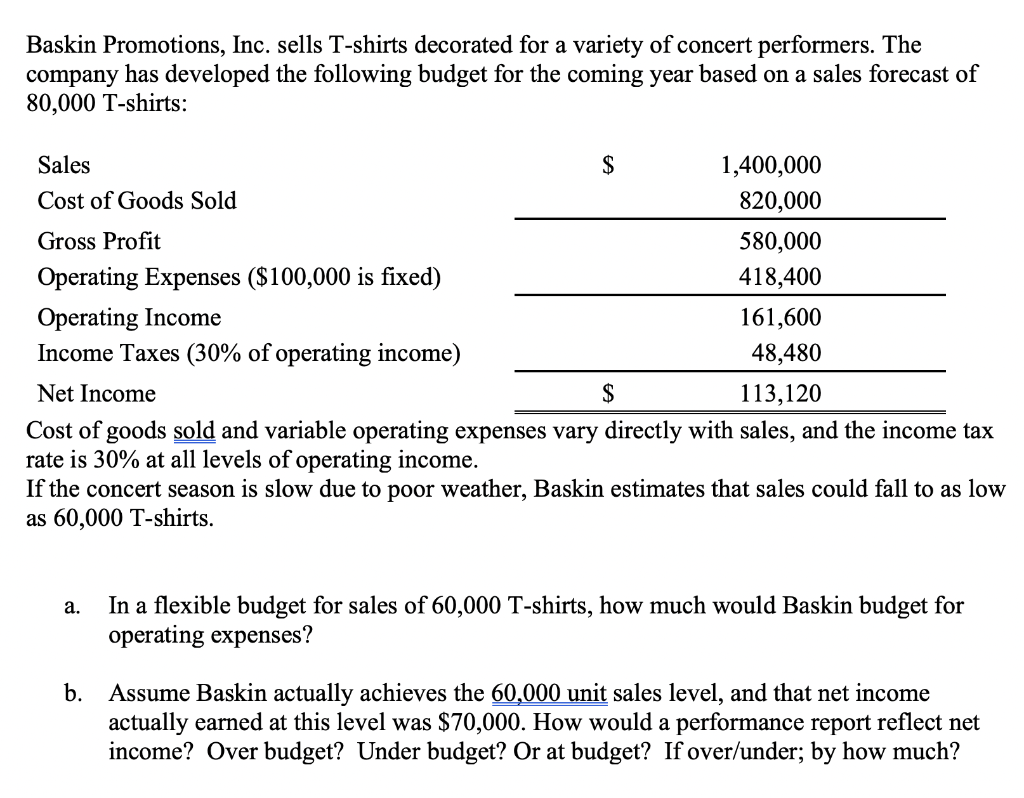

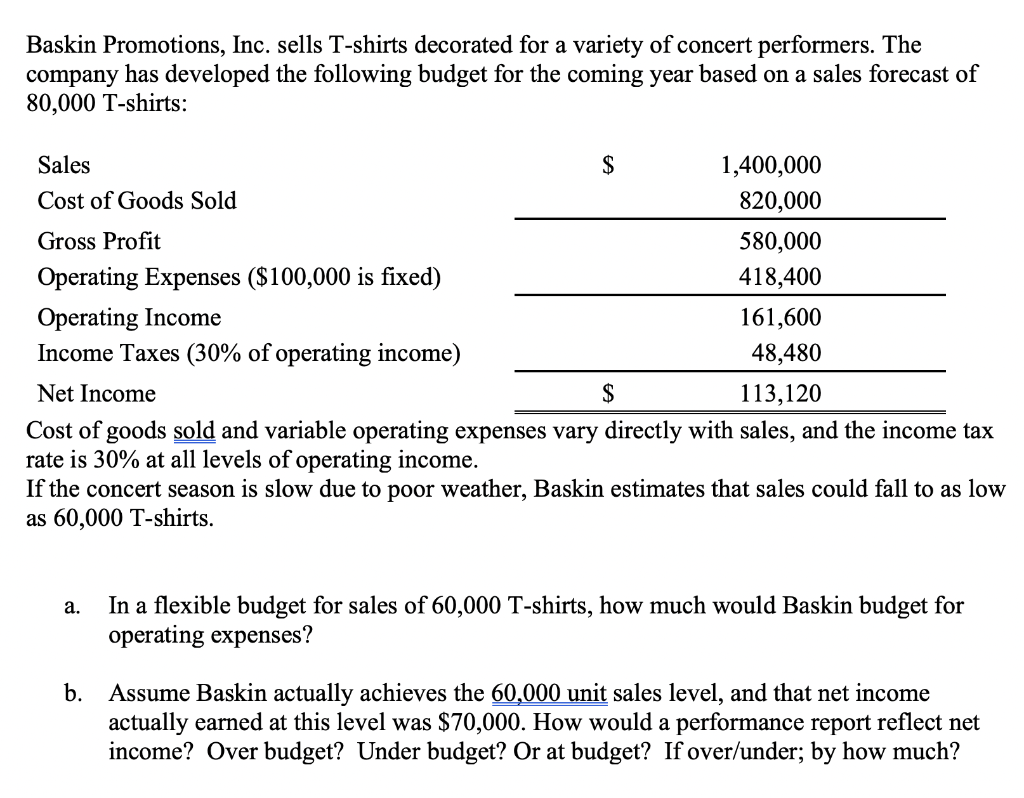

You have been asked to resolve a transfer pricing dispute between two divisions. Division 1 is willing to sell component XYZ to Division 2 for $2.25 per unit. Division 2 says that if Division 1 doesn't sell component XYZ to them at cost, they will buy from Component's RUS, one of Division ls competitors, for $1.90 per unit. Division 1 is balking, saying that their units are far superior in quality, with a 99% efficiency, far better than Components RUS that is widely known to have a 3% failure rate. Due to the superior quality, Division 1 normally sells component XYZ for $2.30 per unit so they believe Division 2 is already getting a bargain. Question 1: What additional information would you need in order to make a decision? Please provide at least 2, but no more than 4, additional pieces of information you would need and why you would need that information to make a decision. Question 2: Assuming Division 1 has no excess capacity, at what price should they set their transfer price to Division 2 and why? Foreman Inc. was in a bind. The mid-sized manufacturer had experienced phenomenal growth in the last three years. Sales had gone through the roof, thanks to an eager and creative marketing group that had come up with some clever strategies to expand sales by offering discounts or deferred payments. Margins were healthy, despite the discounts. Net income after taxes was sizable for a company this size. Why, then, were they struggling to make payroll? And lately, the Accounts Payable supervisor was fielding more and more angry vendor calls about late payments. This had already caused one vendor to put the company on COD (cash on delivery) terms, a huge problem since this was one of their key vendors that provided a large amount of the material required in their manufacturing process. How can this be? Profits have never been so high! Question 3: What is your assessment of F&D's problem? Question 4: Provide a reasonable recommendation that might help alleviate F&D's struggle. Baskin Promotions, Inc. sells T-shirts decorated for a variety of concert performers. The company has developed the following budget for the coming year based on a sales forecast of 80,000 T-shirts: Sales 1,400,000 Cost of Goods Sold 820,000 Gross Profit 580,000 Operating Expenses ($100,000 is fixed) 418,400 Operating Income 161,600 Income Taxes (30% of operating income) 48,480 Net Income $ 113,120 Cost of goods sold and variable operating expenses vary directly with sales, and the income tax rate is 30% at all levels of operating income. If the concert season is slow due to poor weather, Baskin estimates that sales could fall to as low as 60,000 T-shirts. a. In a flexible budget for sales of 60,000 T-shirts, how much would Baskin budget for operating expenses? Assume Baskin actually achieves the 60,000 unit sales level, and that net income actually earned at this level was $70,000. How would a performance report reflect net income? Over budget? Under budget? Or at budget? If over/under; by how much