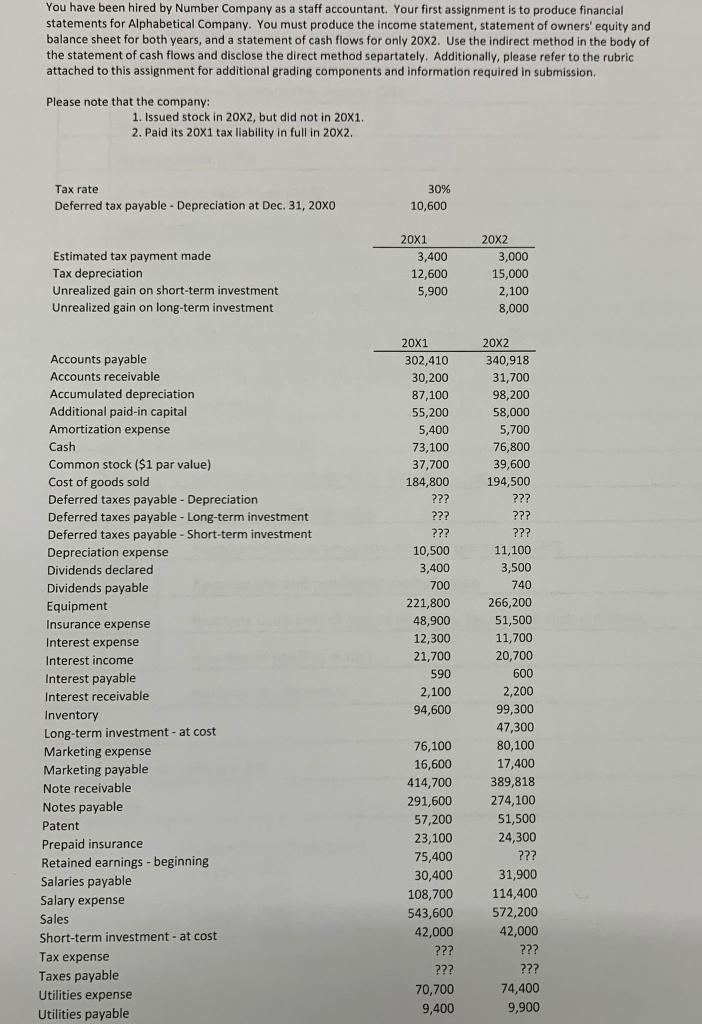

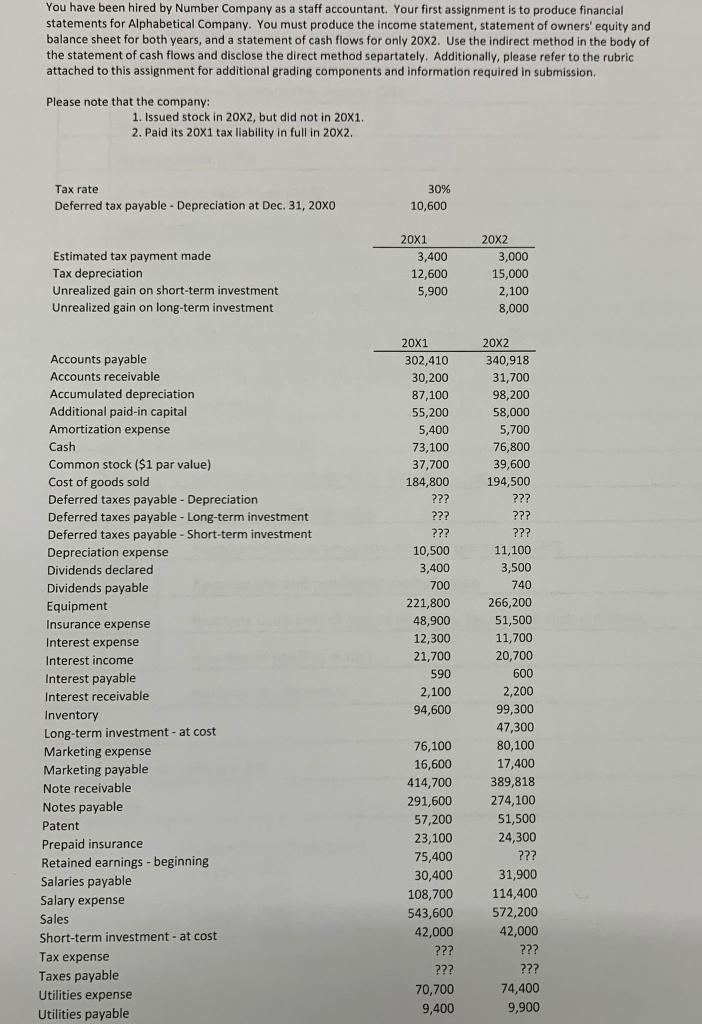

You have been hired by Number Company as a staff accountant. Your first assignment is to produce financial statements for Alphabetical Company. You must produce the income statement, statement of owners' equity and balance sheet for both years, and a statement of cash flows for only 20x2. Use the indirect method in the body of the statement of cash flows and disclose the direct method separtately. Additionally, please refer to the rubric attached to this assignment for additional grading components and information required in submission Please note that the company: 1. Issued stock in 20x2, but did not in 20X1. 2. Paid its 20X1 tax liability in full in 20x2. Tax rate Deferred tax payable - Depreciation at Dec 31, 20xo 30% 10,600 Estimated tax payment made Tax depreciation Unrealized gain on short-term investment Unrealized gain on long-term investment 20X1 3,400 12,600 5,900 20X2 3,000 15,000 2,100 8,000 20X1 302,410 30,200 87,100 55,200 5,400 73,100 Accounts payable Accounts receivable Accumulated depreciation Additional paid-in capital Amortization expense Cash Common stock ($1 par value) Cost of goods sold Deferred taxes payable - Depreciation Deferred taxes payable - Long-term investment Deferred taxes payable - Short-term investment Depreciation expense Dividends declared Dividends payable Equipment Insurance expense Interest expense Interest income Interest payable Interest receivable Inventory Long-term investment - at cost Marketing expense Marketing payable Note receivable Notes payable Patent Prepaid insurance Retained earnings - beginning Salaries payable Salary expense Sales Short-term investment - at cost Tax expense Taxes payable Utilities expense Utilities payable 37,700 184,800 ??? ??? ??? 10,500 3,400 700 221,800 48,900 12,300 21,700 590 2,100 94,600 20x2 340,918 31,700 98,200 58,000 5,700 76,800 39,600 194,500 ??? ??? ??? 11,100 3,500 740 266,200 51,500 11,700 20,700 600 2,200 99,300 47,300 80,100 17,400 389,818 274,100 51,500 24,300 ??? 31,900 114,400 572,200 42,000 ??? ??? 74,400 9,900 76,100 16,600 414,700 291,600 57,200 23,100 75,400 30,400 108,700 543,600 42,000 ??? ??? 70,700 9,400 You have been hired by Number Company as a staff accountant. Your first assignment is to produce financial statements for Alphabetical Company. You must produce the income statement, statement of owners' equity and balance sheet for both years, and a statement of cash flows for only 20x2. Use the indirect method in the body of the statement of cash flows and disclose the direct method separtately. Additionally, please refer to the rubric attached to this assignment for additional grading components and information required in submission Please note that the company: 1. Issued stock in 20x2, but did not in 20X1. 2. Paid its 20X1 tax liability in full in 20x2. Tax rate Deferred tax payable - Depreciation at Dec 31, 20xo 30% 10,600 Estimated tax payment made Tax depreciation Unrealized gain on short-term investment Unrealized gain on long-term investment 20X1 3,400 12,600 5,900 20X2 3,000 15,000 2,100 8,000 20X1 302,410 30,200 87,100 55,200 5,400 73,100 Accounts payable Accounts receivable Accumulated depreciation Additional paid-in capital Amortization expense Cash Common stock ($1 par value) Cost of goods sold Deferred taxes payable - Depreciation Deferred taxes payable - Long-term investment Deferred taxes payable - Short-term investment Depreciation expense Dividends declared Dividends payable Equipment Insurance expense Interest expense Interest income Interest payable Interest receivable Inventory Long-term investment - at cost Marketing expense Marketing payable Note receivable Notes payable Patent Prepaid insurance Retained earnings - beginning Salaries payable Salary expense Sales Short-term investment - at cost Tax expense Taxes payable Utilities expense Utilities payable 37,700 184,800 ??? ??? ??? 10,500 3,400 700 221,800 48,900 12,300 21,700 590 2,100 94,600 20x2 340,918 31,700 98,200 58,000 5,700 76,800 39,600 194,500 ??? ??? ??? 11,100 3,500 740 266,200 51,500 11,700 20,700 600 2,200 99,300 47,300 80,100 17,400 389,818 274,100 51,500 24,300 ??? 31,900 114,400 572,200 42,000 ??? ??? 74,400 9,900 76,100 16,600 414,700 291,600 57,200 23,100 75,400 30,400 108,700 543,600 42,000 ??? ??? 70,700 9,400