Question: You have been assigned to implement a three-month hedge for a stock mutual fund portfolio that primarily invests in medium-sized companies. The mutual fund has

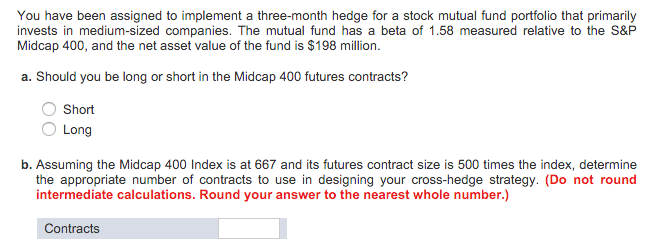

You have been assigned to implement a three-month hedge for a stock mutual fund portfolio that primarily invests in medium-sized companies. The mutual fund has a beta of 1.58 measured relative to the S&P Midcap 400, and the net asset value of the fund is $198 million. Should you be long or short in the Midcap 400 futures contracts? Short Long Assuming the Midcap 400 Index is at 667 and its futures contract size is 500 times the index, determine the appropriate number of contracts to use in designing your cross-hedge strategy. (Do not round intermediate calculations. Round your answer to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts