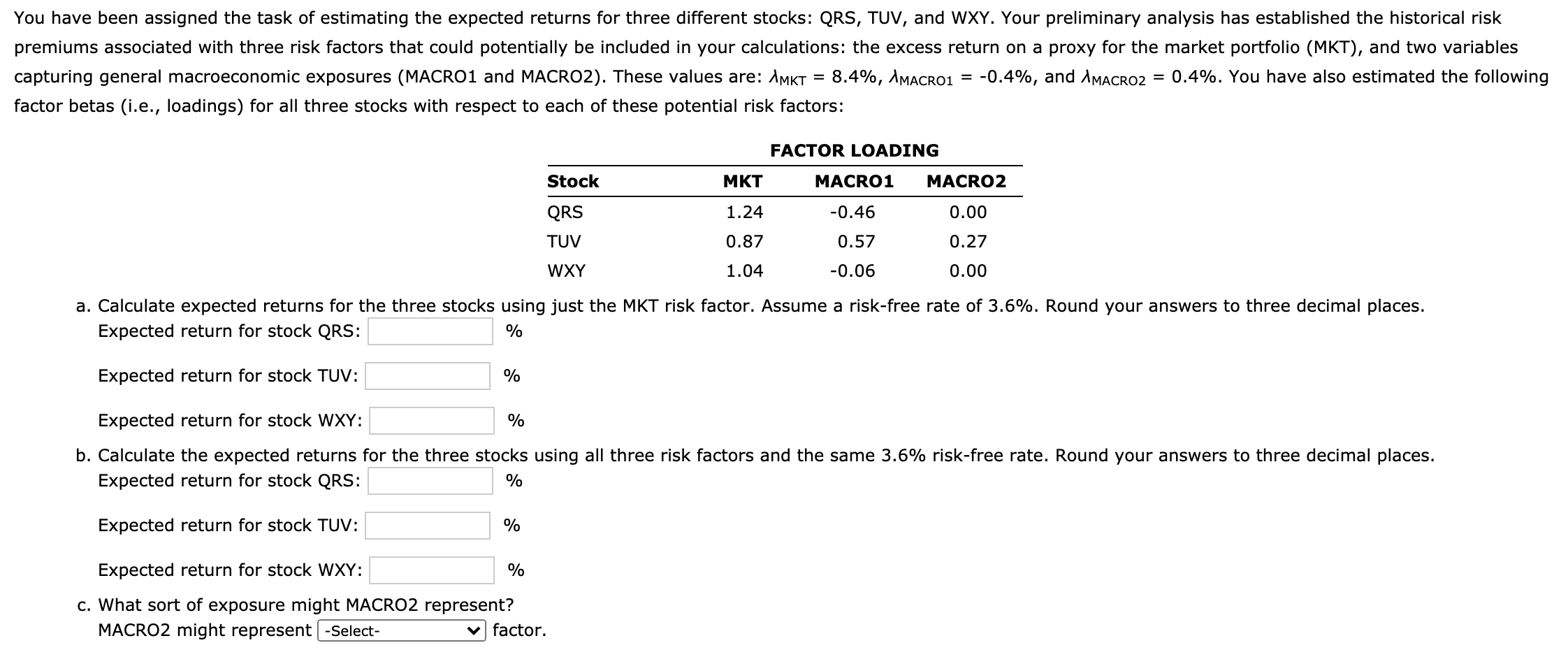

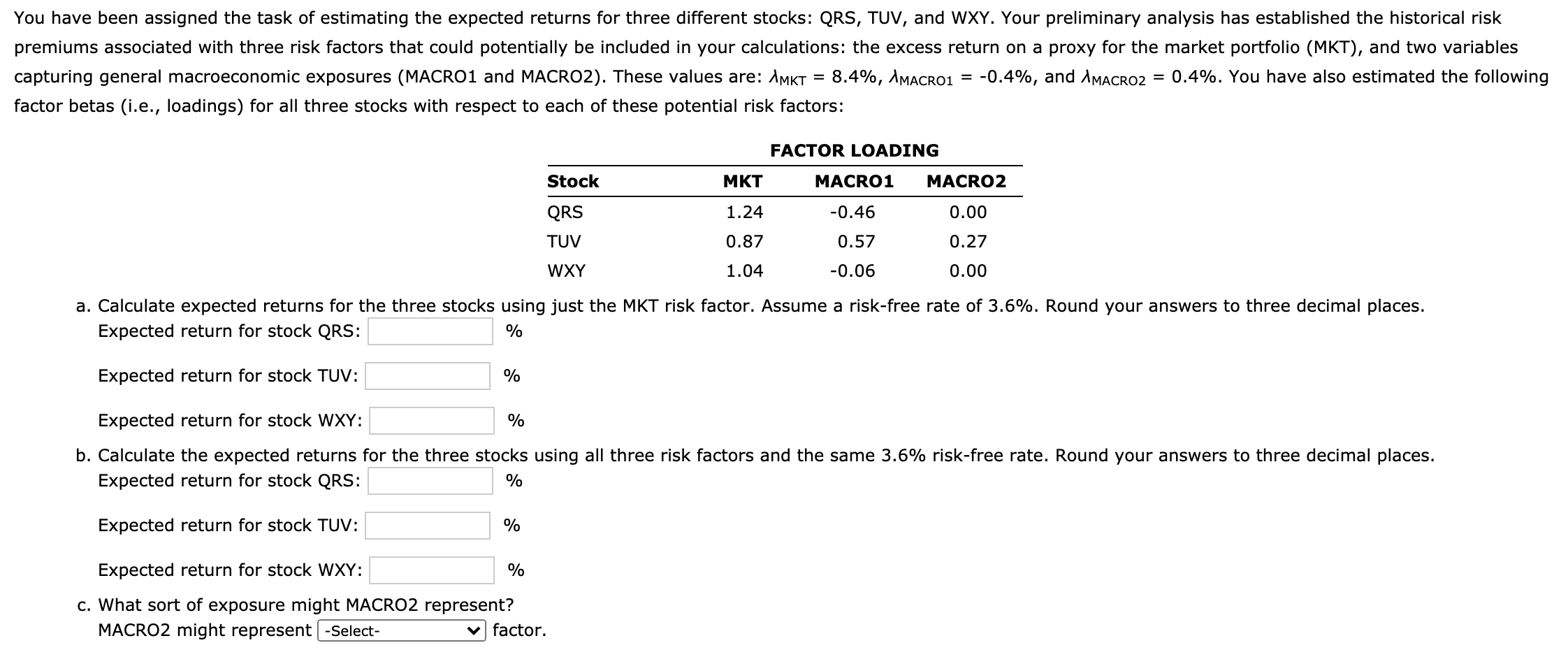

You have been assigned the task of estimating the expected returns for three different stocks: QRS, TUV, and WXY. Your preliminary analysis has established the historical risk premiums associated with three risk factors that could potentially be included in your calculations: the excess return on a proxy for the market portfolio (MKT), and two variables capturing general macroeconomic exposures (MACRO1 and MACRO2). These values are: /MKT = 8.4%, IMACRO1 = -0.4%, and .MACRO2 = 0.4%. You have also estimated the following factor betas (i.e., loadings) for all three stocks with respect to each of these potential risk factors: FACTOR LOADING Stock MKT MACRO1 MACRO2 1.24 -0.46 0.00 QRS TUV 0.87 0.57 0.27 WXY 1.04 -0.06 0.00 a. Calculate expected returns for the three stocks using just the MKT risk factor. Assume a risk-free rate of 3.6%. Round your answers to three decimal places. Expected return for stock QRS: % Expected return for stock TUV: % Expected return for stock WXY: % b. Calculate the expected returns for the three stocks using all three risk factors and the same 3.6% risk-free rate. Round your answers to three decimal places. Expected return for stock QRS: % Expected return for stock TUV: % Expected return for stock WXY: % c. What sort of exposure might MACRO2 represent? MACRO2 might represent -Select- Vfactor. c. What sort of exposure might MACRO2 represent? MACRO2 might represer -Select- factor. a systematic an industry-specific You have been assigned the task of estimating the expected returns for three different stocks: QRS, TUV, and WXY. Your preliminary analysis has established the historical risk premiums associated with three risk factors that could potentially be included in your calculations: the excess return on a proxy for the market portfolio (MKT), and two variables capturing general macroeconomic exposures (MACRO1 and MACRO2). These values are: /MKT = 8.4%, IMACRO1 = -0.4%, and .MACRO2 = 0.4%. You have also estimated the following factor betas (i.e., loadings) for all three stocks with respect to each of these potential risk factors: FACTOR LOADING Stock MKT MACRO1 MACRO2 1.24 -0.46 0.00 QRS TUV 0.87 0.57 0.27 WXY 1.04 -0.06 0.00 a. Calculate expected returns for the three stocks using just the MKT risk factor. Assume a risk-free rate of 3.6%. Round your answers to three decimal places. Expected return for stock QRS: % Expected return for stock TUV: % Expected return for stock WXY: % b. Calculate the expected returns for the three stocks using all three risk factors and the same 3.6% risk-free rate. Round your answers to three decimal places. Expected return for stock QRS: % Expected return for stock TUV: % Expected return for stock WXY: % c. What sort of exposure might MACRO2 represent? MACRO2 might represent -Select- Vfactor. c. What sort of exposure might MACRO2 represent? MACRO2 might represer -Select- factor. a systematic an industry-specific