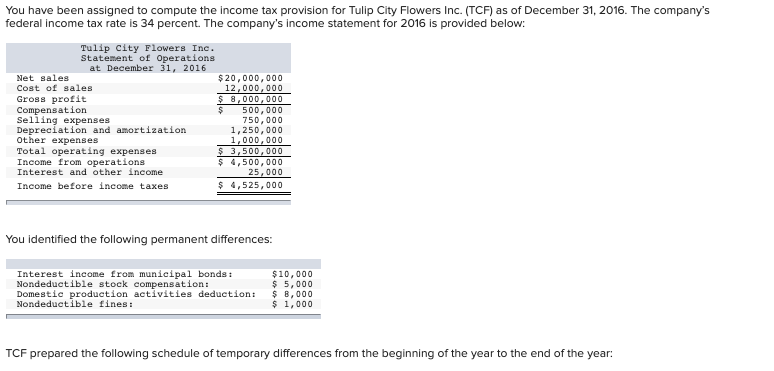

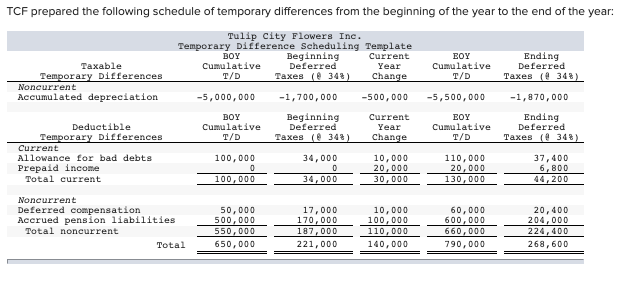

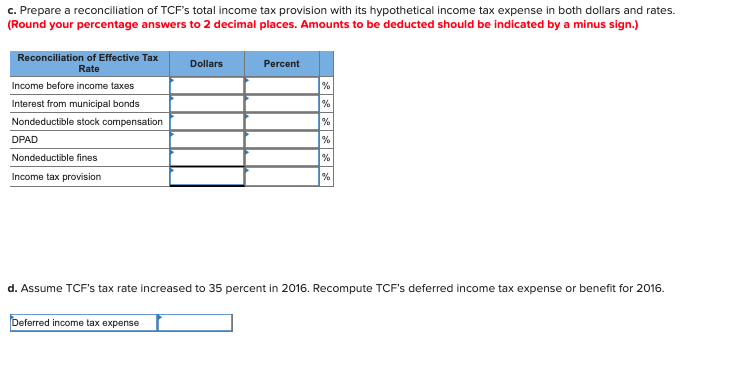

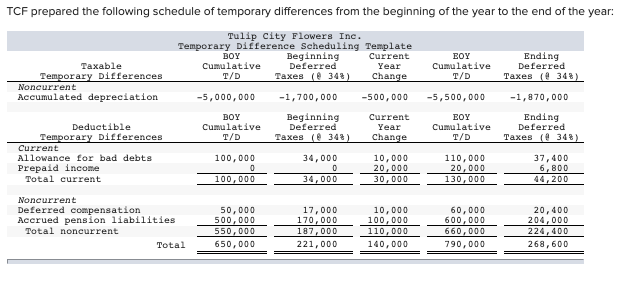

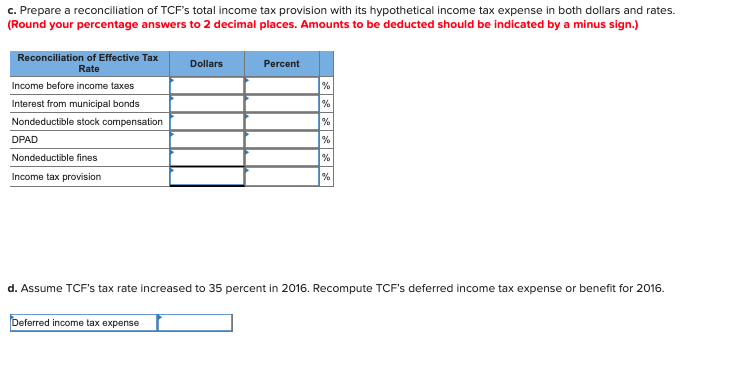

You have been assigned to compute the income tax provision for Tulip City Flowers Inc. (TCF) as of December 31, 2016. The company's federal income tax rate is 34 percent. The company's income statement for 2016 is provided below: Tulip City Flowers Inc Statement of Operations at December 31, 2016 Net sales $20,000,000 12,000,000 $ 8,000,000 Cost of sales Gross profit Compensation Selling expenses Depreciation and amortization Other expenses Total operating expenses Income from operations 500,000 750,000 1,250,000 1,000,000 3,500,000 $4,500,000 25,000 Interest and other income Income before income taxes 4,525,000 You identified the following permanent differences: Interest income from municipal bonds: Nondeductible stock compensation: Domestic production activities deduction Nondeductible fines $10,000 $ 5,000 8,000 1,000 TCF prepared the following schedule of temporary differences from the beginning of the year to the end of the year: TCF prepared the following schedule of temporary differences from the beginning of the year to the end of the year: Tulip city Flowers Inc Temporary Difference Scheduling Template Beginning Deferred BOY Cumulative Ending Deferred es (@ 348). Current EOY Cumulative T/D Taxable Year Taxes (e 343) Temporary Differences T/D Change Noncurrent Accumulated depreciation 1,870,000 -5,000,000 1,700,000 500,000 5,500,000 Y Cumulative T/D Beginning Deferred Taxes ( 348) EOY Ending Current Deductible Cumulative T/D Year Deferred Taxes (348) Temporary Differences Change Current Allowance for bad debts Prepaid income Total current 100,000 0 34,000 10,000 110,000 37,400 6,800 0 20,000 30,000 20,000 130,000 100,000 34,000 44,200 Noncurrent Deferred compensation Accrued pension liabilities Total 50,000 17,000 170,000 10,000 60,000 20,400 500,000 550,000 100,000 110,000 600,000 204,000 ,400 oncurrent 187 00 000 22 650,000 221,000 140,000 790,000 268,600 Total c. Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates. (Round your percentage answers to 2 decimal places. Amounts to be deducted should be indicated by a minus sign.) Reconciliation of Effective Tax Dollars Percent Rate Income before income taxes Interest from municipal bonds Nondeductible stock compensation DPAD Nondeductible fines Income tax provision d. Assume TCF's tax rate increased to 35 percent in 2016. Recompute TCF's deferred income tax expense or benefit for 2016 Deferred income tax expense You have been assigned to compute the income tax provision for Tulip City Flowers Inc. (TCF) as of December 31, 2016. The company's federal income tax rate is 34 percent. The company's income statement for 2016 is provided below: Tulip City Flowers Inc Statement of Operations at December 31, 2016 Net sales $20,000,000 12,000,000 $ 8,000,000 Cost of sales Gross profit Compensation Selling expenses Depreciation and amortization Other expenses Total operating expenses Income from operations 500,000 750,000 1,250,000 1,000,000 3,500,000 $4,500,000 25,000 Interest and other income Income before income taxes 4,525,000 You identified the following permanent differences: Interest income from municipal bonds: Nondeductible stock compensation: Domestic production activities deduction Nondeductible fines $10,000 $ 5,000 8,000 1,000 TCF prepared the following schedule of temporary differences from the beginning of the year to the end of the year: TCF prepared the following schedule of temporary differences from the beginning of the year to the end of the year: Tulip city Flowers Inc Temporary Difference Scheduling Template Beginning Deferred BOY Cumulative Ending Deferred es (@ 348). Current EOY Cumulative T/D Taxable Year Taxes (e 343) Temporary Differences T/D Change Noncurrent Accumulated depreciation 1,870,000 -5,000,000 1,700,000 500,000 5,500,000 Y Cumulative T/D Beginning Deferred Taxes ( 348) EOY Ending Current Deductible Cumulative T/D Year Deferred Taxes (348) Temporary Differences Change Current Allowance for bad debts Prepaid income Total current 100,000 0 34,000 10,000 110,000 37,400 6,800 0 20,000 30,000 20,000 130,000 100,000 34,000 44,200 Noncurrent Deferred compensation Accrued pension liabilities Total 50,000 17,000 170,000 10,000 60,000 20,400 500,000 550,000 100,000 110,000 600,000 204,000 ,400 oncurrent 187 00 000 22 650,000 221,000 140,000 790,000 268,600 Total c. Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates. (Round your percentage answers to 2 decimal places. Amounts to be deducted should be indicated by a minus sign.) Reconciliation of Effective Tax Dollars Percent Rate Income before income taxes Interest from municipal bonds Nondeductible stock compensation DPAD Nondeductible fines Income tax provision d. Assume TCF's tax rate increased to 35 percent in 2016. Recompute TCF's deferred income tax expense or benefit for 2016 Deferred income tax expense