Question

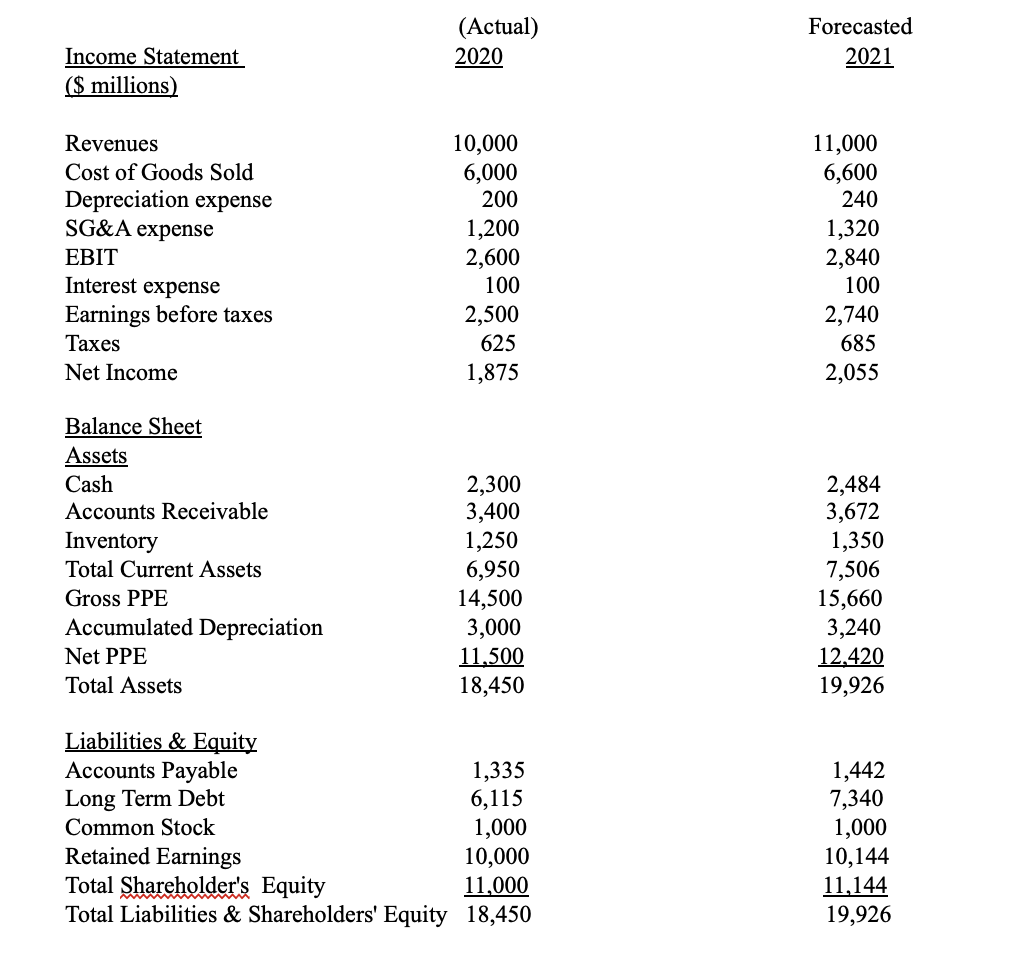

You have been hired as a consultant to develop a valuation model for Whale, Inc. Management has provided you with partial income statement and balance

-

You have been hired as a consultant to develop a valuation model for Whale, Inc. Management has provided you with partial income statement and balance sheet. Below is information for the most recent year (2020, year 0) and projected information for 2021. All numbers are in millions. After 2021, the firm is expected to grow at 3% in perpetuity. The weighted average cost of capital (WACC) is 12% and the corporate tax rate is 25%. There are 200 million shares outstanding. Show Steps

-

What is your estimate of 2021 free cash flow? (50)

-

What is your estimate of the value of Whale, Inc as of January 1, 2021? Assume that 2020 free cash flow has already been distributed. (30)

-

What is your estimate of a single share of stock in Whale, Inc.? (20)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started