Answered step by step

Verified Expert Solution

Question

1 Approved Answer

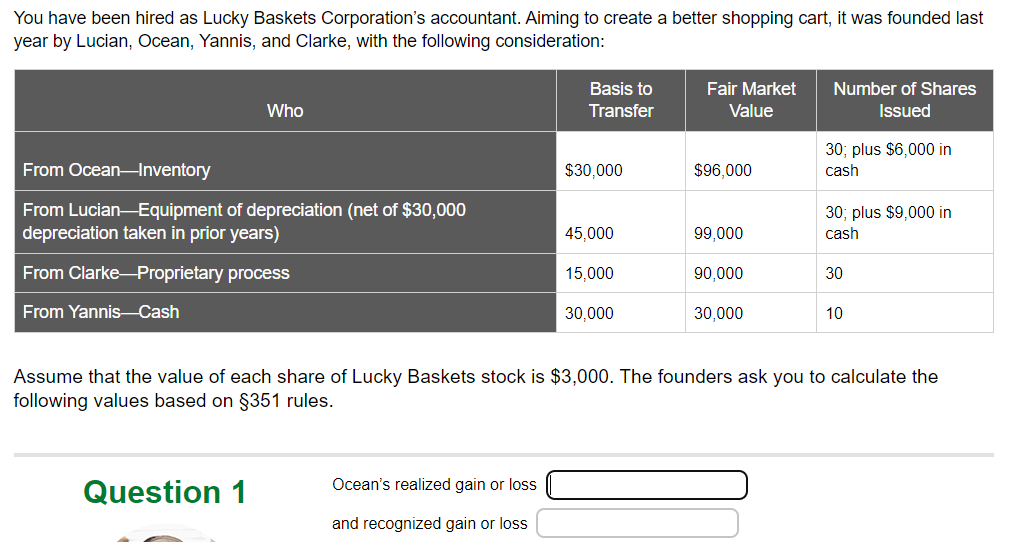

? You have been hired as Lucky Baskets Corporation's accountant. Aiming to create a better shopping cart, it was founded last year by Lucian, Ocean,

?

? You have been hired as Lucky Baskets Corporation's accountant. Aiming to create a better shopping cart, it was founded last year by Lucian, Ocean, Yannis, and Clarke, with the following consideration: Who From Ocean Inventory From Lucian-Equipment of depreciation (net of $30,000 depreciation taken in prior years) From Clarke-Proprietary process From Yannis-Cash Question 1 Basis to Transfer Ocean's realized gain or loss and recognized gain or loss $30,000 45,000 15,000 30,000 Fair Market Value $96,000 99,000 90,000 30,000 Number of Shares Issued 30; plus $6,000 in cash 30; plus $9,000 in cash 30 Assume that the value of each share of Lucky Baskets stock is $3,000. The founders ask you to calculate the following values based on 351 rules. 10

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A realized gain is recognized on a 351 transfer if the transferor receives boot i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started