Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been assigned the task of using the corporate, or free cash flow, model to estimate Petry Corporation's intrinsic value. The firm's WACC is

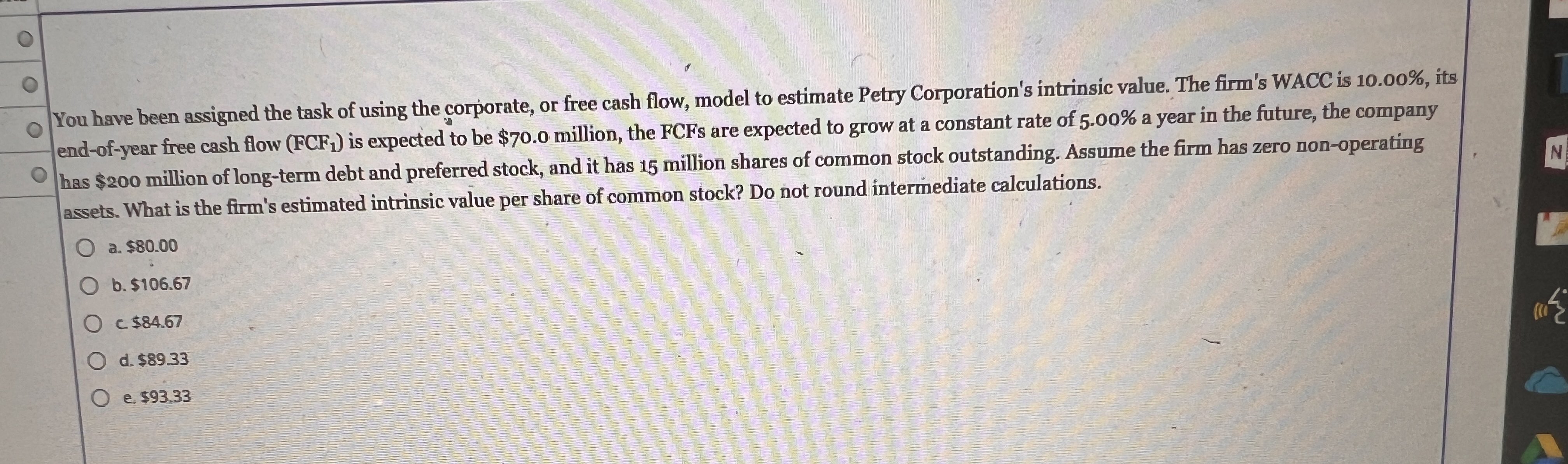

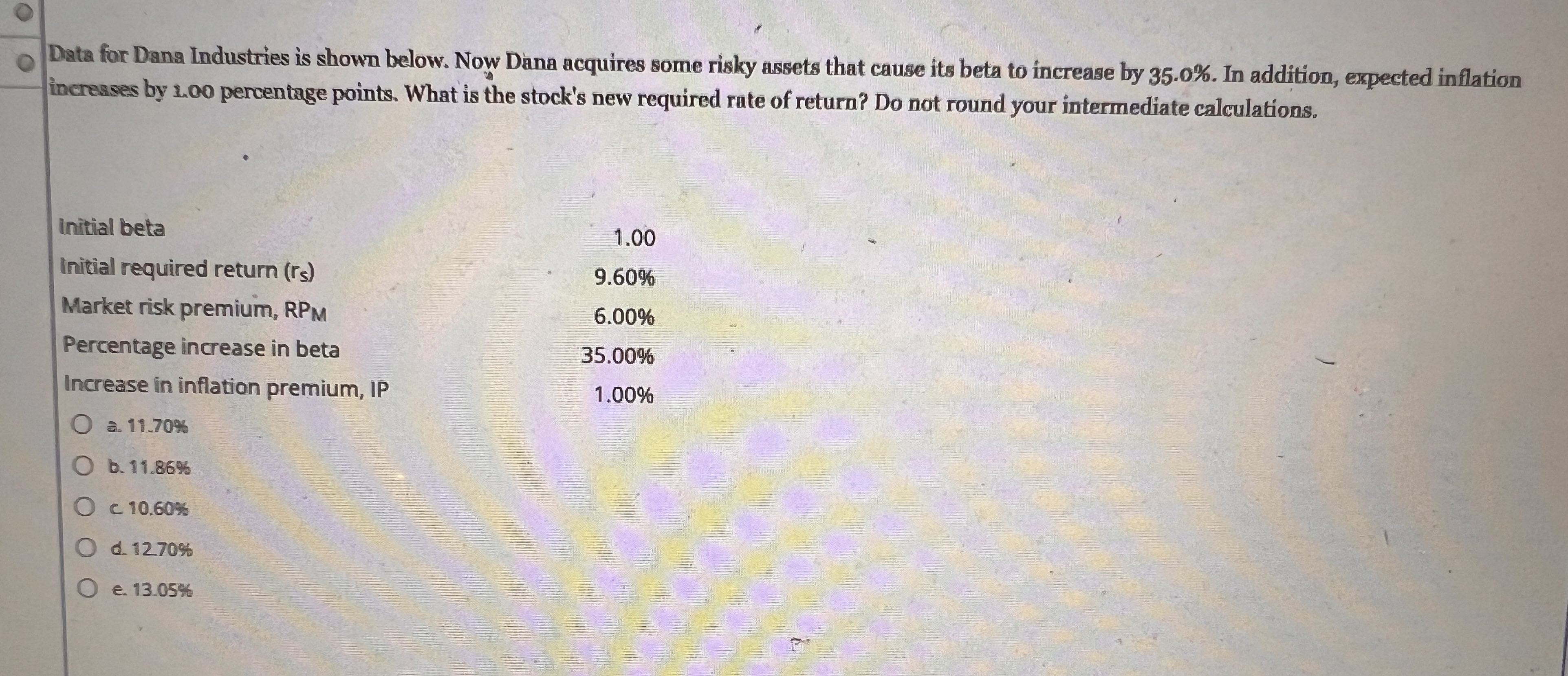

You have been assigned the task of using the corporate, or free cash flow, model to estimate Petry Corporation's intrinsic value. The firm's WACC is 10.00\%, its end-of-year free cash flow (FCF1) is expected to be $70.0 million, the FCFs are expected to grow at a constant rate of 5.00% a year in the future, the company has \$200 million of long-term debt and preferred stock, and it has 15 million shares of common stock outstanding. Assume the firm has zero non-operating acsets. What is the firm's estimated intrinsic value per share of common stock? Do not round intermediate calculations. a. $80.00 b. $106.67 0$84.67 d. $89.33 e. $93.33 Data for Dans Industries is shown below. Now Dana acquires some risky assets that cause its beta to increase by 35.0%. In addition, expected inflation incresses by 400 percentage points. What is the stock's new required rate of return? Do not round your intermediate calculations. . 11707 b. 19.869 C 10.60\% d. 1270% e. 13.05%

You have been assigned the task of using the corporate, or free cash flow, model to estimate Petry Corporation's intrinsic value. The firm's WACC is 10.00\%, its end-of-year free cash flow (FCF1) is expected to be $70.0 million, the FCFs are expected to grow at a constant rate of 5.00% a year in the future, the company has \$200 million of long-term debt and preferred stock, and it has 15 million shares of common stock outstanding. Assume the firm has zero non-operating acsets. What is the firm's estimated intrinsic value per share of common stock? Do not round intermediate calculations. a. $80.00 b. $106.67 0$84.67 d. $89.33 e. $93.33 Data for Dans Industries is shown below. Now Dana acquires some risky assets that cause its beta to increase by 35.0%. In addition, expected inflation incresses by 400 percentage points. What is the stock's new required rate of return? Do not round your intermediate calculations. . 11707 b. 19.869 C 10.60\% d. 1270% e. 13.05% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started