Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you have been hired by SM as a financial consultant to advise them on the HD camera system project. sutton manufacturing is a producer for

you have been hired by SM as a financial consultant to advise them on the HD camera system project.

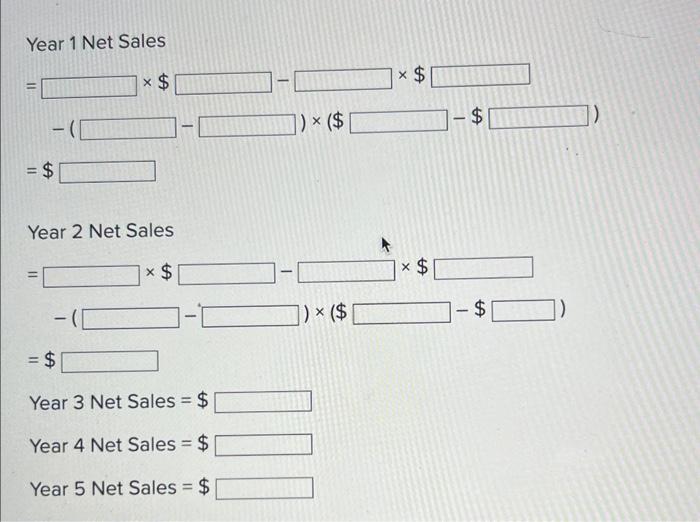

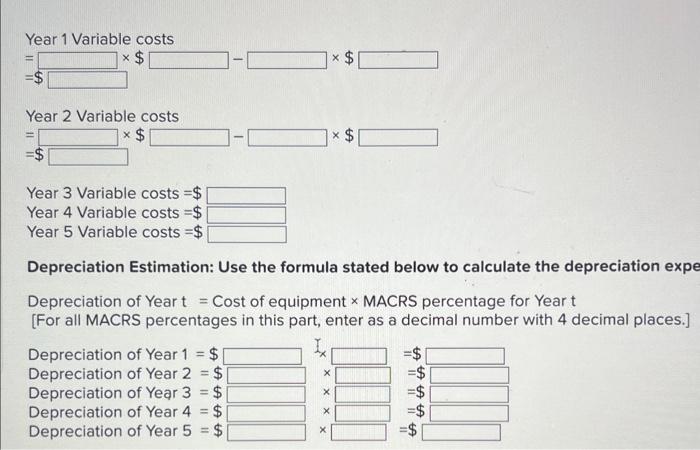

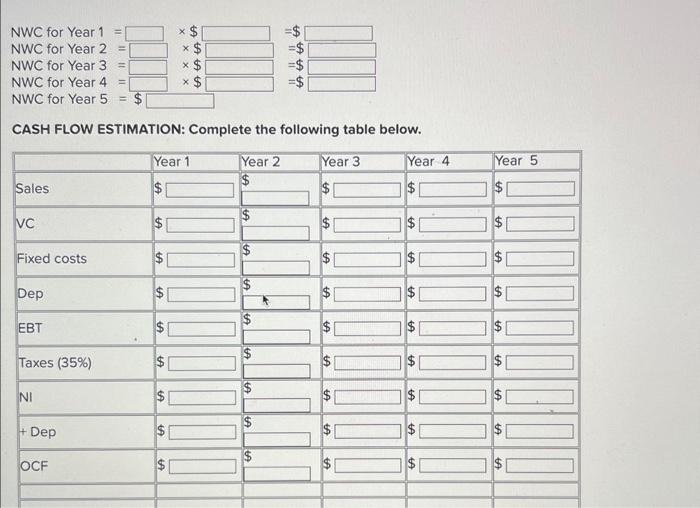

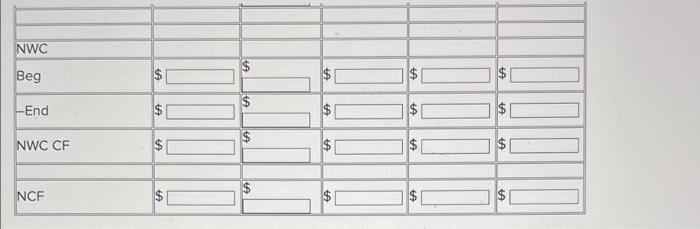

The conprehensive 1440p HD camera model can be used very well for any small home and businesses. As a result of the advanced HD analog technology made up of a 4-channel 4K ultra high definition MPX camera recorder two two 1440p bullet and two 1440p done weatherproof security camera. the system can show videos of remarketable level of clarity and show details with the 2560X1440 resolution for recording and live. With this new professional grade camera system it can provide users with sharp HD resolution and have outstanding night version. the night vision is up to 250 feet. The HD MPX DVR comes with a hard drive of the size of 5TB and supports up to a 12 TB hard drive of video storage. This company had spent $1,300,000 to futher the study of marketability for the new line of HD cameras (marketability study cost). SM is able to produce the HD cameras at the variable cost of $50 each. the total fixed cost for the operation is expected to be $8,000,000 per year. the company excepts to sell 3,600,000 unjts, 4,500,000 units, 3,700,000 units, 2,300,000 units and 1,600,000 units of the new HD camera model per year over the next 5 years respectively. The HD camera system will be selling at a price of $150 each. to launch the nee line of production, SM needs to invest $33,000,000 in equipment which will be depreciated on a seven year MACRS schedule. The value of the used equipment is expected to be worth $3,500,000 at the end of 5 year projected life. SM is planning to stop the production of the existing camera midel entirely in two years. Should SM not introduce the HD camera system, sales per year of the existing camera system model will be 1,700,000 units and 1,300,000 units for the next two years respectively. The existing model can be produced at a variable cost of $40 each. The total fixed cost of $7,500,00 per year. The existing camera system model is selling for $120 each. If SM produces the HD camera system model, sales of existing model will be eroded by 1,020,000 units for the next year and 1,105,000 units for the year after next. Plus to promote sales of the existing model along side with the HD camera system model, SM has to reduce the price of the existing model to $70 each networking capital for the HD camera system project will be 25% of sales and will vary with the occurrence of the cash flows such as there will be no initial NWC required. The first change in NWC is expected to occur in your one according to the sales of the year SM is currently in a tax bracket of 35% and it requires a 15% returns on all its projects. The firm also requires a pack of three years for all projects.

PLEASE ANSWER ALL QUESTIOS BELOW AND SHOW WORK!!!:

What are the revuenes?

what are the costs?

what are the sunk costs for the HD camera system project? explain. you have to tell what sunk cost js and the amount of the total sunk cost. you have to advise SM on how to handle sunk cost.

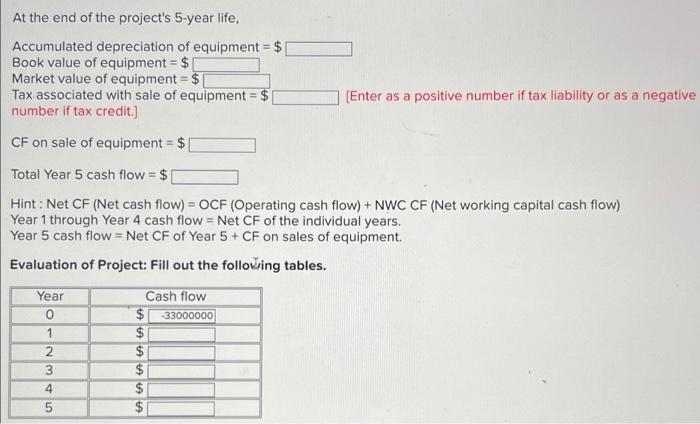

what are the cash flows of the project for each year?

what is the payback period of the project?

what is the PI (profitability index) of the project?

what is the IRR (internal rate of return) of the project?

what is the NPV (net present value) of the project?

should the project be accepted based on the payback, PI, IRR and NPV? explain

see pics!

THANKS!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started