Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been assigned to analyze the year-end inventory of Amitel Company. This company sells three items of inventory and tracks of the average

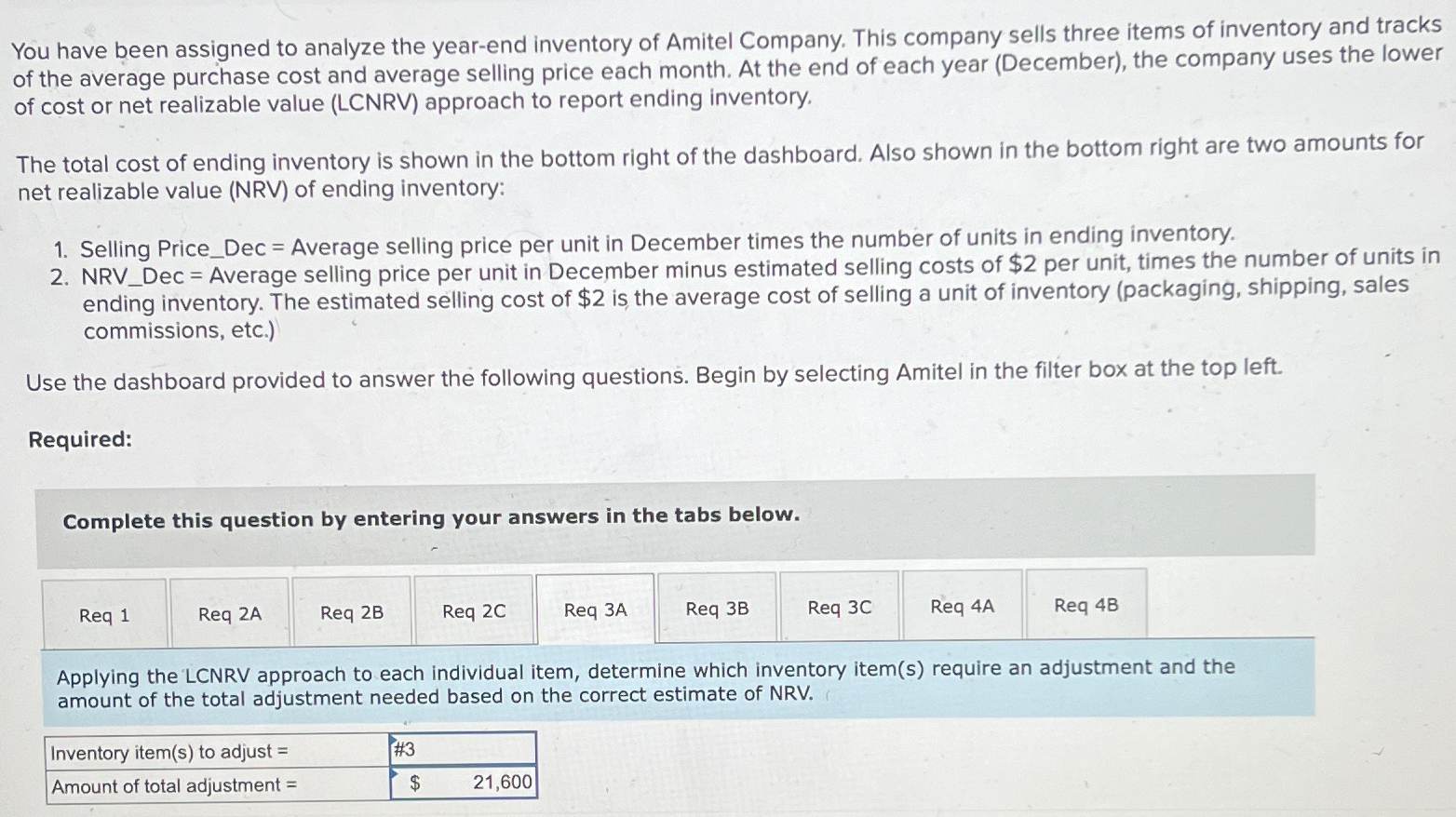

You have been assigned to analyze the year-end inventory of Amitel Company. This company sells three items of inventory and tracks of the average purchase cost and average selling price each month. At the end of each year (December), the company uses the lower of cost or net realizable value (LCNRV) approach to report ending inventory. The total cost of ending inventory is shown in the bottom right of the dashboard. Also shown in the bottom right are two amounts for net realizable value (NRV) of ending inventory: 1. Selling Price Dec Average selling price per unit in December times the number of units in ending inventory. 2. NRV Dec Average selling price per unit in December minus estimated selling costs of $2 per unit, times the number of units in ending inventory. The estimated selling cost of $2 is the average cost of selling a unit of inventory (packaging, shipping, sales commissions, etc.) Use the dashboard provided to answer the following questions. Begin by selecting Amitel in the filter box at the top left. Required: Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 2C Req 3A Req 3B Req 3C Req 4A Req 4B Applying the LCNRV approach to each individual item, determine which inventory item(s) require an adjustment and the amount of the total adjustment needed based on the correct estimate of NRV. Inventory item(s) to adjust = Amount of total adjustment = # 3 $ 21,600

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Amitel Company Inventory Analysis Req 1 Applying the LCNRV Approach to Each Individual Item Item Cost Selling PriceDec NRVDec Adjustment Needed 1 1300 1500 1300 No 2 1700 1900 1700 No 3 2000 2200 2000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started