You have been assigned to prepare the cash budget, which is one portion of the master budget for Marble Company.

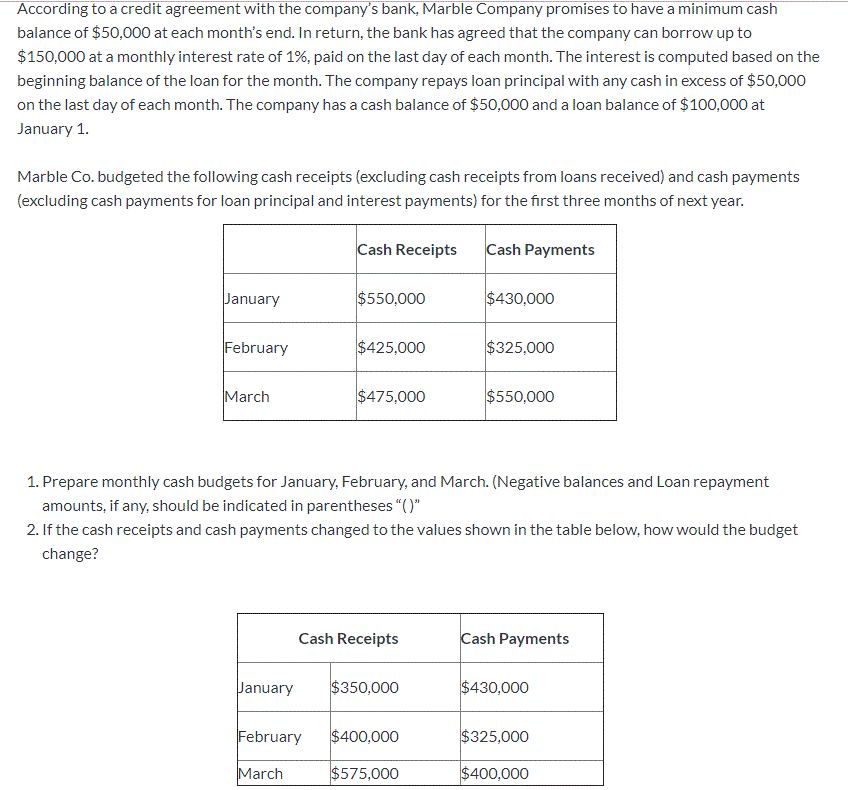

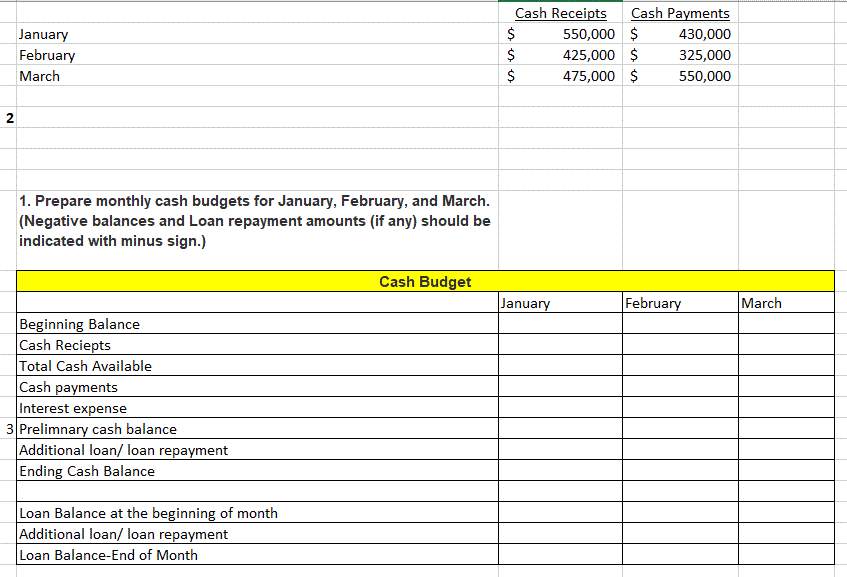

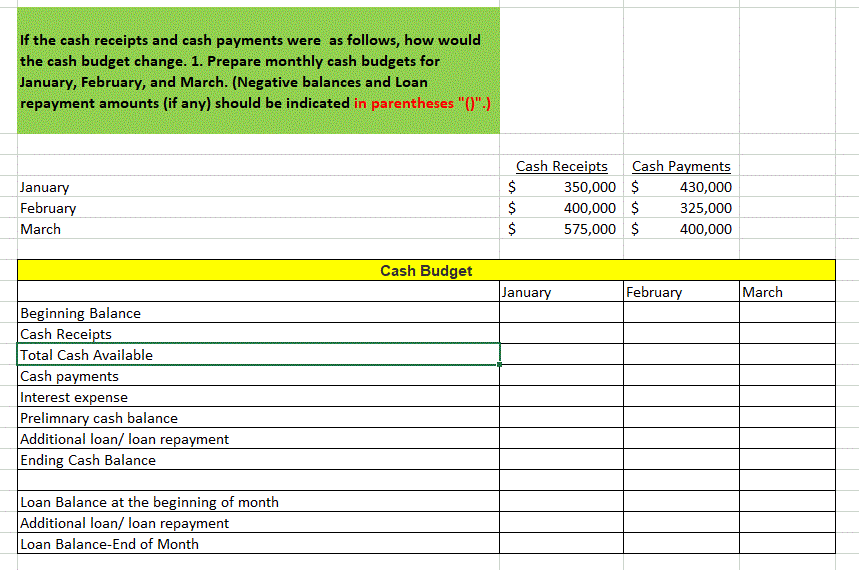

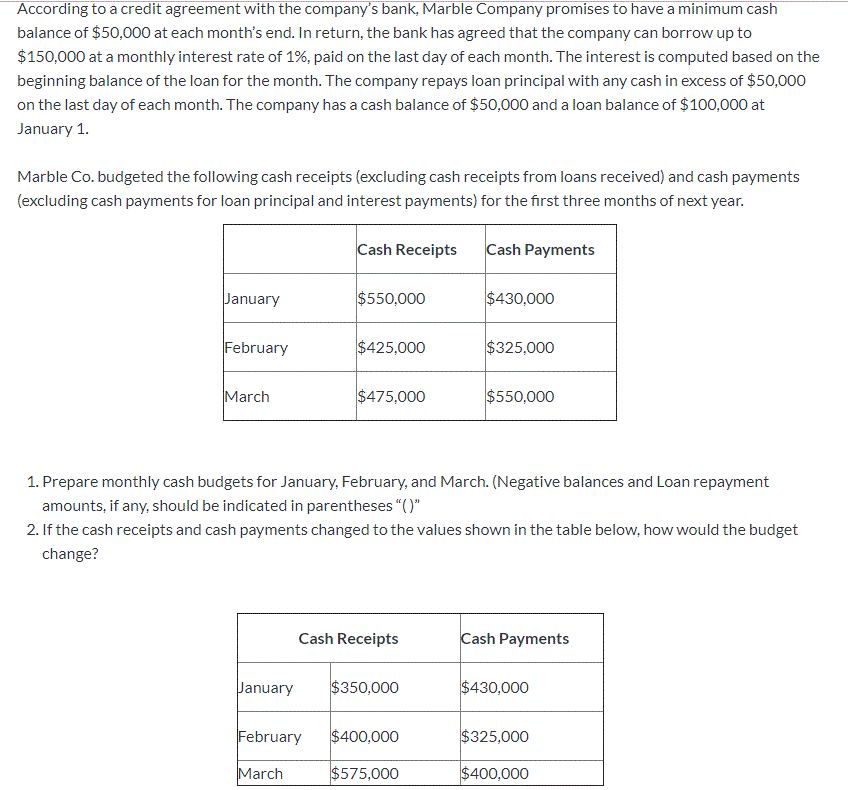

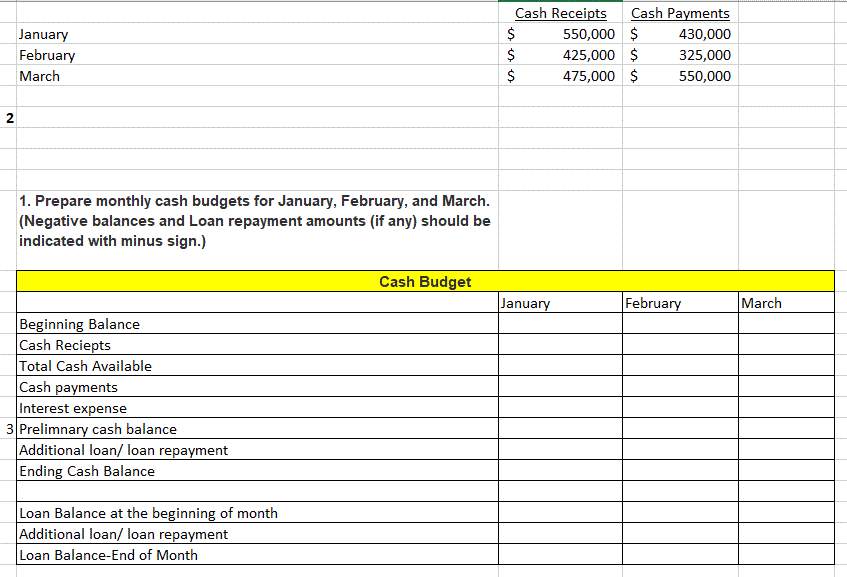

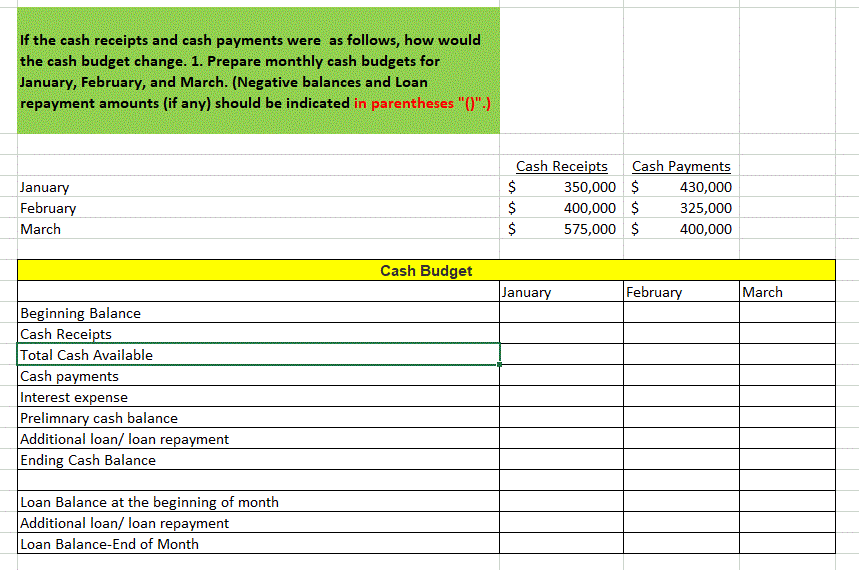

According to a credit agreement with the company's bank, Marble Company promises to have a minimum cash balance of $50,000 at each month's end. In return, the bank has agreed that the company can borrow up to $150,000 at a monthly interest rate of 1%, paid on the last day of each month. The interest is computed based on the beginning balance of the loan for the month. The company repays loan principal with any cash in excess of $50,000 on the last day of each month. The company has a cash balance of $50,000 and a loan balance of $100,000 at January 1. Marble Co. budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. Cash Receipts Cash Payments January $550,000 $430,000 February $425,000 $325,000 March $475,000 $550,000 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts, if any, should be indicated in parentheses "C" 2. If the cash receipts and cash payments changed to the values shown in the table below, how would the budget change? Cash Receipts Cash Payments January $350,000 $430,000 February $400,000 $325,000 March $575,000 $400,000 January February March Cash Receipts Cash Payments $ 550,000 $ 430,000 425,000 $ 325,000 475,000 $ 550,000 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Cash Budget January February March Beginning Balance Cash Reciepts Total Cash Available Cash payments Interest expense 3 Prelimnary cash balance Additional loan/ loan repayment Ending Cash Balance Loan Balance at the beginning of month Additional loan/ loan repayment Loan Balance-End of Month If the cash receipts and cash payments were as follows, how would the cash budget change. 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated in parentheses "0") January February March Cash Receipts Cash Payments $ 350,000 $ 430,000 325,000 $ 575,000 $ 400,000 Cash Budget January February March Beginning Balance Cash Receipts Total Cash Available Cash payments Interest expense Prelimnary cash balance Additional loan/ loan repayment Ending Cash Balance Loan Balance at the beginning of month Additional loan/ loan repayment Loan Balance-End of Month According to a credit agreement with the company's bank, Marble Company promises to have a minimum cash balance of $50,000 at each month's end. In return, the bank has agreed that the company can borrow up to $150,000 at a monthly interest rate of 1%, paid on the last day of each month. The interest is computed based on the beginning balance of the loan for the month. The company repays loan principal with any cash in excess of $50,000 on the last day of each month. The company has a cash balance of $50,000 and a loan balance of $100,000 at January 1. Marble Co. budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. Cash Receipts Cash Payments January $550,000 $430,000 February $425,000 $325,000 March $475,000 $550,000 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts, if any, should be indicated in parentheses "C" 2. If the cash receipts and cash payments changed to the values shown in the table below, how would the budget change? Cash Receipts Cash Payments January $350,000 $430,000 February $400,000 $325,000 March $575,000 $400,000 January February March Cash Receipts Cash Payments $ 550,000 $ 430,000 425,000 $ 325,000 475,000 $ 550,000 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Cash Budget January February March Beginning Balance Cash Reciepts Total Cash Available Cash payments Interest expense 3 Prelimnary cash balance Additional loan/ loan repayment Ending Cash Balance Loan Balance at the beginning of month Additional loan/ loan repayment Loan Balance-End of Month If the cash receipts and cash payments were as follows, how would the cash budget change. 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated in parentheses "0") January February March Cash Receipts Cash Payments $ 350,000 $ 430,000 325,000 $ 575,000 $ 400,000 Cash Budget January February March Beginning Balance Cash Receipts Total Cash Available Cash payments Interest expense Prelimnary cash balance Additional loan/ loan repayment Ending Cash Balance Loan Balance at the beginning of month Additional loan/ loan repayment Loan Balance-End of Month