Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been considering going into business for some time and have been on the look-out for opportunities. You decide that West End is

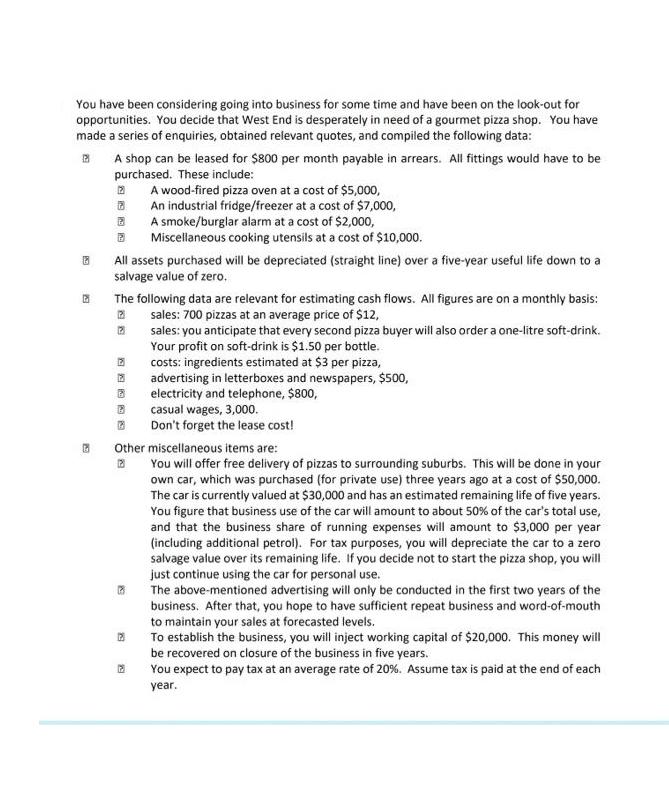

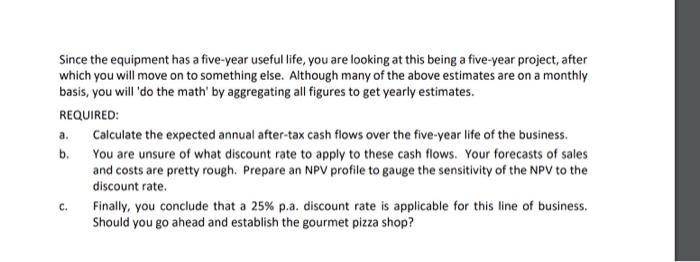

You have been considering going into business for some time and have been on the look-out for opportunities. You decide that West End is desperately in need of a gourmet pizza shop. You have made a series of enquiries, obtained relevant quotes, and compiled the following data: 123 A shop can be leased for $800 per month payable in arrears. All fittings would have to be purchased. These include: 1 A wood-fired pizza oven at a cost of $5,000, 8 An industrial fridge/freezer at a cost of $7,000, B A smoke/burglar alarm at a cost of $2,000, Miscellaneous cooking utensils at a cost of $10,000. B All assets purchased will be depreciated (straight line) over a five-year useful life down to a salvage value of zero. 19 The following data are relevant for estimating cash flows. All figures are on a monthly basis: sales: 700 pizzas at an average price of $12, 123 13 sales: you anticipate that every second pizza buyer will also order a one-litre soft-drink. Your profit on soft-drink is $1.50 per bottle. costs: ingredients estimated at $3 per pizza, S advertising in letterboxes and newspapers, $500, electricity and telephone, $800, Other miscellaneous items are: You will offer free delivery of pizzas to surrounding suburbs. This will be done in your own car, which was purchased (for private use) three years ago at a cost of $50,000. The car is currently valued at $30,000 and has an estimated remaining life of five years. You figure that business use of the car will amount to about 50% of the car's total use, and that the business share of running expenses will amount to $3,000 per year (including additional petrol). For tax purposes, you will depreciate the car to a zero salvage value over its remaining life. If you decide not to start the pizza shop, you will just continue using the car for personal use. 83 casual wages, 3,000. Don't forget the lease cost! The above-mentioned advertising will only be conducted in the first two years of the business. After that, you hope to have sufficient repeat business and word-of-mouth to maintain your sales at forecasted levels. 13 To establish the business, you will inject working capital of $20,000. This money will be recovered on closure of the business in five years. You expect to pay tax at an average rate of 20%. Assume tax is paid at the end of each year. 12 Since the equipment has a five-year useful life, you are looking at this being a five-year project, after which you will move on to something else. Although many of the above estimates are on a monthly basis, you will 'do the math' by aggregating all figures to get yearly estimates. REQUIRED: a. b. C. Calculate the expected annual after-tax cash flows over the five-year life of the business. You are unsure of what discount rate to apply to these cash flows. Your forecasts of sales and costs are pretty rough. Prepare an NPV profile to gauge the sensitivity of the NPV to the discount rate. Finally, you conclude that a 25% p.a. discount rate is applicable for this line of business. Should you go ahead and establish the gourmet pizza shop?

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a Calcul ate the expected annual after tax cash flows over the five year life of the business ANS WER Year 1 Re venue 700 pizz as x 12 8 400 Soft drin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started