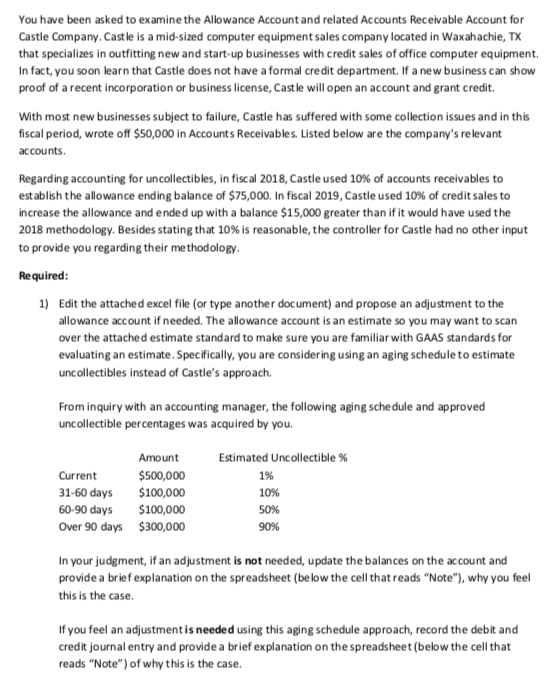

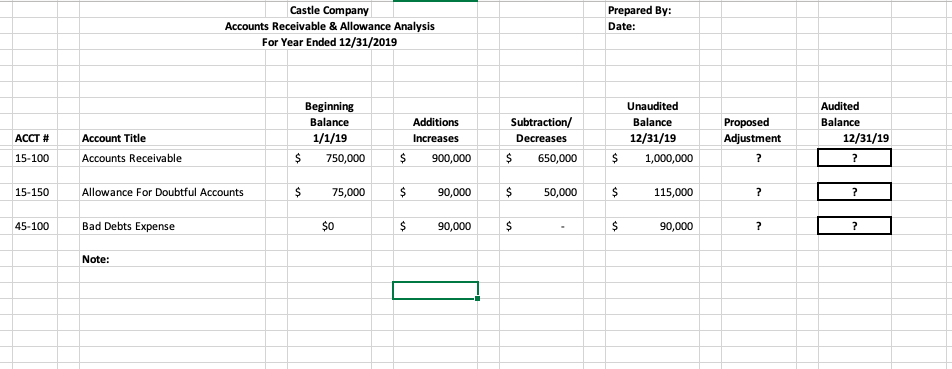

You have been asked to examine the Allowance Account and related Accounts Castle Company, Castle is a mid-sized computer equipment sales company located in Waxahachie, TX that specializes in outfitting new and start-up businesses with credit sales of office computer equipment. In fact, you soon learn that Castle does not have a formal credit department. If a new business can show proof of a recent incorporation or business license, Castle will open an account and grant credit. With most new businesses subject to failure, Castle has suffered with some collection issues and in this fiscal period, wrote off $50,000 in Accounts Receivables. Listed below are the company's relevant accounts. Regarding accounting for uncollectibles, in fiscal 2018, Castle used 10% of accounts receivables to establish the allowance ending balance of $75,000. In fiscal 2019, Castle used 10% of credit sales to increase the allowance and ended up with a balance $15,000 greater than if it would have used the 2018 methodology. Besides stating that 10% is reasonable, the controller for Castle had no other input to provide you regarding their methodology Required: 1) Edit the attached excel file (or type another document) and propose an adjustment to the allowance account if needed. The allowance account is an estimate so you may want to scan over the attached estimate standard to make sure you are familiar with GAAS standards for evaluating an estimate. Specifically, you are considering using an aging schedule to estimate uncollectibles instead of Castle's approach. From inquiry with an accounting manager, the following aging schedule and approved uncollectible percentages was acquired by you. Estimated Uncollectible % 1% Current 31-60 days 60-90 days Over 90 days Amount $500,000 $100,000 $100,000 $300,000 10% 50% 90% In your judgment, if an adjustment is not needed, update the balances on the account and provide a brief explanation on the spreadsheet (below the cell that reads "Note"), why you feel this is the case. If you feel an adjustment is needed using this aging schedule approach, record the debit and credit journal entry and provide a brief explanation on the spreadsheet (below the cell that reads "Note") of why this is the case. Castle Company Accounts Receivable & Allowance Analysis For Year Ended 12/31/2019 Prepared By: Date: Beginning Balance 1/1/19 $ 750,000 Account Title Additions Increases 900,000 ACCT # 15-100 Subtraction/ Decreases $ 650,000 Proposed Adjustment Unaudited Balance 12/31/19 1,000,000 Audited Balance 12/31/19 Accounts Receivable $ $ 15-150 Allowance For Doubtful Accounts 75,000 $ 90,000 $ 50,000 $ 115,000 45-100 Bad Debts Expense $0 $ 90,000 $ $ 90,000