Question

You have been assigned the task of analyzing whether to purchase or lease some transportation equipment for your company. The analysis period is six years,

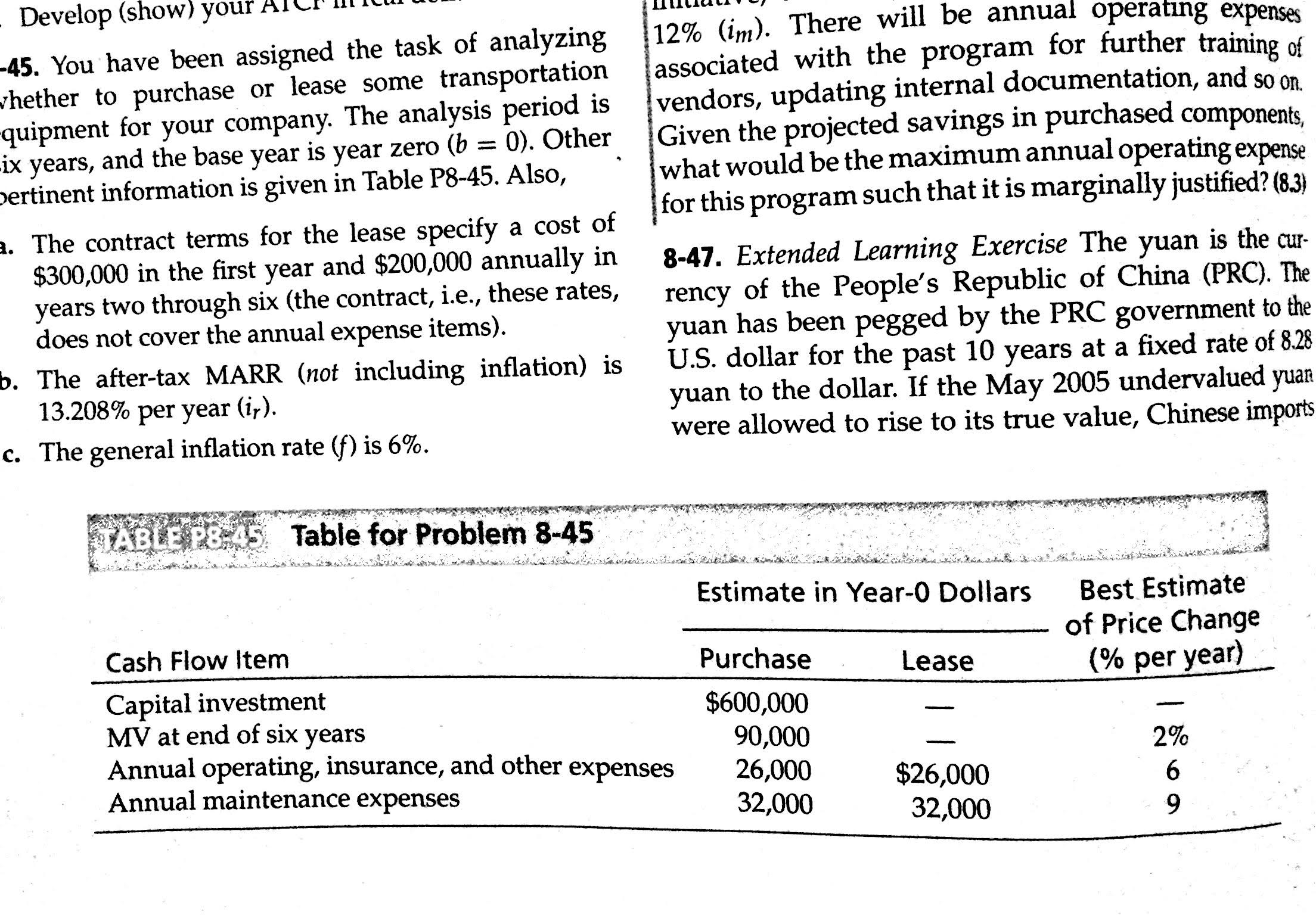

You have been assigned the task of analyzing whether to purchase or lease some transportation equipment for your company. The analysis period is six years, and the base year is year zero (b=0). Other pertinent information is given in Table P8-45. Also,

The contract terms for the lease specify a cost of $300,000 in the first year and $200,000 annually in years two through six (the contract, ie these rates does not cover the annual expense items.)

The after-tax MARR (not including inflation) is 13.208% per year (ir)

The general inflation rate (f) is 6%

The effective income tax rate (t) is 34%

Assume the equipment is in the MACRS (GDS) five-year property class

Which alternative is preferred? (Use an after-tax, actual dollar, analysis and the FW criterion)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started