Question

You have been hired by a vendor who is preparing for an upcoming K-Pop (Korean pop music) concert featuring the singer IU (Lee Ji-eun) in

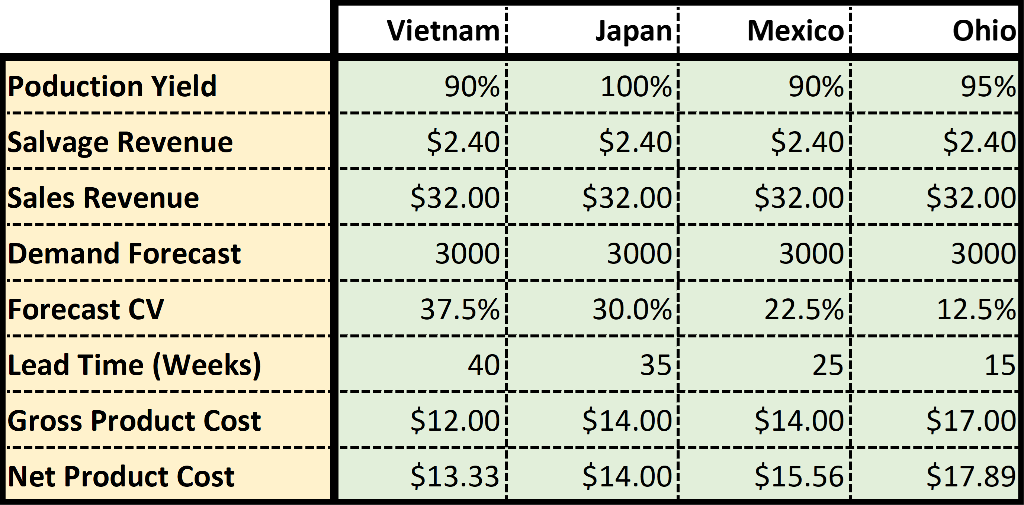

You have been hired by a vendor who is preparing for an upcoming K-Pop (Korean pop music) concert featuring the singer IU (Lee Ji-eun) in Cincinnati. The concert organizer is allowing vendors to sell IU paraphernalia. You determine that certain one-size-fits-all winter hats featuring IUs image will be sold. You have four choices for OEM suppliers of the hats. Due to their locations, their lead times differ, along with your costs. Based on past concerts, the product sales forecast is for 3000 hats, but this estimate is uncertain depending on the concert attendance. Each hat will sell for $32. Once the concert ends, products not sold will be bought by a discounter at a heavily reduced price of $2.40 per hat. Sales forecasts will be more accurate as the concert approaches (forecast CVs are available based on past forecasting performance). Production quality varies according to location, which is expressed as an expected production yield. Production costs are adjusted to account for these yields (and shown below as net product cost). Because the products all require careful handling, there will be an inventory holding cost that will apply as soon as the order is placed. However, the annual holding percentage is unknown at this time. The table below summarizes the important information regarding the locations under consideration.

Create a spreadsheet that determines, for each manufacturing location, the expected profits and how many units the vendor should order from each manufacturer. Assume that demand variation is normally distributed. Vary the annual holding cost percentage and show how the expected profits and order quantities for a range of holding rates from 10% to 40%. Show these results in tabular and graphical form. Clearly organize and label the spreadsheet to show inputs and results (i.e., a user may wish to modify inputs later as more information becomes available).

\begin{tabular}{|l|r|r|r|r|} \hline Poduction Yield & 90% & 100% & 90% & 95% \\ \hline Salvage Revenue & $2.40 & $2.40 & $2.40 & $2.40 \\ \hline Sales Revenue & $32.00 & $32.00 & $32.00 & $32.00 \\ \hline Demand Forecast & 3000 & 3000 & 3000 & 3000 \\ \hline Forecast CV & 37.5% & 30.0% & 22.5% & 12.5% \\ \hline Lead Time (Weeks) & 40 & 35 & 25 & 15 \\ \hline Gross Product Cost & $12.00 & $14.00 & $14.00 & $17.00 \\ \hline Net Product Cost & $13.33 & $14.00 & $15.56 & $17.89 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|r|} \hline Poduction Yield & 90% & 100% & 90% & 95% \\ \hline Salvage Revenue & $2.40 & $2.40 & $2.40 & $2.40 \\ \hline Sales Revenue & $32.00 & $32.00 & $32.00 & $32.00 \\ \hline Demand Forecast & 3000 & 3000 & 3000 & 3000 \\ \hline Forecast CV & 37.5% & 30.0% & 22.5% & 12.5% \\ \hline Lead Time (Weeks) & 40 & 35 & 25 & 15 \\ \hline Gross Product Cost & $12.00 & $14.00 & $14.00 & $17.00 \\ \hline Net Product Cost & $13.33 & $14.00 & $15.56 & $17.89 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started