Question

You have been assigned to analyze the year-end inventory of Amitel Company. This company sells three items of inventory and tracks of the average purchase

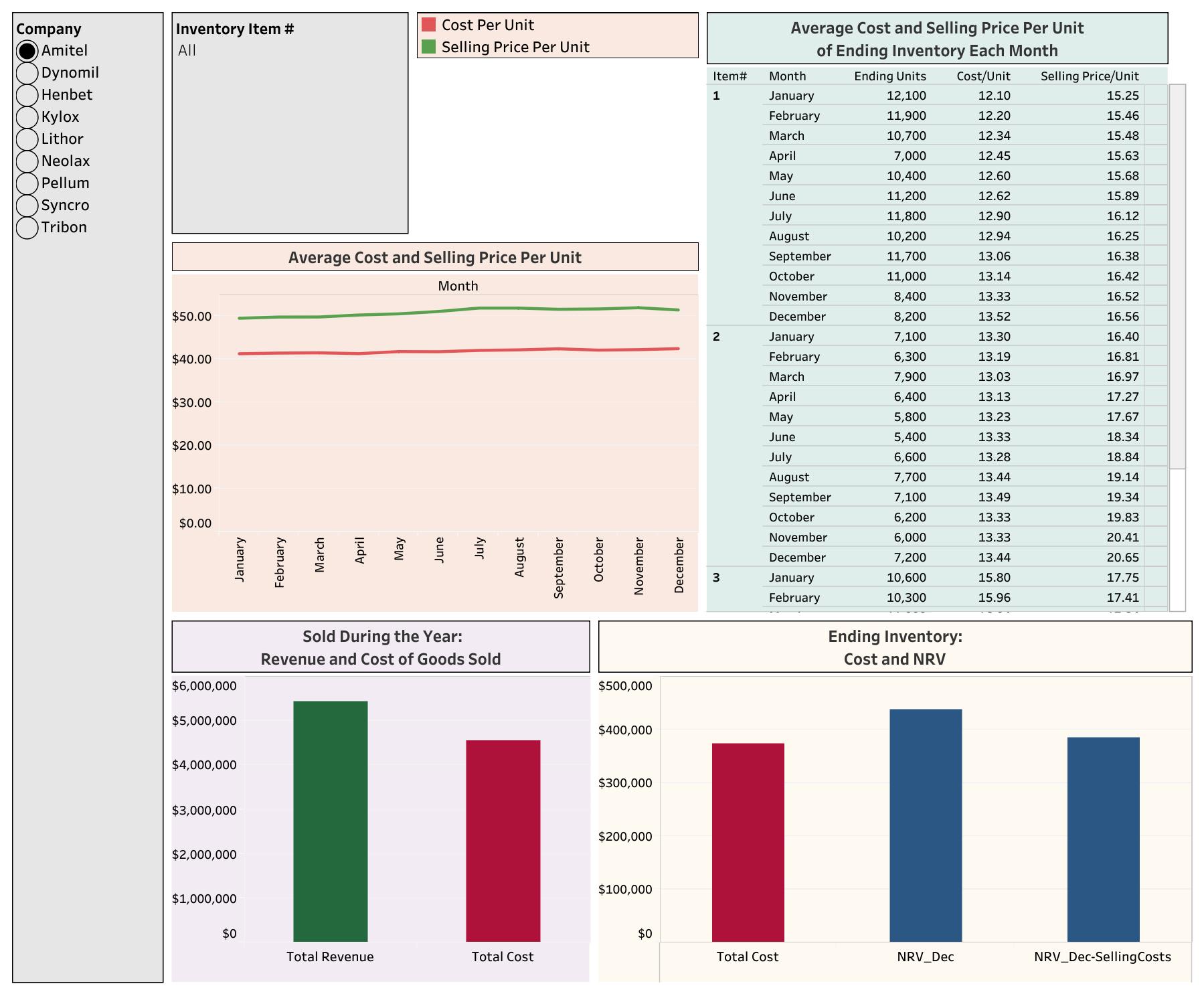

You have been assigned to analyze the year-end inventory of Amitel Company. This company sells three items of inventory and tracks of the average purchase cost and average selling price each month. At the end of each year (December), the company uses the lower of cost or net realizable value (LCNRV) approach to report ending inventory.

The total cost of ending inventory is shown in the bottom right of the dashboard. Also shown in the bottom right are two amounts for net realizable value (NRV) of ending inventory:

- NRV_Dec = Average selling price per unit in December times the number of units in ending inventory.

- NRV_Dec-Selling Costs = Average selling price per unit in December minus estimated selling costs of $2 per unit, times the number of units in ending inventory. The estimated selling cost of $2 is the average cost of selling a unit of inventory (packaging, shipping, sales commissions, etc.)

Use the dashboard provided to answer the following questions. Begin by selecting Amitel in the filter box at the top left.

Required:

- What is Amitel’s total revenue, total cost of goods sold, gross profit, and ending inventory for the year before any year-end adjustments?

| before adjustment | amount |

| total revenue | |

| total cost of goods sold | |

| gross profit | |

| ending inventory |

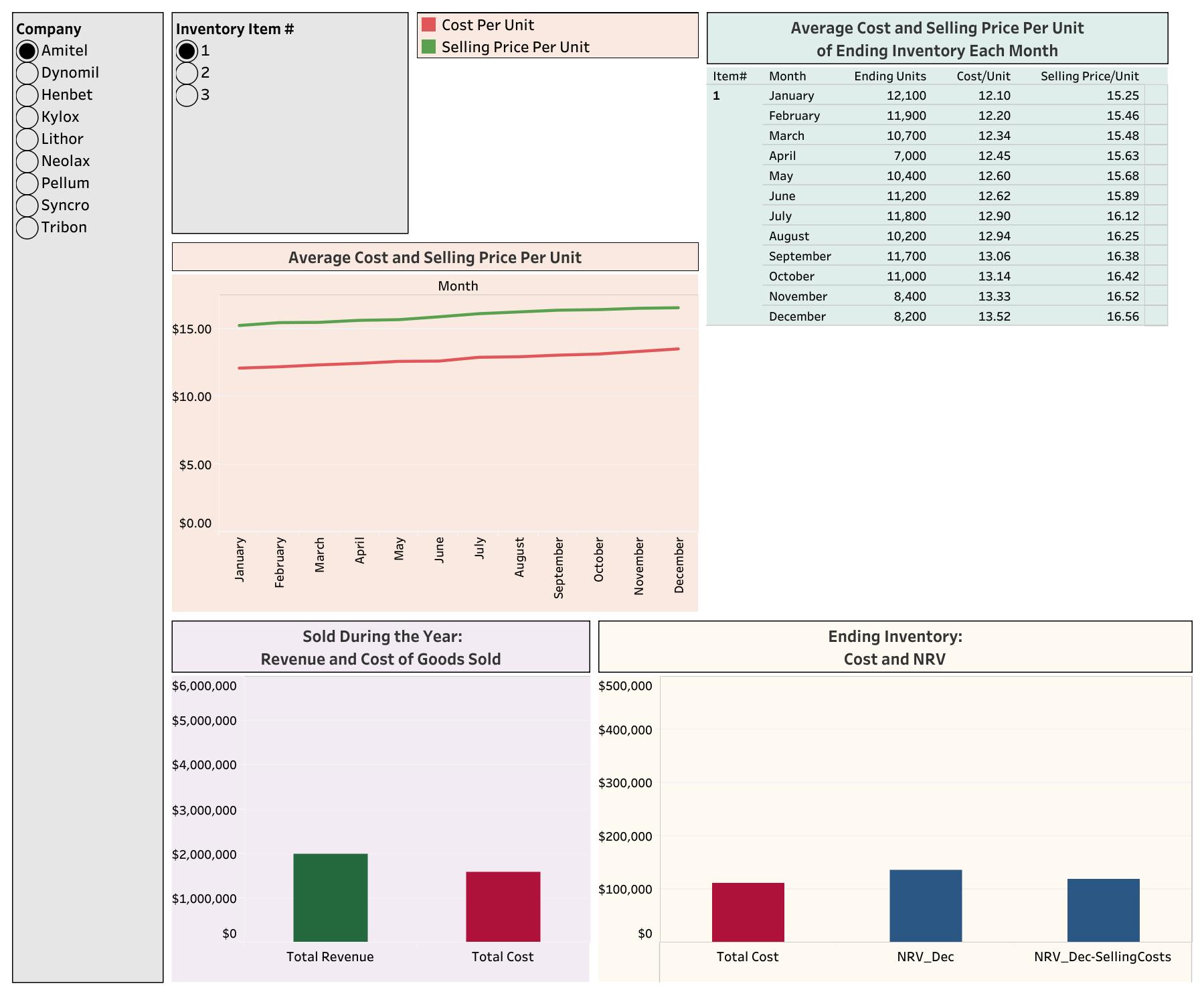

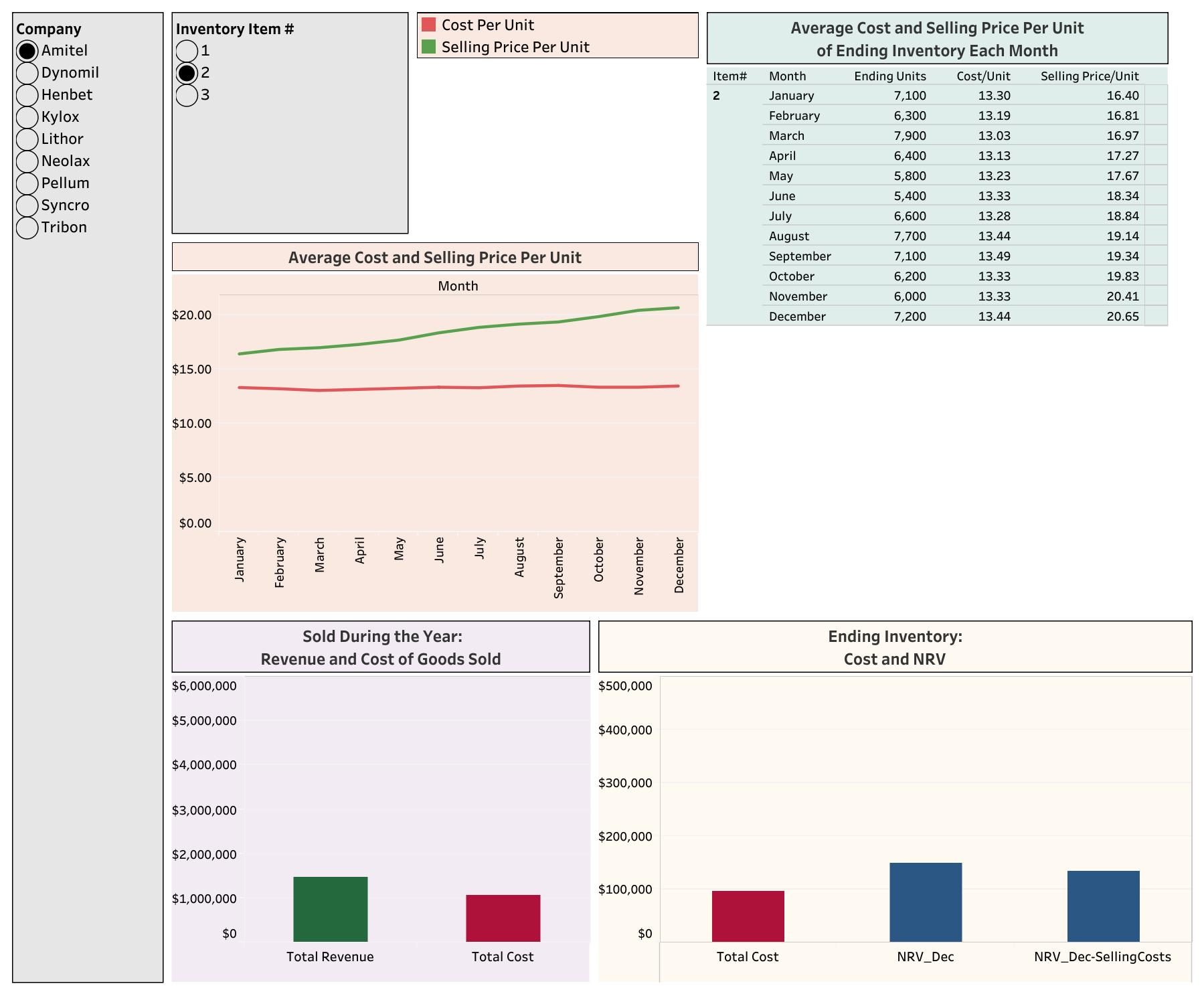

2. a) What is the total cost of ending inventory for inventory item #2? (Hint: Select Inventory Item #2 in the filter box near the top left.

| total cost of ending inventory | $ __________ |

b) Verify your answer in 2a by determining the number of units in ending inventory and the average cost per unit of ending inventory.

| number of units in ending inventory: | _______________ |

| average cost per unit: | $ ________ |

c) What is the NRV of ending inventory for item #2 based on each of the two estimates?

| NRV_Dec | |

| NRV_Dec-Selling costs = |

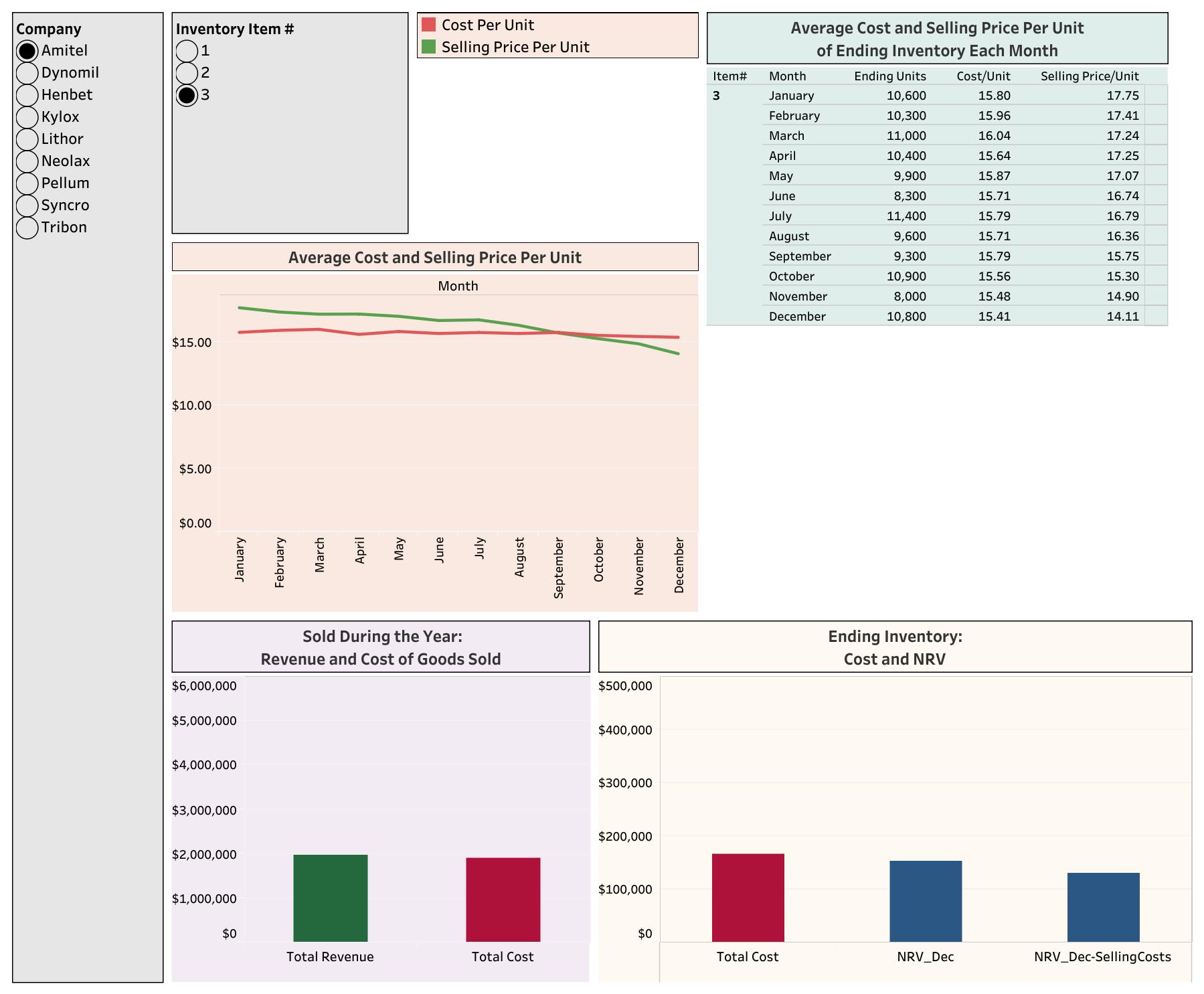

3. a) Applying the LCNRV approach to each individual item, determine which inventory item(s) require an adjustment and the amount of the total adjustment needed based on the correct estimate of NRV.

| inventory items to adjust = | |

| amount of total adjustment= |

b) Record the adjusting entry.

c) After the adjustment for LCNRV in Requirement 3b, recalculate the total revenue, total cost of goods sold, gross profit, and ending inventory for the year and compare your answers to those in Requirement 1.

| After adjustment | amount | change from requirement 1 |

| total revenue | ||

| total cost of goods sold | ||

| gross profit | ||

| ending inventory |

4. a) Now assume that instead of applying LCNRV to each individual item, you decide to treat all inventory as a single total. What is the amount of the total adjustment needed using this alternative approach to LCNRV? (Hint: Select “(All)” inventory items in the filter box near the top left.)

Amount of total adjustment: _______________________

b) Now assume that instead of applying LCNRV to each individual item, you decide to treat all inventory as a single total. What is the amount of the total adjustment needed using this alternative approach to LCNRV? (Hint: Select “(All)” inventory items in the filter box near the top left.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started