Answered step by step

Verified Expert Solution

Question

1 Approved Answer

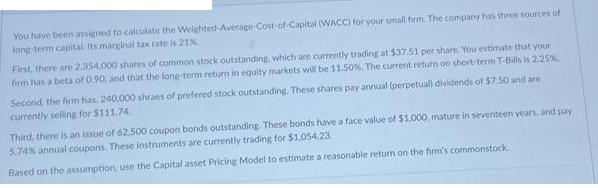

You have been assigned to calculate the long-term capital Its marginal tax rate is 21% Weighted-Average-Cost-of-Capital (WACC) for your small firm. The company has

You have been assigned to calculate the long-term capital Its marginal tax rate is 21% Weighted-Average-Cost-of-Capital (WACC) for your small firm. The company has three sources of First, there are 2,354,000 shares of common stock outstanding, which are currently trading at $37.51 per share. You estimate that your firm has a beta of 0.90, and that the long-term return in equity markets will be 11.50%. The current return on short-term T-Bills is 2.25% Second, the firm has. 240,000 shraes of prefered stock outstanding. These shares pay annual (perpetual) dividends of $7.50 and are currently selling for $111.74 Third, there is an issue of 62.500 coupon bonds outstanding. These bonds have a face value of $1.000, mature in seventeen years, and pay 5.74% annual coupons. These instruments are currently trading for $1,054.23. Based on the assumption, use the Capital asset Pricing Model to estimate a reasonable return on the firm's commonstock.

Step by Step Solution

★★★★★

3.58 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To estimate a reasonable return on the firms common stock using the Capit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started