Question

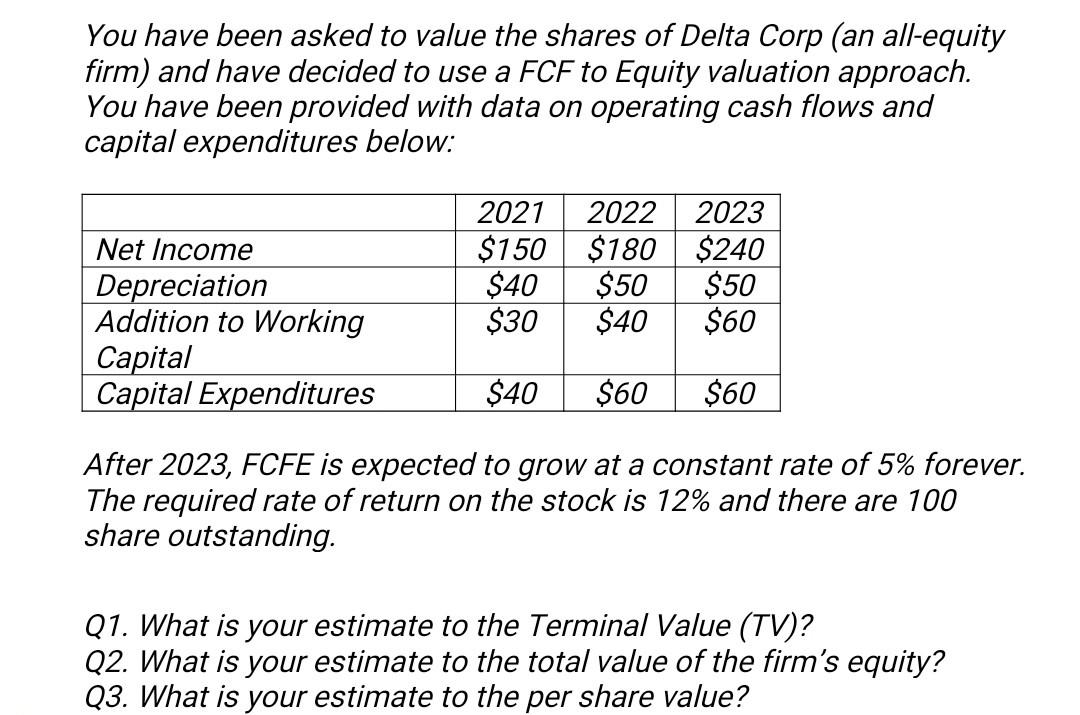

You have been asked to value the shares of Delaa Corp (an all-equity firm) and have decided to use a FCF to Equity valuation approach.

You have been asked to value the shares of Delaa Corp (an all-equity firm) and have decided to use a FCF to Equity valuation approach. You have been provided with data on operating cash flows and capital expenditures below: (check attached chart above in the pic)

After 2023, FCEE is expected to grow at a constant rate of 5% forever. The required rate of return on the stock is 12% and there are 100 share outstanding.

Q1. What is your estimate to the Terminal Value (TV)? Q2. What is your estimate to the total value of the firms equity? Q3. What is your estimate to the per share value?

You have been asked to value the shares of Delta Corp (an all-equity firm) and have decided to use a FCF to Equity valuation approach. You have been provided with data on operating cash flows and capital expenditures below: Net Income Depreciation Addition to Working Capital Capital Expenditures 2021 $150 $40 $30 2022 2023 $180 $240 $50 $50 $40 $60 $40 $60 $60 After 2023, FCFE is expected to grow at a constant rate of 5% forever. The required rate of return on the stock is 12% and there are 100 share outstanding. Q1. What is your estimate to the Terminal Value (TV)? Q2. What is your estimate to the total value of the firm's equity? Q3. What is your estimate to the per share valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started