Question

You have been hired by Internal Business Machines Corporation (IBM) in their capital budgeting division. Your first assignment is to determine the free cash flows

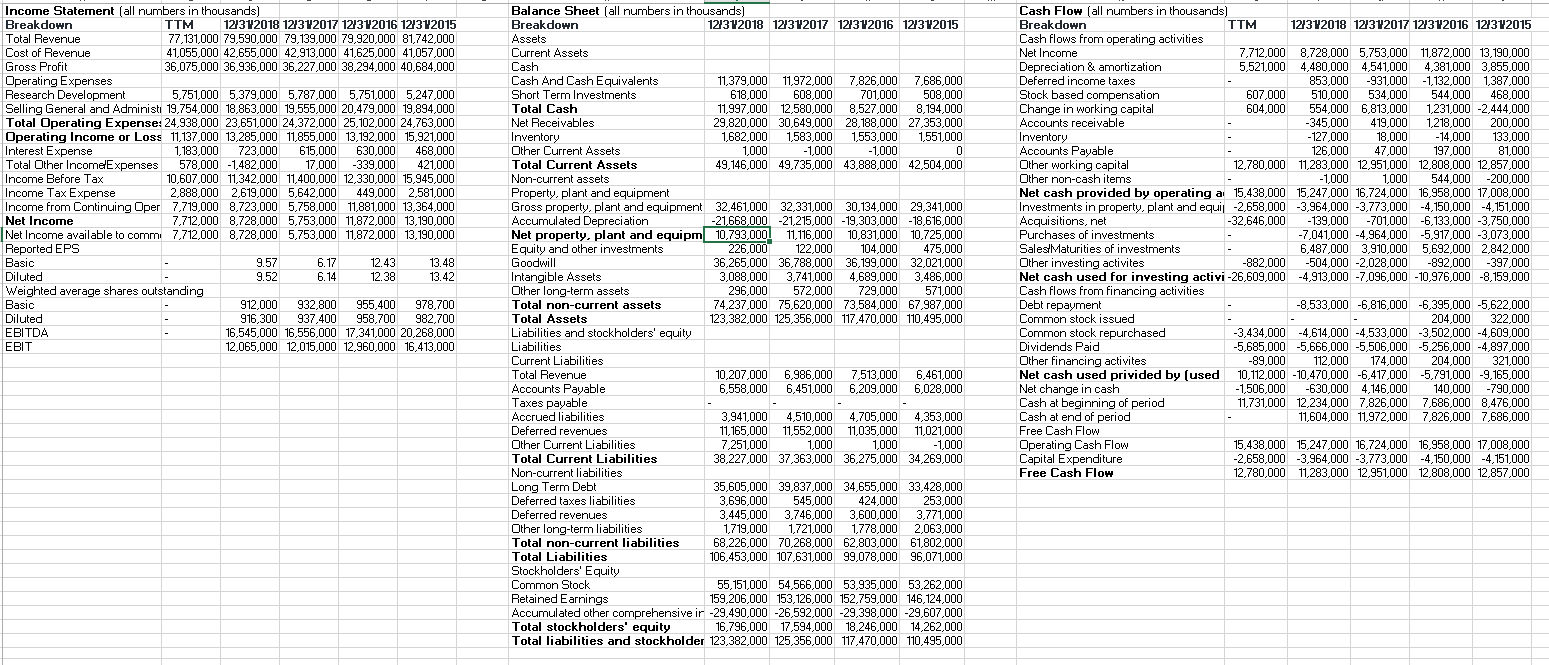

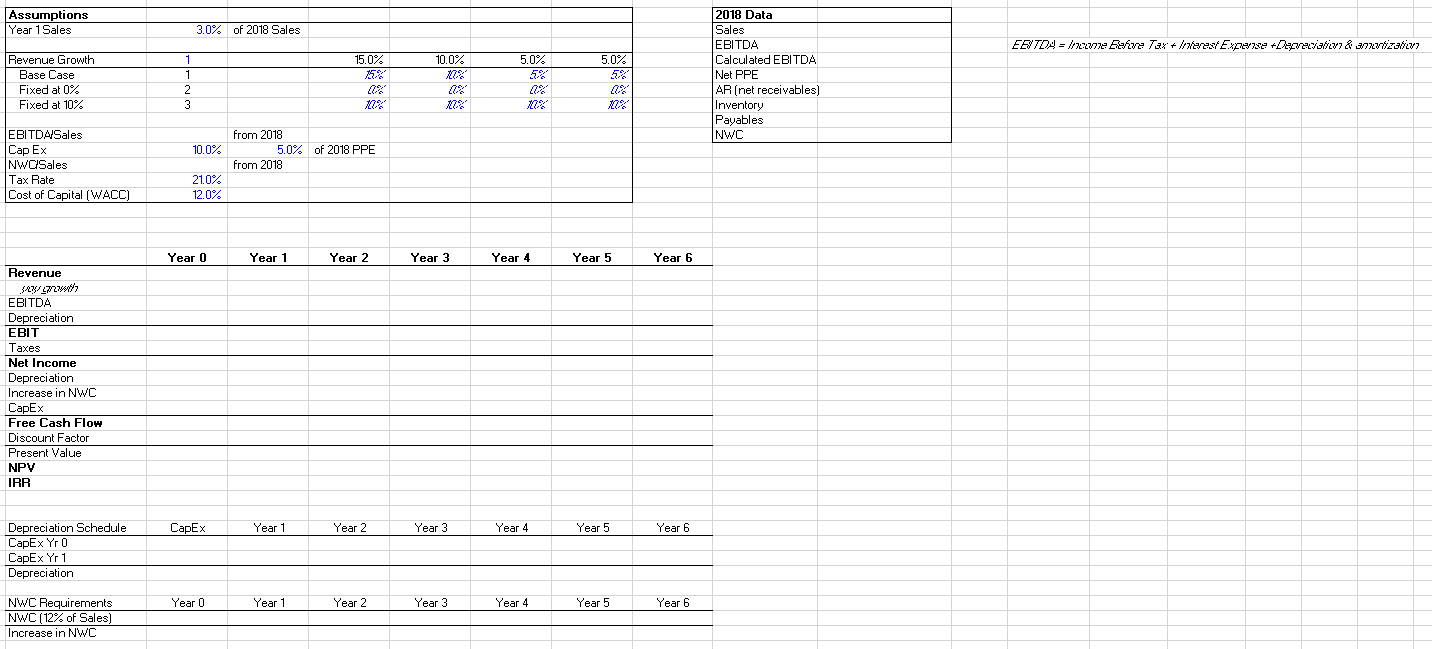

You have been hired by Internal Business Machines Corporation (IBM) in their capital budgeting division. Your first assignment is to determine the free cash flows and NPV of a proposed new type of tablet computer similar in size to an iPad but with the operating power of a high-end desktop system. Development of the new system will initially require an initial capital expenditure equal to 10% of IBMs The product is expected to have a life of five years. First-year revenues for the new product are expected to be 3% of IBMs total revenue for the latest fiscal year for which data is available. The new products revenues are expected to grow at 15% for the second year then 10% for the third and 5% annually for the final two years of the expected life of the project. Your job is to determine the rest of the cash flows associated with this project. Your boss has indicated that the operating costs and net working capital requirements are similar to the rest of the company and that depreciation is straight-line for capital budgeting purposes.

Compute the Free Cash Flow for each year. (excel attached)

a. Assume that the projects profitability will be similar to IBMs existing projects in the latest fiscal year and estimate (revenues - costs) each year by using the latest EBITDA/Sales profit margin. Calculate EBITDA as EBIT + Depreciation expense from the cash flow statement.

b. Determine the annual depreciation by assuming IBM depreciates these assets by the straight-line method over a five-year life.

c. Calculate the net working capital required each year by assuming that the level of NWC will be a constant percentage of the projects sales. Use IBMs NWC/Sales for the latest fiscal year to estimate the required percentage. (Use only accounts receivable, accounts payable, and inventory to measure working capital. Other components of current assets and liabilities are harder to interpret and not necessarily reflective of the projects required NWCfor example, IBMs cash holdings.)

d. To determine the free cash flow, deduct the additional capital investment and the change in net working capital each year. Net Property, Plant, and Equipment (PPE) at the end of the latest fiscal year for which data is available (year 0). The project will then require an additional investment equal to 50% of the initial capital expenditure in the first year of the project (year 1).

Income Statement (all numbers in thousands) Breakdown TIM 12312018 12/312017 12/3/2016 12/3/2015 Total Revenue 77,131,000 79,590,000 79,139,000 79.920,000 81,742,000 Cost of Revenue 41,055,000 42,655,000 42,913,000 41,625,000 41,057,000 Gross Profit 36,075,000 36,936,000 36,227,000 38,294,000 40,684,000 Operating Expenses Research Development 5,751,000 5,379,000 5,787,000 5,751,000 5,247,000 Selling General and Administ 19,754,000 18,863.000 19,555,000 20,479.000 19,894,000 Total Operating Expense: 24,938,000 23.651,000 24,372,000 25,102,000 24,763,000 Operating Income or Loss 11,137,000 13,285,000 11,855,000 13,192,000 15,921,000 Interest Expense 1.183,000 723.000 615,000 630.000 468,000 Total Other Income Expenses 578,000 -1.482.000 17,000 -339,000 421,000 Income Before Tax 10,607,000 11,342,000 11,400,000 12,330,000 15,945,000 Income Tax Expense 2,888,000 2,619,000 5,642,000 449,000 2,581,000 Income from Continuing Oper 7.719,000 8,723,000 5,758,000 11,881,000 13,364,000 Net Income 7.712,000 8,728,000 5,753,000 11,872,000 13,190,000 Net Income available to comm 7,712,000 8,728,000 5,753,000 11,872,000 13,190,000 Reported EPS Basic 9.57 6.17 12.43 13.48 Diluted 9.52 6.14 12.38 13.42 Weighted average shares outstanding Basic 912,000 932,800 955,400 978,700 Diluted 916.300 937,400 958,700 982,700 EBITDA 16,545,000 16,556,000 17,341,000 20,268,000 EBIT 12,065,000 12,015,000 12,960,000 16,413,000 122,000 Balance Sheet (all numbers in thousands) Breakdown 12312018 121312017 12/312016 12/312015 Assets Current Assets Cash Cash And Cash Equivalents 11,379,000 11,972,000 11,972,000 7,826,000 7,686,000 Short Term Investments 618,000 608,000 701,000 508,000 Total Cash 11,997,000 12,580,000 8,527,000 8,194,000 Net Receivables 29,820,000 30,649,000 28,188,000 27,353,000 Inventory 1,682,000 1,583,000 1,553,000 1,551,000 Other Current Assets 1,000 -1,000 -1,000 0 0 Total Current Assets 49,146,000 49,735,000 43,888,000 42,504,000 Non-current assets Property, plant and equipment Gross property, plant and equipment 32,461,000 32,331,000 30,134,000 29,341,000 Accumulated Depreciation -21.668.000 -21,215,000 -19,303,000 -18,616,000 Net property, plant and equipm 10,793,000 11,116,000 10,831,000 10,725,000 Equity and other investments 226,000 104,000 475,000 Goodwill 36,265,000 36,788,000 36,199,000 32,021,000 Intangible Assets 3,088,000 3,741,000 4,689,000 3,486,000 Other long-term assets 296,000 572,000 729,000 571,000 Total non-current assets 74,237,000 75,620,000 73,584,000 67,987,000 Total Assets 123,382,000 125,356,000 117,470,000 110,495,000 Liabilities and stockholders' equity Liabilities Current Liabilities Total Revenue 10,207,000 6,986,000 7,513,000 6,461,000 Accounts Payable 6,558,000 6,451,000 6,209,000 6,028,000 Taxes payable - - Accrued liabilities 3,941,000 4,510,000 4,705,000 4,353,000 Deferred revenues 11,165,000 11,552,000 11,035,000 11,021,000 Other Current Liabilities 7,251,000 1,000 1,000 -1,000 Total Current Liabilities 38,227,000 37,363,000 36,275,000 34,269,000 Non-current liabilities Long Term Debt 35,605,000 39,837,000 34,655,000 33,428,000 Deferred taxes liabilities 3,696,000 545,000 424,000 253,000 Deferred revenues 3,445,000 3,746,000 3,600,000 3,771,000 Other long-term liabilities 1.719,000 1,721,000 1,778,000 2,063,000 Total non-current liabilities 68,226,000 70,268,000 62,803,000 61,802,000 Total Liabilities 106,453,000 107,631,000 99,078,000 96,071,000 Stockholders' Equity Common Stock 55,151,000 54,566,000 53,935,000 53,262,000 Retained Earnings 159,206,000 153,126,000 152,759,000 146,124,000 Accumulated other comprehensive ir -29,490,000 -26,592,000 -29,398,000 -29,607,000 Total stockholders' equity 16,796,000 17,594,000 18,246,000 14,262,000 Total liabilities and stockholder 123,382,000 125,356,000 117,470,000 110,495,000 Cash Flow (all numbers in thousands) Breakdown TTM 121312018 12/312017 12/312016 12/312015 Cash flows from operating activities Net Income 7,712,000 8,728,000 5,753,000 11,872,000 13,190,000 Depreciation & amortization 5,521,000 4,480,000 4,541,000 4,381,000 3,855,000 Deferred income taxes 853,000 -931,000 -1,132,000 1,387,000 Stock based compensation 607,000 510,000 534.000 544,000 468.000 Change in working capital 604,000 554,000 6,813,000 1,231,000 -2,444,000 Accounts receivable -345,000 419.000 1,218,000 200,000 Inventory -127,000 18,000 -14.000 133,000 Accounts Payable 126.000 47,000 197,000 81,000 Other working capital 12,780,000 11,283,000 12,951,000 12,808,000 12,857,000 Other non-cash items -1,000 1,000 544,000 -200,000 Net cash provided by operating a 15,438,000 15,247,000 16,724,000 16,958,000 17,008,000 Investments in property, plant and equil -2,658,000 -3,964,000 -3,773,000 -4,150,000 -4,151,000 Acquisitions, net -32,646,000 -139,000 -701,000 -6,133,000 -3,750,000 Purchases of investments -7,041,000 -4,964,000 -5,917,000 -3,073,000 Sales/Maturities of investments 6,487,000 3,910,000 5,692,000 2.842,000 Other investing activites -882,000 -504,000 -2,028,000 -892,000 -397,000 Net cash used for investing activi -26,609,000 -4,913,000 -7,096,000 -10,976,000 -8,159,000 Cash flows from financing activities Debt repayment -8,533,000 -6,816,000 -6,395,000 -5,622,000 Common stock issued - - 204,000 322.000 Common stock repurchased -3,434,000 -4,614,000 -4,533,000 -3,502,000 -4,609,000 Dividends Paid -5,685,000 -5,666,000 -5,506,000 -5,256,000 -4,897,000 Other financing activites -89,000 112,000 174,000 204,000 321,000 Net cash used privided by (used 10,112,000 -10,470,000 -6,417,000 -5,791,000 -9,165,000 Net change in cash -1,506,000 -630 000 4.146.000 140,000 -790,000 Cash at beginning of period 11,731,000 12,234,000 7,826,000 7,686,000 8,476,000 Cash at end of period 11,604,000 11,972,000 7,826,000 7,686,000 Free Cash Flow Operating Cash Flow 15,438,000 15,247,000 16,724,000 16,958,000 17,008,000 Capital Expenditure -2,658,000 -3,964,000 -3,773,000 -4,150,000 -4,151,000 Free Cash Flow 12,780,000 11,283,000 12,951,000 12,808,000 12,857,000 Assumptions Year 1 Sales 3.0% of 2018 Sales EETDA = xwe Burve 73x+/Vest Expense Davv7 & 371.vizavi 10.0% 5.0% 5.0% 15.0% 15% Revenue Growth Base Case Fixed at 0% Fixed at 10% 1 1 2 3 2018 Data Sales EBITDA Calculated EBITDA Net PPE AR (net receivables) Inventory Payables NWC Na XX 10.0% EBITDA/Sales Cap Ex NWC/Sales Tax Rate Cost of Capital (WACC) from 2018 50% of 2018 PPE from 2018 21.0% 12.0% Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 6 Revenue SRX 472 EBITDA Depreciation EBIT Taxes Net Income Depreciation Increase in NWC Capex Free Cash Flow Discount Factor Present Value NPV IRR Capex Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Depreciation Schedule CapEx Yr 0 CapEx Yr 1 Depreciation Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 NWC Requirements NWC (12% of Sales) Increase in NWC Income Statement (all numbers in thousands) Breakdown TIM 12312018 12/312017 12/3/2016 12/3/2015 Total Revenue 77,131,000 79,590,000 79,139,000 79.920,000 81,742,000 Cost of Revenue 41,055,000 42,655,000 42,913,000 41,625,000 41,057,000 Gross Profit 36,075,000 36,936,000 36,227,000 38,294,000 40,684,000 Operating Expenses Research Development 5,751,000 5,379,000 5,787,000 5,751,000 5,247,000 Selling General and Administ 19,754,000 18,863.000 19,555,000 20,479.000 19,894,000 Total Operating Expense: 24,938,000 23.651,000 24,372,000 25,102,000 24,763,000 Operating Income or Loss 11,137,000 13,285,000 11,855,000 13,192,000 15,921,000 Interest Expense 1.183,000 723.000 615,000 630.000 468,000 Total Other Income Expenses 578,000 -1.482.000 17,000 -339,000 421,000 Income Before Tax 10,607,000 11,342,000 11,400,000 12,330,000 15,945,000 Income Tax Expense 2,888,000 2,619,000 5,642,000 449,000 2,581,000 Income from Continuing Oper 7.719,000 8,723,000 5,758,000 11,881,000 13,364,000 Net Income 7.712,000 8,728,000 5,753,000 11,872,000 13,190,000 Net Income available to comm 7,712,000 8,728,000 5,753,000 11,872,000 13,190,000 Reported EPS Basic 9.57 6.17 12.43 13.48 Diluted 9.52 6.14 12.38 13.42 Weighted average shares outstanding Basic 912,000 932,800 955,400 978,700 Diluted 916.300 937,400 958,700 982,700 EBITDA 16,545,000 16,556,000 17,341,000 20,268,000 EBIT 12,065,000 12,015,000 12,960,000 16,413,000 122,000 Balance Sheet (all numbers in thousands) Breakdown 12312018 121312017 12/312016 12/312015 Assets Current Assets Cash Cash And Cash Equivalents 11,379,000 11,972,000 11,972,000 7,826,000 7,686,000 Short Term Investments 618,000 608,000 701,000 508,000 Total Cash 11,997,000 12,580,000 8,527,000 8,194,000 Net Receivables 29,820,000 30,649,000 28,188,000 27,353,000 Inventory 1,682,000 1,583,000 1,553,000 1,551,000 Other Current Assets 1,000 -1,000 -1,000 0 0 Total Current Assets 49,146,000 49,735,000 43,888,000 42,504,000 Non-current assets Property, plant and equipment Gross property, plant and equipment 32,461,000 32,331,000 30,134,000 29,341,000 Accumulated Depreciation -21.668.000 -21,215,000 -19,303,000 -18,616,000 Net property, plant and equipm 10,793,000 11,116,000 10,831,000 10,725,000 Equity and other investments 226,000 104,000 475,000 Goodwill 36,265,000 36,788,000 36,199,000 32,021,000 Intangible Assets 3,088,000 3,741,000 4,689,000 3,486,000 Other long-term assets 296,000 572,000 729,000 571,000 Total non-current assets 74,237,000 75,620,000 73,584,000 67,987,000 Total Assets 123,382,000 125,356,000 117,470,000 110,495,000 Liabilities and stockholders' equity Liabilities Current Liabilities Total Revenue 10,207,000 6,986,000 7,513,000 6,461,000 Accounts Payable 6,558,000 6,451,000 6,209,000 6,028,000 Taxes payable - - Accrued liabilities 3,941,000 4,510,000 4,705,000 4,353,000 Deferred revenues 11,165,000 11,552,000 11,035,000 11,021,000 Other Current Liabilities 7,251,000 1,000 1,000 -1,000 Total Current Liabilities 38,227,000 37,363,000 36,275,000 34,269,000 Non-current liabilities Long Term Debt 35,605,000 39,837,000 34,655,000 33,428,000 Deferred taxes liabilities 3,696,000 545,000 424,000 253,000 Deferred revenues 3,445,000 3,746,000 3,600,000 3,771,000 Other long-term liabilities 1.719,000 1,721,000 1,778,000 2,063,000 Total non-current liabilities 68,226,000 70,268,000 62,803,000 61,802,000 Total Liabilities 106,453,000 107,631,000 99,078,000 96,071,000 Stockholders' Equity Common Stock 55,151,000 54,566,000 53,935,000 53,262,000 Retained Earnings 159,206,000 153,126,000 152,759,000 146,124,000 Accumulated other comprehensive ir -29,490,000 -26,592,000 -29,398,000 -29,607,000 Total stockholders' equity 16,796,000 17,594,000 18,246,000 14,262,000 Total liabilities and stockholder 123,382,000 125,356,000 117,470,000 110,495,000 Cash Flow (all numbers in thousands) Breakdown TTM 121312018 12/312017 12/312016 12/312015 Cash flows from operating activities Net Income 7,712,000 8,728,000 5,753,000 11,872,000 13,190,000 Depreciation & amortization 5,521,000 4,480,000 4,541,000 4,381,000 3,855,000 Deferred income taxes 853,000 -931,000 -1,132,000 1,387,000 Stock based compensation 607,000 510,000 534.000 544,000 468.000 Change in working capital 604,000 554,000 6,813,000 1,231,000 -2,444,000 Accounts receivable -345,000 419.000 1,218,000 200,000 Inventory -127,000 18,000 -14.000 133,000 Accounts Payable 126.000 47,000 197,000 81,000 Other working capital 12,780,000 11,283,000 12,951,000 12,808,000 12,857,000 Other non-cash items -1,000 1,000 544,000 -200,000 Net cash provided by operating a 15,438,000 15,247,000 16,724,000 16,958,000 17,008,000 Investments in property, plant and equil -2,658,000 -3,964,000 -3,773,000 -4,150,000 -4,151,000 Acquisitions, net -32,646,000 -139,000 -701,000 -6,133,000 -3,750,000 Purchases of investments -7,041,000 -4,964,000 -5,917,000 -3,073,000 Sales/Maturities of investments 6,487,000 3,910,000 5,692,000 2.842,000 Other investing activites -882,000 -504,000 -2,028,000 -892,000 -397,000 Net cash used for investing activi -26,609,000 -4,913,000 -7,096,000 -10,976,000 -8,159,000 Cash flows from financing activities Debt repayment -8,533,000 -6,816,000 -6,395,000 -5,622,000 Common stock issued - - 204,000 322.000 Common stock repurchased -3,434,000 -4,614,000 -4,533,000 -3,502,000 -4,609,000 Dividends Paid -5,685,000 -5,666,000 -5,506,000 -5,256,000 -4,897,000 Other financing activites -89,000 112,000 174,000 204,000 321,000 Net cash used privided by (used 10,112,000 -10,470,000 -6,417,000 -5,791,000 -9,165,000 Net change in cash -1,506,000 -630 000 4.146.000 140,000 -790,000 Cash at beginning of period 11,731,000 12,234,000 7,826,000 7,686,000 8,476,000 Cash at end of period 11,604,000 11,972,000 7,826,000 7,686,000 Free Cash Flow Operating Cash Flow 15,438,000 15,247,000 16,724,000 16,958,000 17,008,000 Capital Expenditure -2,658,000 -3,964,000 -3,773,000 -4,150,000 -4,151,000 Free Cash Flow 12,780,000 11,283,000 12,951,000 12,808,000 12,857,000 Assumptions Year 1 Sales 3.0% of 2018 Sales EETDA = xwe Burve 73x+/Vest Expense Davv7 & 371.vizavi 10.0% 5.0% 5.0% 15.0% 15% Revenue Growth Base Case Fixed at 0% Fixed at 10% 1 1 2 3 2018 Data Sales EBITDA Calculated EBITDA Net PPE AR (net receivables) Inventory Payables NWC Na XX 10.0% EBITDA/Sales Cap Ex NWC/Sales Tax Rate Cost of Capital (WACC) from 2018 50% of 2018 PPE from 2018 21.0% 12.0% Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 6 Revenue SRX 472 EBITDA Depreciation EBIT Taxes Net Income Depreciation Increase in NWC Capex Free Cash Flow Discount Factor Present Value NPV IRR Capex Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Depreciation Schedule CapEx Yr 0 CapEx Yr 1 Depreciation Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 NWC Requirements NWC (12% of Sales) Increase in NWCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started