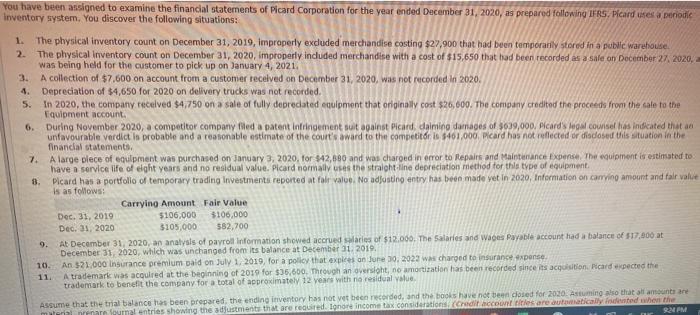

You have been assigned to examine the financial statements of Picard Corporation for the year ended December 31, 2020, as prepared following IFRS, Picard uses a periode Inventory system. You discover the following situations: 1. The physical inventory count on December 31, 2019, improperly exduded merchandise costing $27,900 that had been temporarily stored in a public warehouse 2. The physical Inventory count on December 31, 2020, improperly included merchandise with a cost of $15,650 that had been recorded as a sale on December 27, 2020, was being held for the customer to pick up on January 4, 2021 3. A collection of $7,600 on account from a customer received on December 31, 2020, was not recorded in 2020, Depreciation of $4,650 for 2020 on delivery trucks was not recorded 5. in 2020, the company received $4,750 on a sale of fully deprecated equipment that originally cost $26,600. The company credited the proceeds from the sale to the Equipment account 6. During November 2020, a competitor company filed a patent Infringement suit against Picard, claiming damages of 339,000. Picard's legal course has indicated that a unfavourable verdict is probable and a reasonable estimate of the court's award to the competitor is $461,000. Picard has not reflected or discosed this situation in the financial statements 7. A large piece of equipment was purchased on January 3, 2020, for 142,690 and was charged in error to Repairs and Maintenance Expense. The equipment is estimated to have a service life of eight years and no residual value, Picard normally uses the straight-line depreciation method for this type of equipment 8. Picard has a portfolio of temporary trading Investments reported at for value. No adjusting entry has been made vet in 2020, Information on carrying amount and fair value is as follows: Carrying Amount Fair Value Dec 31, 2019 $106.000 3106,000 Dec 31, 2020 $105,000 $82,700 9. At December 31, 2020, an analysis of payroll Information showed accrued salaries of $12.060. The Salaries and Wages Payable account had a balance of 517,000 at December 31, 2020, which was unchanged from its balance at December 31, 2019, 10. An $21.000 insurance premium paid on July 1, 2019, for a policy that exple on June 30, 2022 w charged to insurance expense 11 A trademark was acquired at the beginning of 2019 for $35,600. Through an oversloht, no amortization has been recorded since its acquisition Picard expected the trademark to benefit the company for a total of approximately 12 years with no residual value Assume that the trial balance has been prepared the ending inventory has not yet been recorded, and the books have not been closed for 2020. Assuming also that all amounts are materialer ournal entries showing the adjustments that are required. lgnore income tax considerations (Credit accounts are automatically dested when the SAM