Question

You have been assigned to implement a three-month hedge for a stock mutual fund portfolio that primarily invests in medium-sized companies. The goal of the

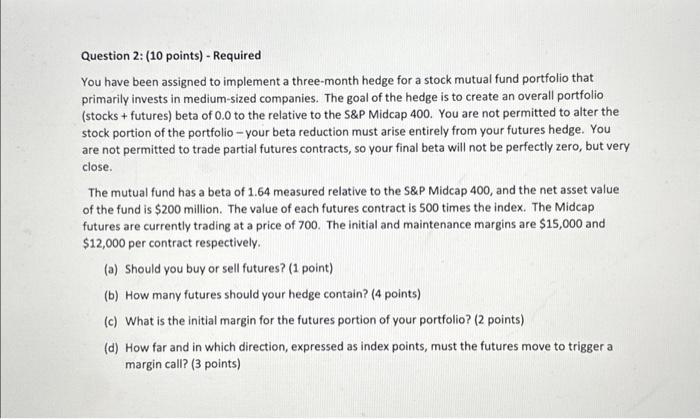

You have been assigned to implement a three-month hedge for a stock mutual fund portfolio that primarily invests in medium-sized companies. The goal of the hedge is to create an overall portfolio (stocks + futures) beta of 0.0 to the relative to the S&P Midcap 400. You are not permitted to alter the stock portion of the portfolio - your beta reduction must arise entirely from your futures hedge. You are not permitted to trade partial futures contracts, so your final beta will not be perfectly zero, but very close. The mutual fund has a beta of 1.64 measured relative to the S&P Midcap 400, and the net asset value of the fund is $200 million. The value of each futures contract is 500 times the index. The Midcap futures are currently trading at a price of 700. The initial and maintenance margins are $15,000 and $12,000 per contract respectively.

(a) Should you buy or sell futures?

(b) How many futures should your hedge contain?

(c) What is the initial margin for the futures portion of your portfolio?

(d) How far and in which direction, expressed as index points, must the futures move to trigger a margin call?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started