Question

You have been asked to estimate the levered beta for GenCorp, a Mexican company with food and tobacco subsidiaries. GenCorp has a debt-to-equity ratio of

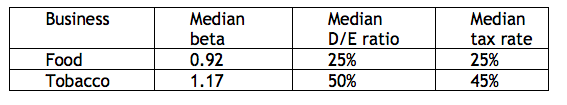

You have been asked to estimate the levered beta for GenCorp, a Mexican company with food and tobacco subsidiaries. GenCorp has a debt-to-equity ratio of 1.00 and a tax rate of 35%. The food subsidiary is estimated to generate 2.8 million earnings before interest and taxes (EBIT) each year and the tobacco subsidiary is estimated to generate 11 million EBIT each year. You are further provided with the following information on comparable firms:

a) Calculate the levered beta of GenCorp using the information provided.

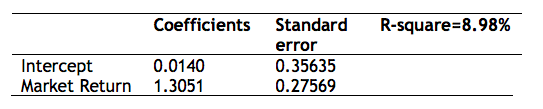

b) In addition to estimating GenCorps beta using the approach described in part (a), you also estimate GenCorps beta by running a regression using GenCorps stock returns on Mexican market returns. You obtain the following outputs:

Suppose the ten-year Mexican Government bond rate is 4.75%. The Mexican government has a local currency rating of A3, with a default spread of 1.23% associated with the rating. The risk premium for Mexican markets is 6.5%. Based on the beta estimation obtained from the regression, estimate the 95% confidence interval of Gencorps equity cost of capital.

c) Explain why you obtain a different estimation of beta in part (a) and part (b).

please answer part b and c

Business Median beta 0.92 1.17 Median D/E ratio 25% 50% Median tax rate 25% 45% Food Tobacco Coefficients R-square=8.98% Standard error 0.35635 0.27569 Intercept Market Return 0.0140 1.3051Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started