Question

You have been furnished with the financial information of Aditya Mills Ltd. for the current year. Sundry debtors and stock at the beginning of the

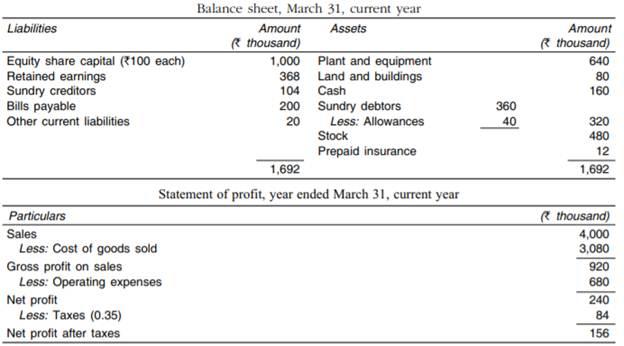

You have been furnished with the financial information of Aditya Mills Ltd. for the current year.

Sundry debtors and stock at the beginning of the year were `3,00,000 and `4,00,000 respectively.

(a) Determine the following ratios of the Aditya Mills Ltd: (i) Current ratio, (ii) Acid-test ratio, (iii) Stock turnover, (iv) Debtors turnover, (v) Gross profit ratio, (vi) Net profit ratio, (vii) Operating ratio, (viii) Earnings per share, (ix) Rate of return on equity capital, and (x) Market value of the shares if P/E ratio is 10 times,

(b) Indicate for each of the following transactions whether the transaction would improve, weaken or have an effect on the current ratio of the Aditya Mills Ltd: (i) Sell additional equity shares, (ii) Sell 10% debentures, (iii) Pay bills payable, (iv) Collect sundry debtors, (v) Purchase additional plant, (vi) Issuing bills payable to creditors, (vii) Collecting bills receivable from debtors, (viii) Purchase of treasury bills, and (ix) Writing off bad debt.

Liabilities Equity share capital (100 each) Retained earnings Sundry creditors Bills payable Other current liabilities Particulars Sales Less: Cost of goods sold Gross profit on sales Less: Operating expenses Net profit Less: Taxes (0.35) Net profit after taxes Balance sheet, March 31, current year Assets Amount (thousand) 1,000 368 104 200 20 Plant and equipment Land and buildings Cash Sundry debtors Less: Allowances Stock Prepaid insurance 1,692 Statement of profit, year ended March 31, current year 360 40 Amount ( thousand) 640 80 160 320 480 12 1,692 ( thousand) 4,000 3,080 920 680 240 84 156

Step by Step Solution

3.49 Rating (182 Votes )

There are 3 Steps involved in it

Step: 1

a i Current ratio Current AssetsCurrent Liabilities 10003681042003604064080160 142 times ii Acidtest ratio Current AssetsStockCurrent Liabilities 10003681042003604048064080160 073 times iii Stock turn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started