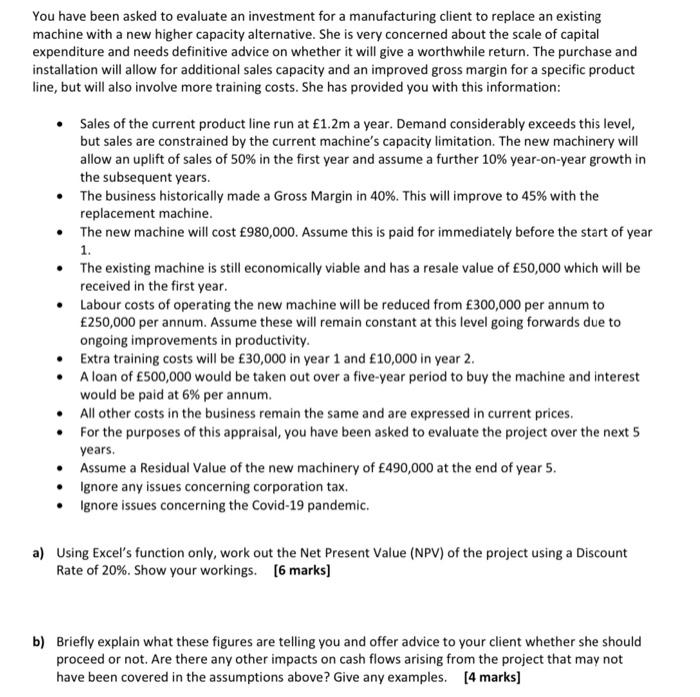

You have been asked to evaluate an investment for a manufacturing client to replace an existing machine with a new higher capacity alternative. She is very concerned about the scale of capital expenditure and needs definitive advice on whether it will give a worthwhile return. The purchase and installation will allow for additional sales capacity and an improved gross margin for a specific product line, but will also involve more training costs. She has provided you with this information: Sales of the current product line run at 1.2m a year. Demand considerably exceeds this level, but sales are constrained by the current machine's capacity limitation. The new machinery will allow an uplift of sales of 50% in the first year and assume a further 10% year-on-year growth in the subsequent years. The business historically made a Gross Margin in 40%. This will improve to 45% with the replacement machine. The new machine will cost 980,000. Assume this is paid for immediately before the start of year 1. The existing machine is still economically viable and has a resale value of 50,000 which will be received in the first year. Labour costs of operating the new machine will be reduced from 300,000 per annum to 250,000 per annum. Assume these will remain constant at this level going forwards due to ongoing improvements in productivity. Extra training costs will be 30,000 in year 1 and 10,000 in year 2. A loan of 500,000 would be taken out over a five-year period to buy the machine and interest would be paid at 6% per annum. All other costs in the business remain the same and are expressed in current prices. For the purposes of this appraisal, you have been asked to evaluate the project over the next 5 years. Assume a Residual Value of the new machinery of 490,000 at the end of year 5. Ignore any issues concerning corporation tax. Ignore issues concerning the Covid-19 pandemic. a) Using Excel's function only, work out the Net Present Value (NPV) of the project using a Discount Rate of 20%. Show your workings. [6 marks) b) Briefly explain what these figures are telling you and offer advice to your client whether she should proceed or not. Are there any other impacts on cash flows arising from the project that may not have been covered in the assumptions above? Give any examples. (4 marks]