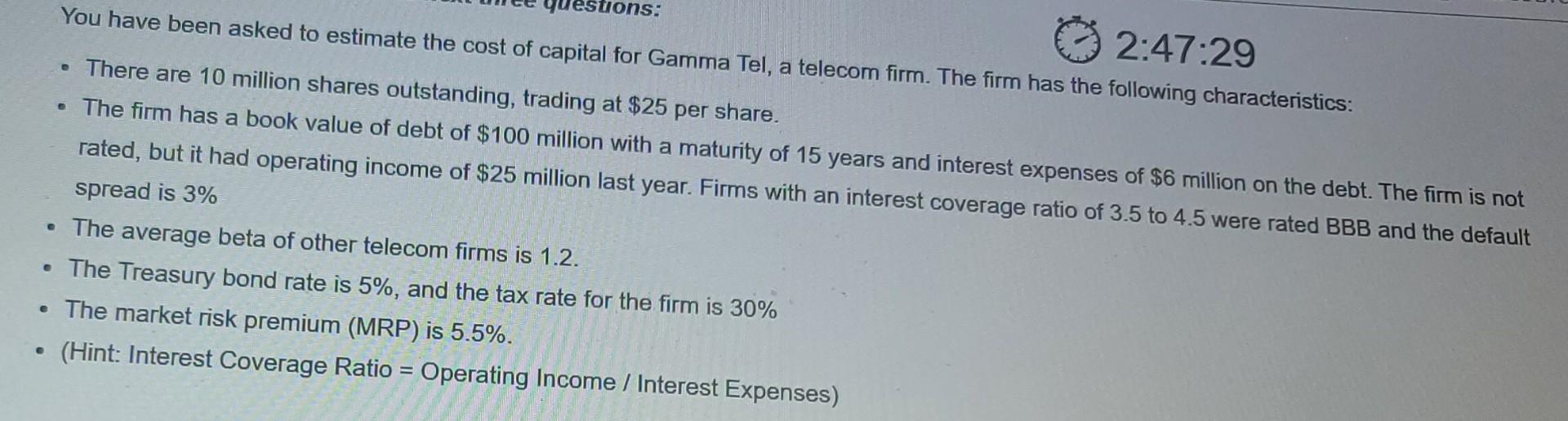

You have been asked to estimate the cost of capital for Gamma Tel, a telecom firm. The firm has the following characteristics: questions: 02:47:29 There

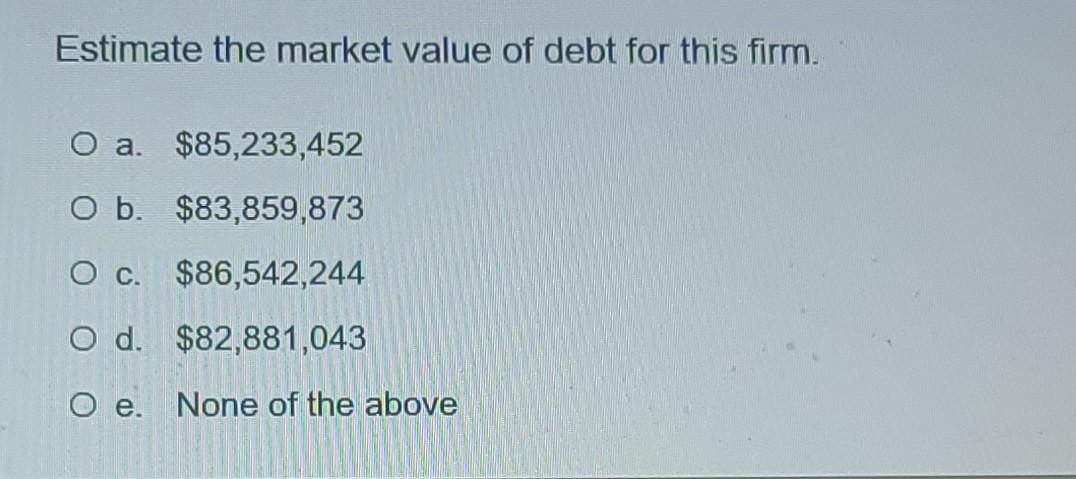

You have been asked to estimate the cost of capital for Gamma Tel, a telecom firm. The firm has the following characteristics: questions: 02:47:29 There are 10 million shares outstanding, trading at $25 per share. The firm has a book value of debt of $100 million with a maturity of 15 years and interest expenses of $6 million on the debt. The firm is not rated, but it had operating income of $25 million last year. Firms with an interest coverage ratio of 3.5 to 4.5 were rated BBB and the default spread is 3% The average beta of other telecom firms is 1.2. The Treasury bond rate is 5%, and the tax rate for the firm is 30% The market risk premium (MRP) is 5.5%. (Hint: Interest Coverage Ratio = Operating Income / Interest Expenses) 2:47:29 You have been asked to estimate the cost of capital for Gamma Tel, a telecom firm. The firm has the following characteristics: estions: There are 10 million shares outstanding, trading at $25 per share. The firm has a book value of debt of $100 million with a maturity of 15 years and interest expenses of $6 million on the debt. The firm is not rated, but it had operating income of $25 million last year. Firms with an interest coverage ratio of 3.5 to 4.5 were rated BBB and the default spread is 3% The average beta of other telecom firms is 1.2. The Treasury bond rate is 5%, and the tax rate for the firm is 30% The market risk premium (MRP) is 5.5%. (Hint: Interest Coverage Ratio = Operating Income / Interest Expenses) e e Estimate the market value of debt for this firm. O a. $85,233,452 O b. $83,859,873 O c. $86,542,244 O d. $82,881,043 O e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started